The Magnificent 7 of the Vietnamese Stock Market: A Tale of Tech, Finance, and Real Estate Giants

In the vibrant landscape of Vietnam’s stock market, a group of seven powerhouse companies, affectionately dubbed the “Magnificent 7 (MAG-7),” have captured the attention of investors. This dynamic septet comprises the country’s largest companies from the tech, finance, and real estate sectors: Apple, Amazon, Alphabet (Google’s parent company), Meta (Facebook’s parent company), Microsoft, Nvidia, and Tesla. The influence of these stocks extends beyond the confines of the US market; they are global power players.

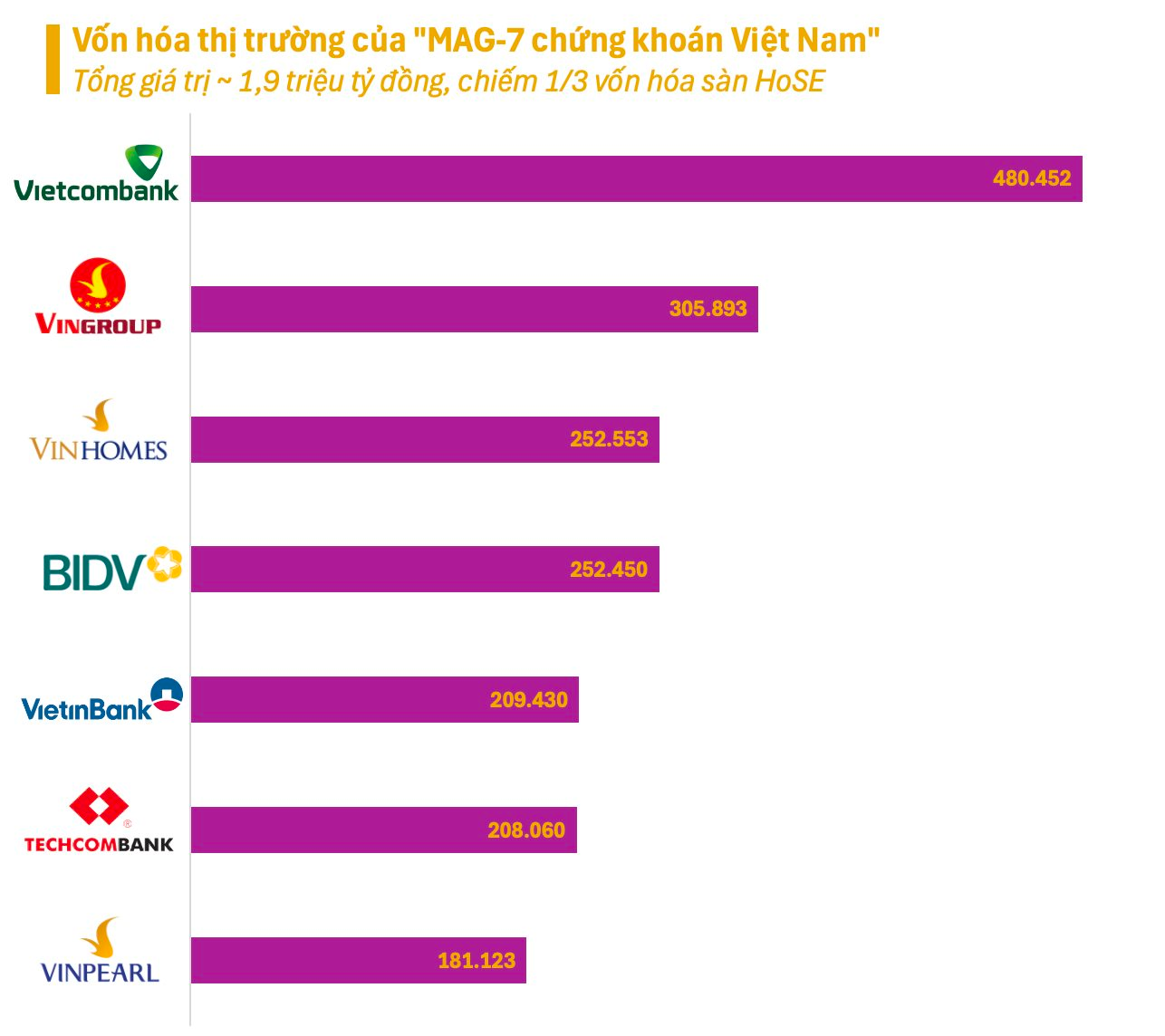

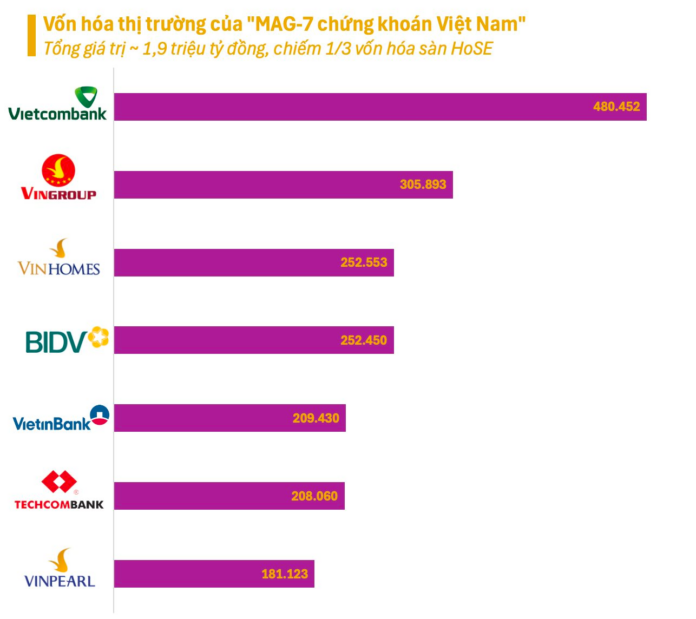

Back home in Vietnam, the seven largest listed companies paint a similar picture of dominance. Leading the pack are two prominent groups: the financial quartet of Vietcombank, BIDV, VietinBank, and Techcombank, and the “Vingroup clan,” which includes Vingroup, Vinhomes, and Vinpearl. Together, they wield significant influence over the stock market dynamics.

The sheer magnitude of their collective market capitalization is astounding, nearing 1.9 million billion VND (approximately 74 billion USD). This equates to a substantial one-third of the HoSE index. Consequently, any fluctuations in the performance of these stocks can have a noticeable impact on the overall VN-Index.

Delving into the composition of Vietnam’s MAG-7, it becomes evident that the financial and real estate sectors dominate. While Vingroup aspires to evolve into a conglomerate spanning industries such as technology, services, and potentially energy, its current stronghold remains in real estate.

