The State Bank of Vietnam has issued Circular 03, providing guidelines on opening and using VND accounts for foreign indirect investment in the country. As a result, foreign investors (FIIs) are no longer required to legalize their consular files when opening investment accounts.

This is a crucial step in facilitating the process for foreign organizations to open monetary accounts. Previously, this process could take months due to consular legalization procedures, but now the time frame for opening indirect investment accounts has been significantly reduced.

Thus, another bottleneck in the process of upgrading Vietnam’s stock market has been addressed. Previously, Circular 68/2024/TT-BTC, which came into effect on November 2, 2024, allowed foreign institutional investors to purchase stocks without pre-funding requirements (Non Pre-funding solution – NPS), and also outlined a comprehensive timeline for English language disclosure requirements.

Notably, on May 5, the new KRX information technology system was officially launched. SSI Chairman Nguyen Duy Hung believes that the KRX system will usher in a new era of modern trading. The system is expected to facilitate the implementation of the clearing mechanism (CCP), intraday trading, and more in the future, thereby promoting the market upgrade process.

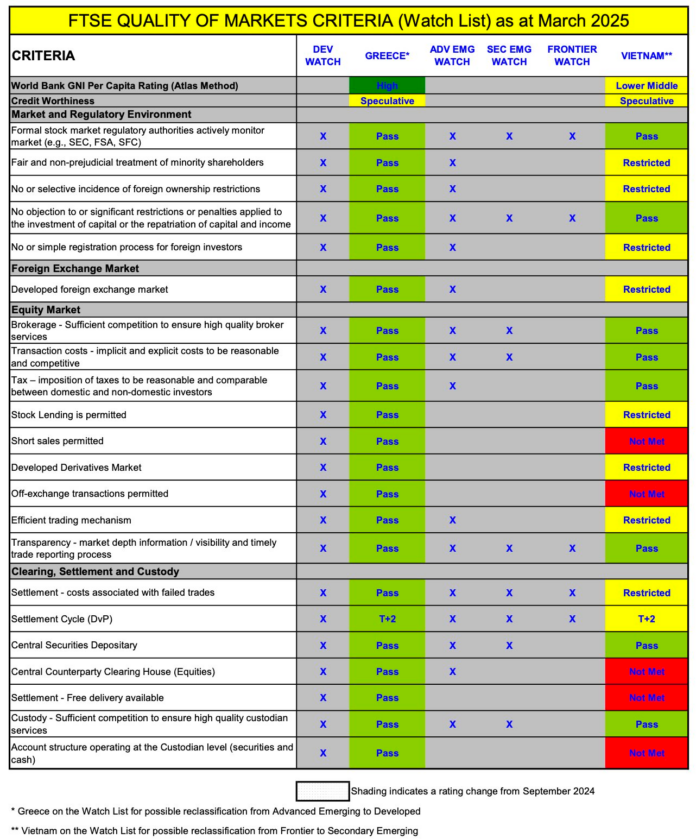

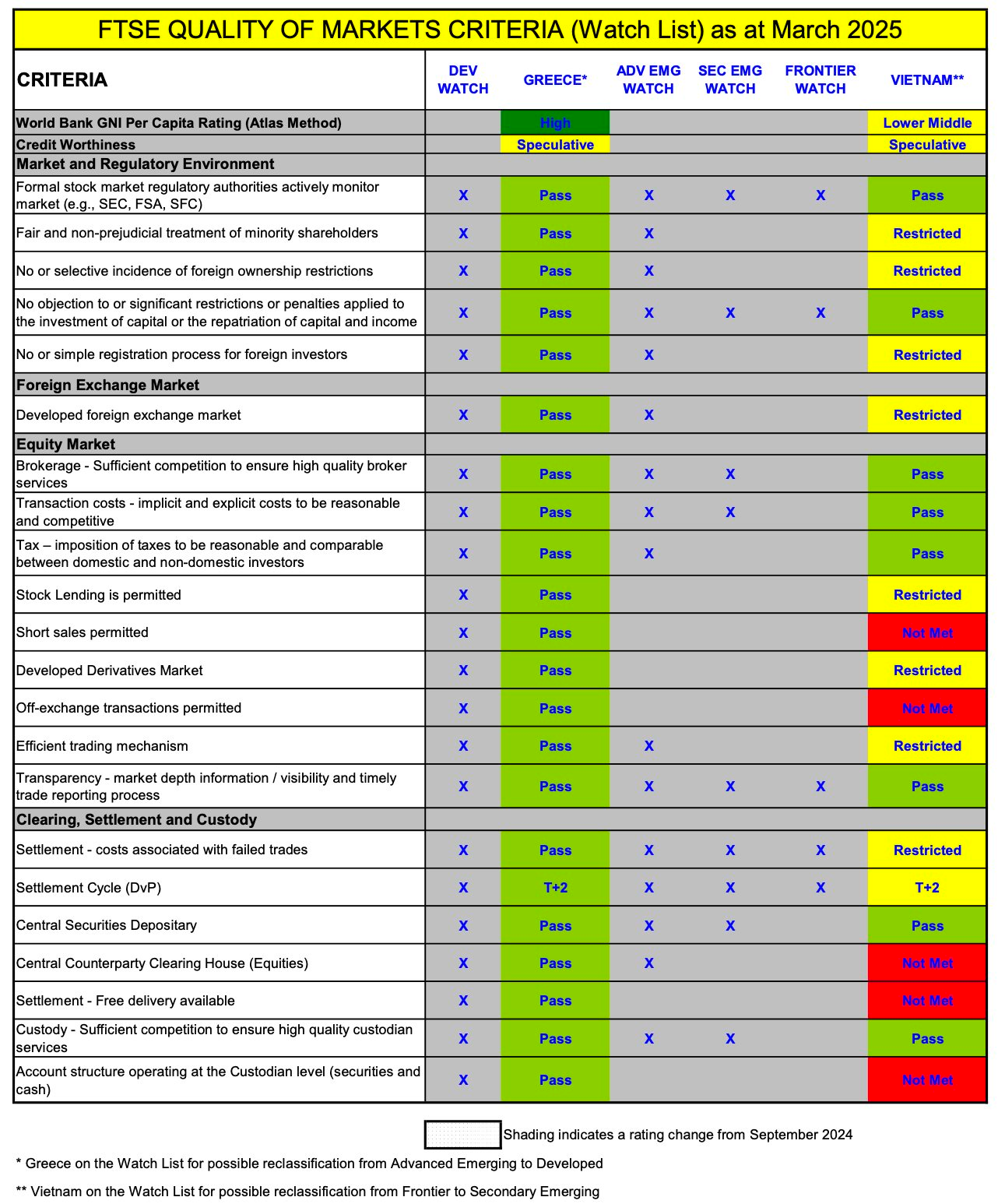

In its market classification report released earlier in April, FTSE Russell maintained Vietnam on its watchlist for potential reclassification from a frontier market to a secondary emerging market.

According to FTSE Russell’s assessment, Vietnam has not yet met the criteria for “DvP Settlement Cycle” and “Settlement – Costs related to failed transactions.” Both of these criteria are currently ranked as “Limited.”

