The Board of Directors of VTZ has approved the mortgaging and pledging of the Company’s assets, as well as any third-party assets raised (if any), as collateral for loan repayment obligations.

Prior to the aforementioned credit facility with SeABank, the VTZ’s Board of Directors had approved two other credit line facilities since the beginning of 2025, with a total value of VND 456 billion. These include a VND 150 billion facility from Kasikornbank – Ho Chi Minh City Branch and a VND 206 billion facility from TPBank – Binh Thanh Branch. The terms of these loans are similar in terms of purpose and collateral.

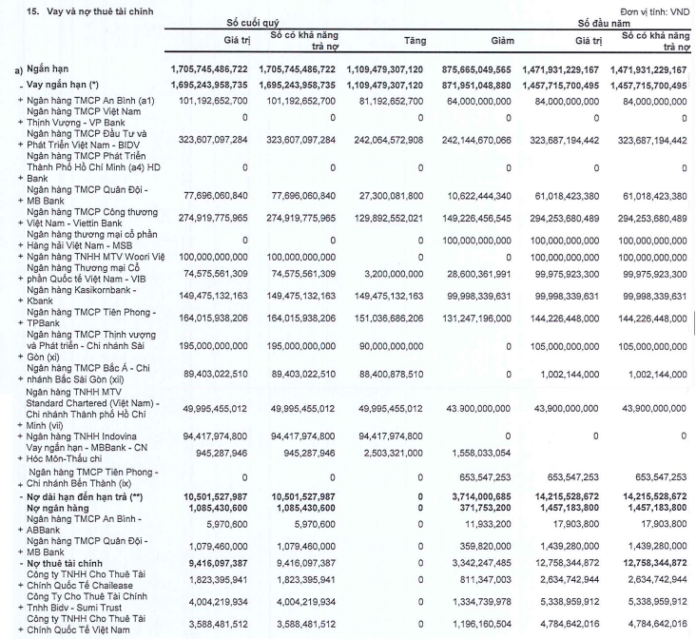

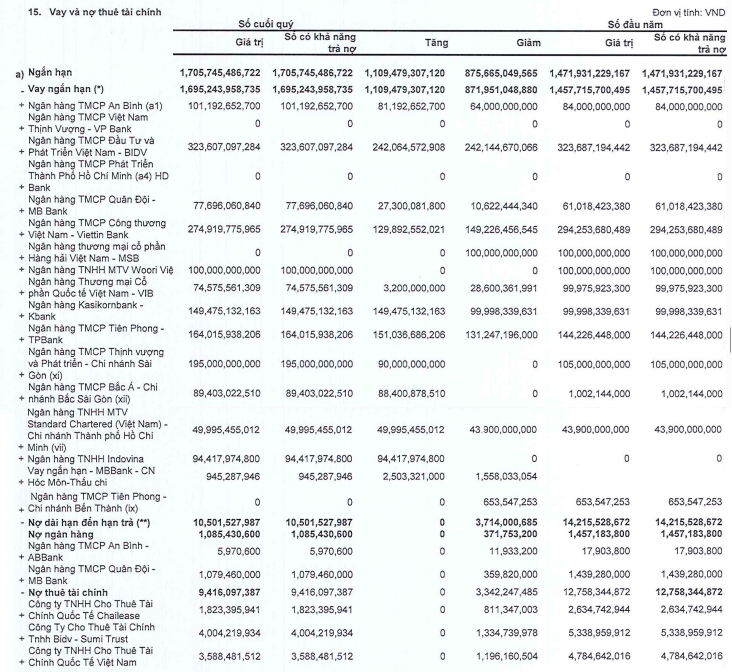

According to updated data as of Q1 2025, VTZ’s total borrowings exceeded VND 1,733 billion, a 16% increase from the beginning of the year, and accounted for 64% of total capital sources. Short-term borrowings made up a significant portion of this debt, with major lenders including BIDV, VietinBank, PGBank, Kasikornbank, and TPBank.