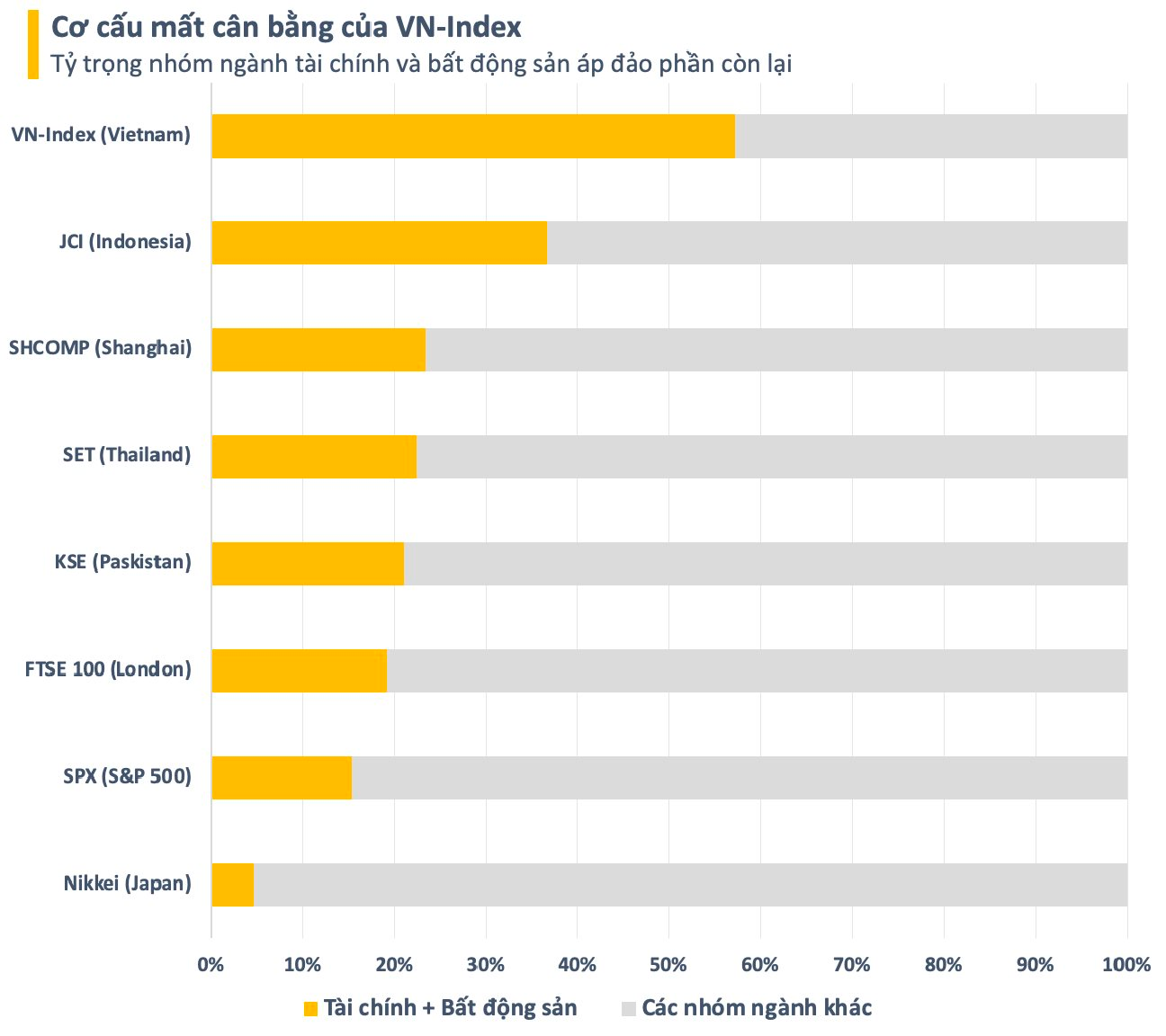

This sectorial concentration is not unique to the MAG-7 but reflects a broader trend in the Vietnamese stock market. Financial and real estate companies collectively account for a staggering 60% of the market’s total capitalization. In contrast, sectors that are currently generating global buzz, such as technology, healthcare, energy, and utilities, are underrepresented in terms of sizeable players.

