As of early afternoon, Bao Tin Minh Chau’s gold ring price was listed at 114.2 – 117.2 million VND per tael, down 300,000 VND per tael compared to the opening of the trading session this morning. Meanwhile, the gold bar price remained unchanged at 116.8 – 119.3 million VND per tael.

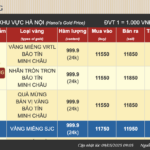

Gold prices listed at Bao Tin Minh Chau at the time of survey on May 19th afternoon.

—

At the opening of today’s trading session, gold prices at major brands such as Bao Tin Minh Chau, PNJ, DOJI, and SJC simultaneously increased by an average of 500,000 VND per tael compared to yesterday’s closing price.

Currently, the gold ring price at Bao Tin Minh Chau is listed at 114.5 – 117.5 million VND per tael. PNJ and SJC listed the same price at 111.5 – 114.5 million VND per tael, while DOJI listed theirs at 105.2 – 112 million VND per tael.

The gold bar prices at these companies were also adjusted upwards to 116.8 – 119.3 million VND per tael.

—

At the opening of the first trading session of the week, Mi Hong Jewelry Company adjusted the gold bar price to 117.5 – 118.5 million VND per tael, increasing the buying price by 500,000 VND while keeping the selling price unchanged from the previous closing price. Simultaneously, the gold ring price at this company also increased by 500,000 VND per tael in both buying and selling prices, reaching 113 – 114.5 million VND per tael.

Meanwhile, many other businesses have not yet adjusted their gold ring and gold bar prices. Specifically, Bao Tin Minh Chau listed their gold ring price at 114 – 117 million VND per tael; PNJ and SJC listed theirs at 111.7 – 114.7 million VND per tael; and DOJI maintained their price at 108.9 – 112.2 million VND per tael. The gold bar price at these companies is currently listed uniformly at 115.7 – 118.7 million VND per tael.

In the global market, the spot gold price stands at $3,227 per ounce, up $28 from the previous trading session.

According to Kitco News, the past week has been another lackluster week for gold prices as the wave of sell-offs intensified. The latest Kitco News gold survey also reflects a shift in investor sentiment after the precious metal lost the $3,200 mark.

Out of the 16 analysts participating in the survey, only 2 or 12% predicted that gold prices would rise next week. 10 people, or 63%, believed that gold prices would fall, while the remaining 4 people, or 25%, forecast a sideways market.

Similarly, an online survey of 294 retail investors also indicated a return to caution. Only 34% of respondents (100 people) remained confident in gold’s potential to rise next week, while 42% (123 people) expected prices to continue falling. The remaining 24% (71 people) predicted a sideways market.

Mr. Adrian Day, Chairman of Adrian Day Asset Management, commented: “Gold prices could continue to fall in the coming weeks, especially as the US considers adjusting its tariff policies. However, after this period, there will be another great buying opportunity.”

Meanwhile, Mr. Adam Button, Head of Currency Strategy at Forexlive.com, shared the same view: “The current trend is still downward. We will need a stable bottom, but it is likely to be higher than the $3,000 per ounce level.”

On the other hand, Mr. Darin Newsom, a senior analyst at Barchart.com, offered a more neutral perspective: “Technically, the ‘increase’ option is the most reasonable among the three scenarios of increase, decrease, and sideways. However, no one can be sure at this point. Nonetheless, the daily chart for the June gold contract suggests the potential for a short-term upward trend, provided that the bottom held on Thursday at $3,123.30 per ounce is maintained.”

He also emphasized the fundamental factors supporting gold: “The market still has an upward bias considering that central banks globally continue to buy gold. Nevertheless, I lean towards an upward trend next week, although I don’t expect a strong recovery.”

In contrast, Mr. Mark Leibovit, founder of the VR Metals/Resource Letter newsletter, stated: “I believe gold may have temporarily peaked. The downside risk remains, potentially reaching $2,900 per ounce.”

The Golden Opportunity: Navigating the Dip in Gold Prices

In the past 24 hours, domestic gold bar prices have plummeted by over VND 3 million per tael, while gold ring prices have dropped by VND 2.5 million per tael.