A recent report by the Ministry of Construction revealed that the disbursement of the 120,000 billion VND credit package, which started in April 2023, has only reached an estimated 3,400 billion VND as of now. This indicates a lack of enthusiasm from both businesses and citizens.

Unattractive due to high-interest rates

Ms. Nguyen Minh Anh from Dong Anh district, Hanoi, shared that when she inquired about this loan package at the beginning of 2024, she learned that the interest rate for investors was 8%/year for the first three years and 7.5%/year for homebuyers for the first five years.

” Assuming I take out a loan of 500 million VND to purchase social housing, I would have to pay an average of over 11 million VND per month for both principal and interest. With a household income of less than 20 million VND, this would be a significant burden, not to mention the complicated loan procedures. After careful consideration, I decided against taking out the loan,” said Minh Anh.

Commenting on the 120,000 billion VND low-interest loan package for social housing, economic expert Nguyen Minh Phong stated that the slow disbursement rate is due to its lack of appeal to citizens, with interest rates only 1.5-2% lower than usual and subject to change. This means that many borrowers may not be able to handle the pressure of the interest burden.

Expert claims that the interest rate for the 120,000 billion VND loan package for social housing is still high. (Illustrative image)

Mr. Phong provided a specific example, recalling a time when the average lending rate of commercial banks was 8-9%, while the interest rate for this package was also around 8%. This is one of the reasons why businesses and citizens are hesitant to take out loans. Not to mention the numerous procedures and conditions that must be met to qualify for the loan.

Additionally, according to Mr. Phong, there are other reasons why the 120,000 billion VND package is challenging to disburse. For instance, citizens may not be able to access social housing, which prevents them from taking advantage of the loan.

Echoing this sentiment, economic expert Dr. Can Van Luc emphasized that solely relying on this credit package would make it difficult to achieve the goal of developing at least one million social housing units by 2030. He clarified that the 120,000 billion VND package is commercial credit with incentives rather than a package for a humane economic policy.

” With an interest rate of over 8% for the first three years and subsequent market-based adjustments, I believe that businesses and citizens are not very interested,” stated Mr. Luc.

A representative of a real estate company also agreed that the interest rate for the 120,000 billion VND package is still high. While the average lending rate is 8-9%, the rate for this package ranges from 7 to 8.2%. This small difference is not enough to make it appealing, and banks should consider further reducing the interest rate.

Meanwhile, Mr. Do Viet Chien, Vice President of the Vietnam Real Estate Association, pointed out that the slow disbursement of the 120,000 billion VND credit package is also due to the banks’ numerous clauses and the limited supply of social housing, making it challenging to implement the support package.

The Ministry of Construction has identified the main reasons why the preferential package has not achieved the expected effectiveness. These include limited social housing supply, many investors not meeting the borrowing requirements or having insufficient collateral, and complex eligibility criteria for beneficiaries.

Additionally, the interest rate for the preferential package remains high, and the loan term is short, making it unattractive to businesses and citizens.

How to make it more appealing?

Mr. Le Hoang Chau, Chairman of HoREA, mentioned that since the end of the 30,000 billion VND credit package for housing support, there have been limitations in allocating capital for social housing development. While the policy allows enterprises constructing social housing to borrow 70-85% of capital at an interest rate equivalent to 50% of the commercial rate (approximately 5%), the lack of a budget to compensate for the interest rate difference means enterprises still have to borrow at higher rates, making it challenging to reduce housing prices.

It is necessary to further lower the interest rate and extend the loan term for the 120,000 billion VND package.

Therefore, according to Mr. Chau, relevant parties need to find suitable solutions to provide more consistent and long-term incentives to help citizens and businesses access this package. Additionally, a certain amount of resources should be allocated annually to promote social housing development, similar to the support package with interest rate compensation for banks.

Mr. Chau also suggested that the Ministry of Construction reinstate the previously proposed 110,000 billion VND package to achieve the goal of constructing a minimum of one million social housing units by 2030. This package would offer an interest rate of 4.8-5%/year, with a maximum loan term of 25 years, similar to the 30,000 billion VND package implemented over a decade ago.

Furthermore, to increase the appeal to enterprises, Mr. Chau recommended increasing the regulated profit margin to 15%, up from 10%, for enterprises that self-acquire land funds.

Dr. Le Xuan Nghia, a member of the Monetary and Financial Policy Advisory Council, stated that the crisis in the segment is worsening, with a shortage of affordable housing and an oversupply of luxury housing. Therefore, we cannot rely solely on banks to promote social housing.

” To ‘rescue’ social housing, a development fund for this segment should be established with preferential capital from the state budget. Consequently, the lending rate could be lowered, becoming more competitive than commercial lending rates. Budgetary funds would act as a catalyst, attracting additional resources,” suggested Mr. Nghia.

From a business perspective, the Deputy General Director of the Housing and Urban Development Corporation (HUD) proposed: ” Commercial banks should not assess the effectiveness of social housing projects. By nature, social housing projects are inherently effective because enterprises are allowed a maximum profit margin of 10%.”

Mr. Nguyen Hung, CEO of TPBank, suggested that additional support measures would be beneficial. For instance, the 2% interest rate support package has been underutilized. If the government allows a portion of it to be used to support homebuyers, a reduction of 2% on top of the current 7.5% would make repayment more manageable for many individuals.

The Vietnamese Dong’s Turbulent Times: A Brighter Future Ahead

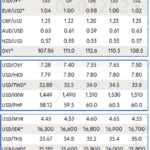

The forex market has been under significant pressure since the US announced countervailing duties in early April, despite a global easing of the US dollar’s strength. Nonetheless, experts assess that the Vietnamese Dong will show positive signs by year-end, with a ‘not-so-bad’ trade deal on the table.

The Greenback’s Tumble: Central Bank’s Rate Cut Strategy Pays Off

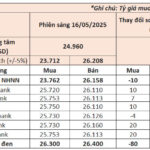

As of May 16th, the USD exchange rate at banks showed an upward trend. Conversely, the black-market USD rate unexpectedly plummeted by 80 VND, trading at 26,300 – 26,400 VND per USD.

The Greenback’s Future: Forecasting USD’s Fate

The Market and Global Economics Research team at UOB Bank (Singapore) has released its May strategy report on exchange rates and interest rates. The bank’s forecast for the upcoming quarters is as follows: 26,100 VND/USD for Q2, 26,300 VND/USD for Q3, 26,000 VND/USD for Q4, and 25,800 VND/USD for Q1 2026.