According to VietstockFinance‘s statistics, the combined revenue of 19 seafood businesses listed on the HOSE, HNX, and UPCoM exchanges surpassed 16.4 trillion VND, marking a 3.4% increase compared to the previous year. Net profit surged by over 50%, reaching approximately 518 billion VND, primarily driven by Nam Viet’s exceptional performance.

However, the industry continues to witness a performance divide. Several businesses grapple with losses due to cost pressures and incomplete recovery in export markets.

Growth in the Tra Fish Enterprises Group

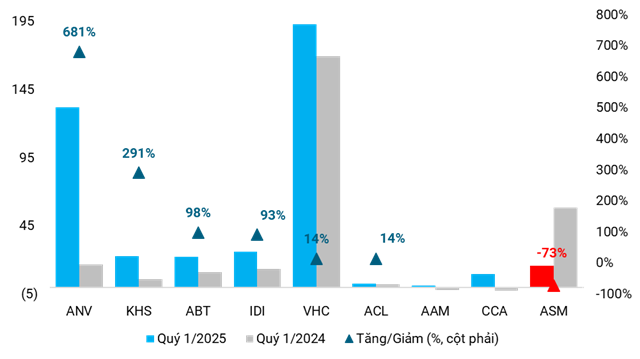

Within the group of companies engaged in pangasius farming and processing, Nam Viet (HOSE: ANV) reported a sevenfold surge in profit, reaching 132 billion VND, despite only an 8.9% increase in revenue to over 1.1 trillion VND. This marks ANV’s highest profit in over two years, attributed to increased sales volume and improved selling prices as the export market rebounded.

Vinh Hoan (HOSE: VHC) recorded a nearly 14% rise in profit to 193 billion VND, despite a slight dip in revenue to around 2.6 trillion VND. The company attributed the positive results to higher selling prices and significantly lower farming costs compared to the previous year.

Among smaller-scale businesses, several names also achieved impressive growth in their operations. Kien Hung (HNX: KHS) effectively leveraged competitively priced imported raw materials and stable output to major markets such as Japan, the US, and the EU, resulting in a profit increase of over 290%.

Ben Tre Seafood Import and Export Joint Stock Company (HOSE: ABT) announced a 34% surge in revenue and nearly doubled its profit to over 22 billion VND, thanks to increased orders and stable business operations.

Multi-National Investment and Development Joint Stock Company – IDI (HOSE: IDI) reported a 93% jump in profit to over 26.3 billion VND, largely attributed to substantial financial income from interest and dividends from associated companies.

|

Profit of many pangasius exporters surged compared to the previous year (in trillion VND)

Source: Author’s compilation

|

Divergence in the Shrimp Group

While the pangasius sector displayed positive signs, the group of shrimp processing and exporting enterprises yielded mixed results.

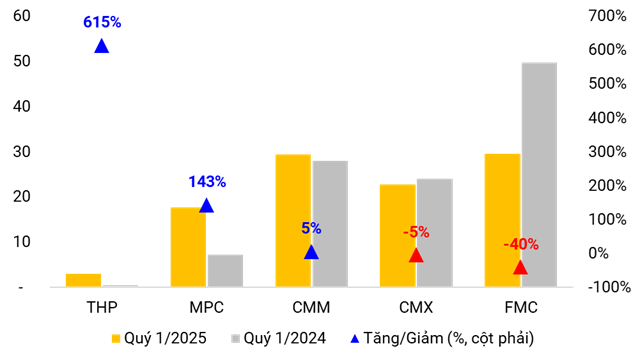

Minh Phu Seafood Corporation (UPCoM: MPC) posted a profit of nearly 17.7 billion VND, reflecting a 143% increase compared to the previous year, even though revenue grew by just 3.5%. The “Shrimp King” attributed this improvement to enhanced production efficiency in its processing plants, along with encouraging signs in its commercial shrimp farming and shrimp breeding segments.

Similarly, Thuan Phuoc Seafood and Trading Corporation (UPCoM: THP) achieved positive results, with profit surging by over 600% to more than 3 billion VND, against a modest rise in revenue.

On the other hand, Sao Ta Food Joint Stock Company (HOSE: FMC) witnessed a 40% decline in net profit to approximately 29.6 billion VND, the lowest in several years, despite a 36% increase in revenue to nearly 2 trillion VND. This downturn was primarily due to elevated raw material prices and the impact of lingering orders from previous periods.

Camimex Group Joint Stock Company (HOSE: CMX) reported a decline in both revenue and profit.

|

Shrimp industry witnessed overall growth but with exceptions (in trillion VND)

Source: Author’s compilation

|

Some Companies Still Struggling

Despite the overall positive performance of the industry, five businesses reported losses.

An Giang Seafood Import and Export Joint Stock Company (UPCoM: AGF) remained in the red, posting a loss of 9.3 billion VND. This was attributed to a decline in revenue from processing and warehouse leasing, as the company operated below capacity due to limited working capital, a consequence of consecutive years of inefficient operations.

ICF, JOS, and SPD continued to struggle with losses. Central Seafood Export Joint Stock Company (UPCoM: SPD) reported an 855 million VND loss despite a rise in export volume and a over 14% increase in order value, falling short of expectations in terms of product mix adjustments outlined in their plans.

– 09:00 20/05/2025

The Profitable Stockbroking Company: Leading the Industry with a 43% Dividend Payout

“VietinBank Securities has announced a dividend plan that will see shareholders receive a substantial return on their investment. In a move that underscores the company’s commitment to rewarding its shareholders, it has been revealed that for every 100 shares owned, shareholders will be entitled to an additional 43 shares. This generous dividend policy highlights VietinBank Securities’ strong financial performance and its dedication to creating value for its investors.”

Sure, I can assist you with that.

Title: Long Thành Riverside Bonds Cleared, Reports Surge in Profit for the First Half of the Year

Long Thành Riverside, the esteemed developers of the ID Junction project in Dong Nai, have achieved a remarkable feat by eliminating their bond debt entirely by the end of June 2024, while also reporting a significant surge in profits for the first half of the year.