Rising Prices: A Persistent Trend in Hanoi’s Condo Market

Hanoi’s condo market has witnessed an unprecedented boom, with prices surging for eight consecutive quarters since Q2 2023. This momentum continued until Q1 2025, when the rate of increase started to slow down.

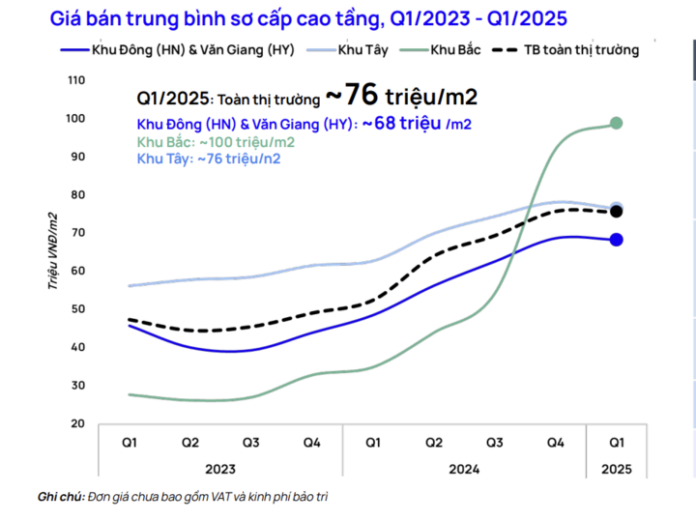

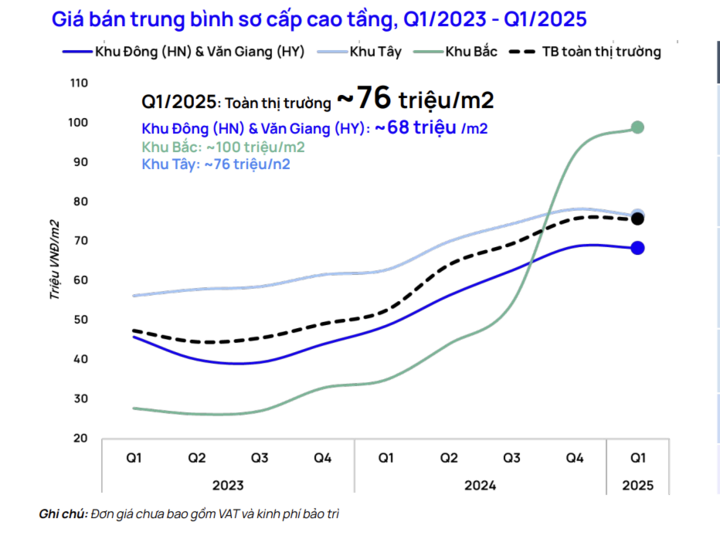

According to CBRE’s report, as of Q4 2024, primary condos in Hanoi reached an average of 72 million VND per square meter (excluding VAT and maintenance fees), a 12% increase quarterly and 36% annually. CBRE assessed this as the strongest growth since 2016 in Hanoi’s condo market.

Analyzing the market by segments, Hanoi saw only one mid-range project launched in Thach That district, which was well-received. The majority of new supply belonged to the high-end segment, mainly from large urban areas in Nam Tu Liem district and Gia Lam district. Expensive condos also tended to expand in peripheral areas such as Dong Anh district and Van Giang district (Hung Yen province).

A series of new, expensive projects entering the market pushed resale prices upward. CBRE informed that Hanoi’s condo resale prices are catching up with Ho Chi Minh City, reaching 48 and 49 million VND per square meter, respectively.

Similar to new projects, resale prices of old condos in Hanoi maintained their upward trajectory compared to the beginning of the year, with a 5% increase quarterly. Compared to the previous year, the increase was over 26% – the highest ever recorded.

Source: OneHousing.

JLL, a real estate service provider, reported that as of the end of 2024, high-end condos in Hanoi averaged 3,124 USD per square meter, approximately 79 million VND per square meter, a more than 12% increase annually.

Among the new supply, projects in central districts commanded higher asking prices. For instance, The Nelson Private Residence in Ba Dinh district was offered at 5,124 USD per square meter, roughly 128 million VND per square meter.

In the resale market, JLL stated that the average price of old condos was around 2,834 USD per square meter, or about 70 million VND per square meter, a more than 17% increase compared to the previous year.

This strong upward trend was only curbed in Q1 2025. CBRE’s Q1 2025 real estate market report showed that in the primary market, the average selling price in Hanoi reached approximately 75 million VND per square meter. While this price was 34% higher than the same period in 2024, it was only 3% higher than the previous quarter, the lowest quarterly increase since Q2 2023.

In the secondary market, Savills Vietnam found that out of over 400 surveyed condo projects in Hanoi, 47% recorded a decrease in secondary selling prices compared to the previous quarter. The decrease varied depending on the project, with the average secondary condo market in Q1 2025 decreasing by about 1% compared to the previous quarter.

” Condo prices in Hanoi have seen very strong growth and have been increasing continuously since Q4 2023, including both the primary and secondary markets. This is almost the first time that Hanoi condos have experienced such rapid price increases in a short period. In the past decade, condo prices in Hanoi have risen by an average of 5% per year. Even during the period from 2009 to 2019, condo prices were stagnant and only increased by an average of 2% per year. It is only since 2022 that condo prices in the city have started to rise rapidly,” said Nguyen Hoai An, Senior Director of CBRE Hanoi.