However, the organization acknowledged the continuous commitment of Vietnam’s market regulators to pursue regulatory reforms that further facilitate the participation of international investors in the country’s stock market, including the upgrade of the main trading platform.

According to several assessments, Vietnam’s stock market could receive an upgrade announcement from FTSE Russell as early as September 2025, while MSCI is considering placing it on their watchlist in June 2025. The reclassification by MSCI will take longer due to its dependence on achieving a sustainable and comprehensive solution regarding foreign ownership limits in the stock market.

According to BSC Research, foreign investors will engage in net buying from 2 to 4 months before FTSE’s approval announcement (T0) and the start of the transition process (T1). For MSCI, foreign investors are expected to act earlier, from 4 to 5 months in advance, due to the larger scale of reference funds and the greater influence of MSCI compared to FTSE Russell.

The Big Buy: Foreign Investors Go on a Shopping Spree, Splurging on Vietnamese Bank Stocks

Foreign transactions continue to be a bright spot, with net buys of 891 billion VND in today’s session.

Breaking News: Foreign Investors Pour in Nearly VND 2.3 Trillion, Sending VN-Index Soaring Past 1,300 Points

The FPT stock witnessed a significant surge in buying activity during the afternoon trading session, with a staggering net buy value of VND 541 billion, making it the most actively bought stock across the market. This was followed by several other stocks that also experienced substantial net buying in the hundreds of billions of VND.

The Great Bank Code “Flush”

The proprietary trading arms of securities companies offloaded a net sell value of VND1.92 trillion on the Ho Chi Minh Stock Exchange (HoSE).