Source: VTZ’s Q1 2025 Financial Statements

|

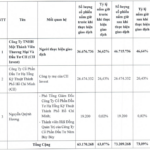

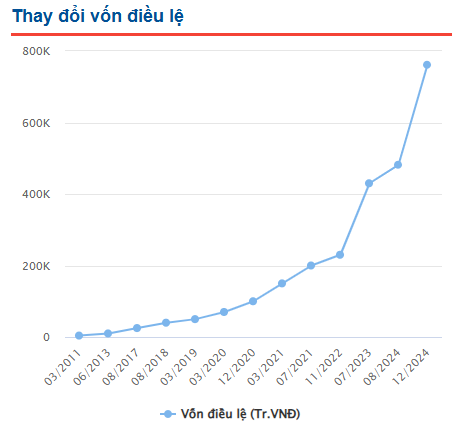

In terms of capital raising activities, in December 2024, VTZ successfully completed a private placement of 28 million shares to three investors, including Chairman Nguyen Van Tuan (who purchased 10 million shares), Vice Chairman and CEO Phan Van Quan (10 million shares), and Mr. Nguyen Phuc Loi (8 million shares).

This private placement increased VTZ’s charter capital to nearly VND 762 billion. With a sale price of VND 10,000 per share, VTZ raised approximately VND 280 billion, which was used entirely to repay bank loans.

Established in March 2011 with initial charter capital of VND 4 billion, CTCP San Xuat va Thuong Mai Nhua Viet Thanh (Vietnam Plastic Production and Trading JSC) has consistently increased its capital over the years, reaching nearly VND 762 billion at present.

Source: VietstockFinance

|

According to the Company’s website, its current production capacity includes a 12,000m2 plastic pressing factory, a 17,000m2 warehouse, a 15,000m2 consumer goods factory, and an annual output of 40,000 tons. The company specializes in the production of household and packaging products.

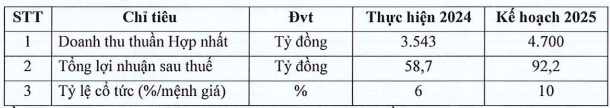

At the 2025 Annual General Meeting of Shareholders, VTZ’s shareholders approved the consolidated business plan for 2025, targeting net revenue of VND 4,700 billion and net profit of over VND 92 billion, representing increases of 33% and 57%, respectively, compared to the previous year. Shareholders also approved the addition of two new business lines: wholesale of other household goods (code 4649) and wholesale of other machinery, equipment, and spare parts (code 4659)

|

VTZ’s 2025 Business Plan

Source: Resolutions of the 2025 Annual General Meeting of VTZ’s Shareholders

|

Regarding dividend plans, the shareholders approved a 6% dividend payout ratio for 2024 in shares and a 10% dividend payout ratio for 2025.

At the meeting, Chairman Phan Van Tuan highlighted the Company’s development of plastic manholes as a replacement for traditional concrete ones. These plastic manholes offer superior advantages and faster installation, taking only 2 hours compared to 3-10 days for traditional concrete manholes.

In Q1 2025, the Company achieved net revenue of over VND 1,112 billion, a 23% increase compared to the same period last year. However, net profit decreased slightly to nearly VND 16 billion. With these results, the Company has achieved 31% of its revenue plan and 17% of its profit plan for the year.

– 14:28 19/05/2025

The Woman in Debt: A Tale of Uncontrollable ‘Investment’ Addiction

The burden of her substantial debt fell heavily on her family. Her husband had no choice but to sell their home, forcing the family to relocate and start anew in their rural hometown. To aid their son-in-law, her parents sold their own land, sacrificing their assets to alleviate their child’s burden.

Two Securities Firms Receive a Combined Limit of VND 2,500 Billion from ACB

On May 15, the Board of Directors of FPT Securities (FPTS, HOSE: FTS) approved a short-term borrowing limit of VND 2,000 billion at Asia Commercial Joint Stock Bank (ACB). On the same day, the Board of Directors of Agribank Securities (Agriseco, HOSE: AGR) also approved a limit of VND 500 billion at ACB, with similar terms and conditions regarding purpose and collateral.

Unlocking the Potential: Ministry of Construction’s Impressive Disbursement of Nearly 16% of the Prime Minister’s Capital Plan in Just 4 Months

As of April 30, 2025, the Ministry of Construction has disbursed over VND 13,200 billion, achieving nearly 16% of the capital plan assigned by the Prime Minister.

A Strategic Stake: CII Invest Acquires Over 10 Million Shares in NBB, Now Holding a Commanding 47% Stake

“In two sessions held between May 9 and May 12, 2025, CII Invest, a renowned private trading and investment company, successfully acquired over 10 million shares of NBB, a leading investment company listed on the HOSE, from My Steel Trading and Services Co., Ltd. This strategic move was executed without the need for a public offering, as per the resolution of the 2025 Annual General Meeting of Shareholders.”