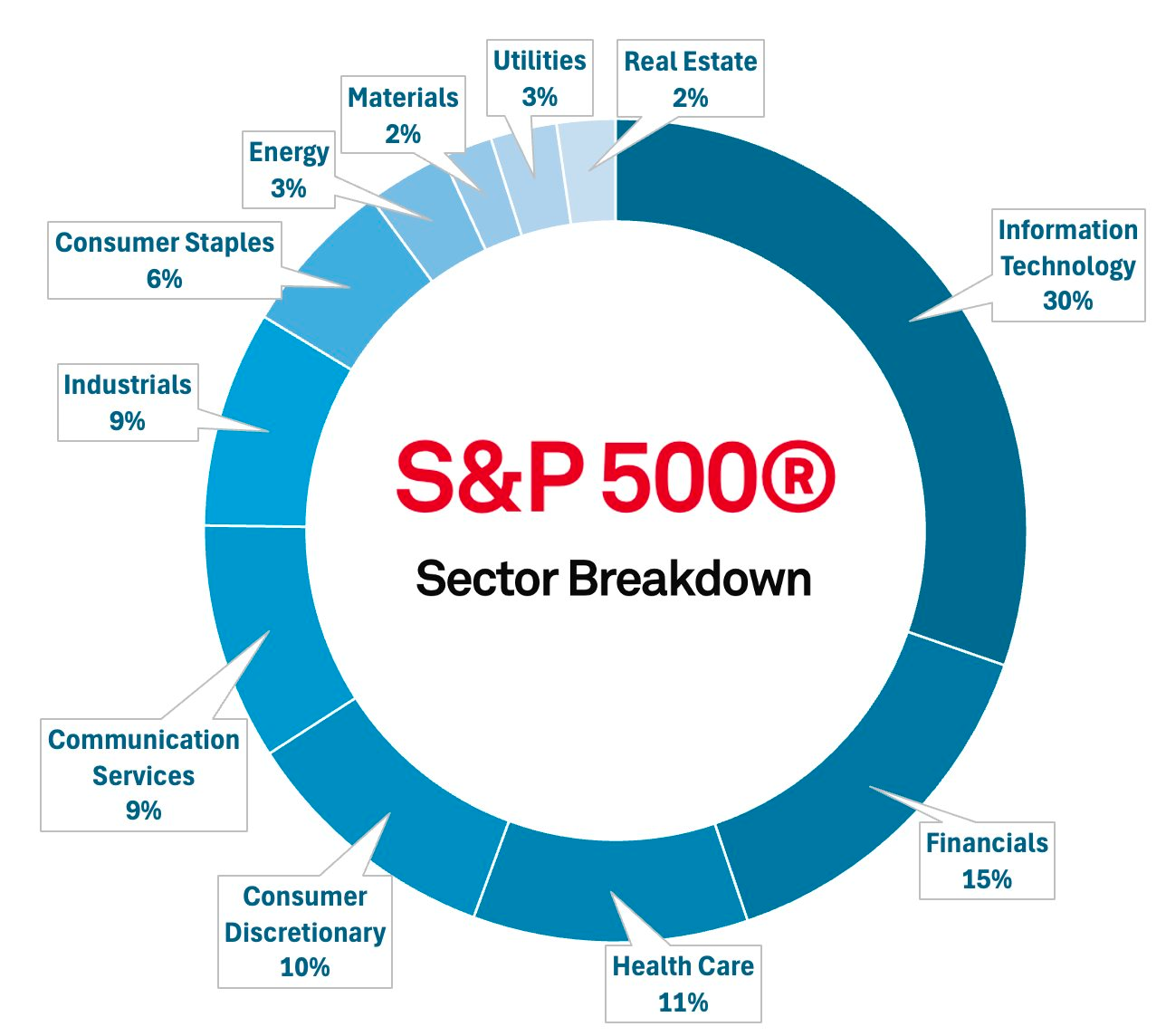

This contrast is stark when compared to the US stock market, where the heavy hitters are predominantly from the technology, healthcare, retail, consumer goods, and telecommunications sectors. These industries boast long-term growth potential and align with the world’s developmental trajectory, offering a multitude of investment narratives.

Within the context of Southeast Asian economies, Vietnam’s stock market exhibits a notable imbalance, with the financial and real estate sectors holding a disproportionately large sway. However, change is on the horizon.

The Vietnamese stock market is poised for a transformation with an influx of new listings on the horizon. During the Dragon Capital Investor Day earlier this year, Le Anh Tuan, the investment director, predicted a wave of IPOs totaling 47 billion USD in the 2027-2028 period. Vinpearl is set to ride this wave, accompanied by notable names such as TCBS, F88, THACO AUTO, Bach Hoa Xanh, Golden Gate, and Highlands Coffee, VPS, Viettel IDC, Misa, and VNPay, to name a few.

Additionally, Vietnam’s economy is undergoing a pivotal phase, marked by a structural shift toward prioritizing the development of science and technology (as outlined in Resolution 57) and the empowerment of the private sector (Resolution 68). These strategic moves serve as catalysts for businesses to thrive, expand their horizons, and propel the nation toward a new era of progress and global competitiveness.

Echoing this sentiment, the VinaCapital director underscores the essence of Resolution 68, which envisions a robust private sector characterized by rapid, sustainable growth, high quality, and global competitiveness. The long-term objective is to steer Vietnam away from the middle-income trap and pave the way for its aspiration to become a high-income nation by 2045.

“Trump Group’s $1.5 Billion Project Takes Off: How Land Prices in the Once-Rural District Are Responding”

The revelation of a $1.5 billion golf course project in Khoai Chau, Hung Yen, has sent a ripple of excitement through the local real estate market. Land prices in the surrounding areas are beginning to stir, with a steady upward trend, capturing the attention of investors near and far.

Conic Boulevard: A Lush, Green Oasis with a Comprehensive Range of On-Site Amenities

Conic Boulevard is emerging as a shining star in the context of the growing trend of residential relocation to the west of Ho Chi Minh City. This vibrant community stands out by seamlessly blending modern living spaces with a comprehensive range of onsite amenities, offering a harmonious and convenient lifestyle to its residents.

Unlocking the Next Chapter for Vietnam’s Stock Market: A Strategic Ascent

The newly issued circular by the State Bank of Vietnam is expected to boost the country’s stock market upgrade process.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)