Sharing the same view, Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, also stated that the average asking price of condos has been continuously increasing in recent years.

Specifically, in 2021, prices fluctuated between 34 and 37 million VND per square meter, reaching 38 to 40 million VND per square meter in 2022, 39 to 42 million VND per square meter in 2023, and then soaring to 45 to 51 million VND per square meter in 2024.

How Long Will Prices Continue to Rise?

Answering the question of how much further prices will rise, Duong Thuy Dung, Senior Director of CBRE Vietnam, affirmed that one certainty is that condo prices cannot rise indefinitely. They will continue to rise until they reach the “tolerance threshold” and the purchasing power of homebuyers.

Hanoi condo prices continue to rise. (Illustrative image: Minh Duc)

The clearest evidence of this is the condo prices in Ho Chi Minh City. After a continuous increase from 2017 to 2019 and reaching a peak, prices in the city leveled off in 2022.

“ Ho Chi Minh City condos have reached a level that people can no longer afford,” Ms. Dung commented.

She provided evidence that the average price for a condo is 100 million VND per square meter. If we include affordable projects, the average price is 65 million VND per square meter, and the highest price is over 200 million VND per square meter.

Similarly, in Hanoi’s condo market, the expert believed that prices would continue to rise until the average price range reached 100 – 200 million VND per square meter, at which point they would have to stop.

Of course, this price increase will depend on the location and quality of each project. For projects currently priced at 70 million VND per square meter, prices will continue to rise until they reach the threshold of 100 – 120 million VND per square meter.

For projects currently priced at 30 – 40 million VND per square meter, prices can go up to 50 – 60 million VND per square meter, depending on the apartment quality and the reputation of the developer.

In the previous cycle, Ho Chi Minh City’s condo market took five years to peak, so Hanoi’s condo market will likely take a similar amount of time to reach its peak.

“ From now until then, Hanoi condo prices will continue to rise until they peak, surpassing the threshold of tolerance and the purchasing power of homebuyers,” Ms. Dung predicted.

Nguyen Hoai An, Director of CBRE Hanoi, also believed that the condo market in Hanoi is gradually alleviating the “thirst” for housing supply. Prices in the future will not decrease but will not increase as “hotly” as in the previous period, with an increase of about 5-8% compared to 2024.

Currently, there is a diverse range of condo products for both owner-occupiers and investors, and the price level is higher than in previous years. Therefore, expecting a decrease in housing prices is not realistic.

According to the expert, real estate prices can only decrease when there is an oversupply, slow growth in demand affecting market liquidity, and a significant impact on selling prices or macroeconomic fluctuations, financial market changes, economic growth, etc.

Predicting when prices will stop rising, Do Thu Hang, Senior Director of Research & Consulting at Savills Hanoi, forecasted that it would be in 2026 when developers return to developing Grade C apartment products – a segment that is almost non-existent today.

“ The re-supply of apartments priced below 2 billion VND will help the market get closer to real demand and create a more sustainable balance between supply and demand,” said Hang.

Also, according to her, from 2026 onwards, about 80,900 apartments from 99 projects will be launched, with Hoai Duc, Dong Anh, and Hoang Mai districts contributing more than half of the supply.

Assessing Hanoi’s housing market, Nguyen Anh Que, Chairman of G6 Group, also predicted that starting in late 2025, there would be a supply of about 4,000 social housing apartments spread across the districts with 10 projects. From 2027 to 2029, the supply of social housing and commercial apartments must reach at least 300,000 units. Only then will the condo market be able to cool down.

The City of Ho Chi Minh Still Offers a Range of Apartments Priced at 2 Billion VND and Below.

The demand for affordable housing in Ho Chi Minh City remains high, with many residents seeking properties within the price range of 2 billion VND. Despite this, there are still a significant number of apartments available on the market that fall within this budget.

The Ultimate Guide to the NHS Gateway Bac Giang: Over 300 Transactions in Just 6 Hours!

“NHS Gateway Bac Giang, a highly anticipated development, hit the market in April, offering a strategic location adjacent to the industrial park. With all legal procedures completed and necessary qualifications met, this project quickly became the focal point for those seeking accommodation and investment opportunities in Lang Giang. The area has witnessed a surge in demand, and NHS Gateway Bac Giang is poised to cater to this rising trend.”

“Ha An Group Partners with Renowned Distributor for Sora Bay Halong Project”

“As a trailblazer in the real estate industry, Ha An Real Estate Group JSC (Ha An Group) cements its position as a market opener. The company has once again been entrusted with the prestigious role of business development for the Sora Bay Halong project. This dynamic venture will bring a vibrant nightlife hub to the shores of the iconic heritage bay.”

The Perils of Negative Cash Flow: A Warning for Investors on the Dangers of Mounting Debt

The real estate market is thawing after a prolonged freeze, sparked by a rise in interest rates and tight liquidity. This revival is due to a relaxation of credit policies by the banking system. Experts advise investors to exercise caution and avoid excessive financial leverage as there are no guarantees of perpetual growth in property values.

Cielo: Affordable Luxury Living – Experience the Ultimate in Comfort and Convenience.

Amidst the rising prices of Ho Chi Minh City apartments, Cielo stands out with its competitive pricing starting from VND 29 million per square meter and an impressive array of 48 on-site amenities. With its attractive pricing compared to the market rate, this residential development captures the attention of prospective homeowners who seek a balanced option that offers a comprehensive ecosystem of facilities and amenities without compromising on affordability.