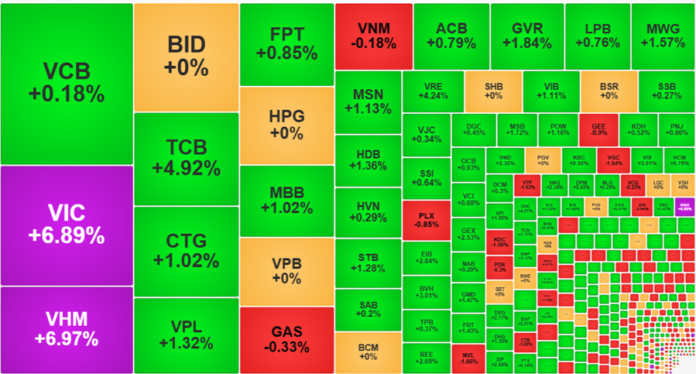

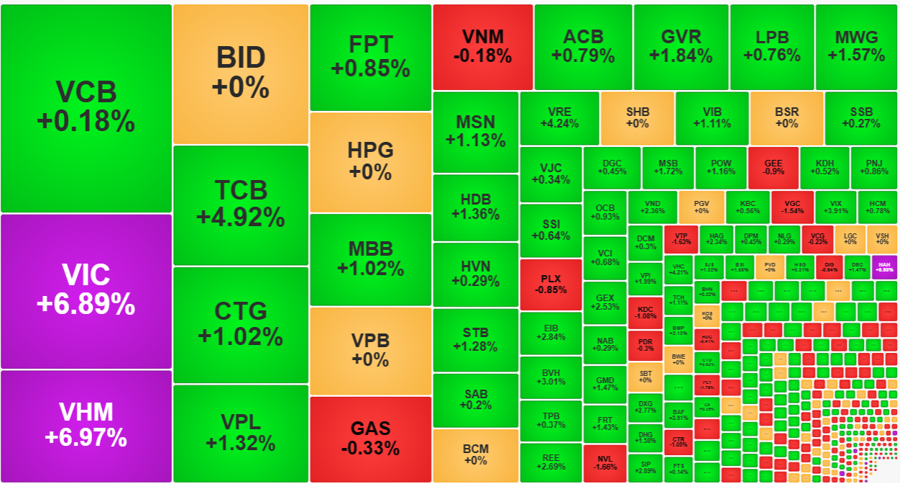

The HoSE liquidity matched a slight increase of 2.6% from the previous session, while the VN30 basket witnessed a more significant surge of 10%. Trading of this blue-chip basket accounted for 62% of the entire exchange, with the VN30-Index climbing by 2.01% and setting a new peak since the beginning of May 2022.

The strength of this index, representing the blue-chip group, was further bolstered by VHM. Within just the first 10 minutes of the afternoon session, a substantial amount of capital rushed in, swiftly clearing the sell orders and pushing the stock to the maximum daily gain. VHM’s trading value in the afternoon alone reached 497 billion VND, the highest in the VN30 basket and across the market. For the whole day, VHM’s liquidity amounted to 21.9 million shares, worth 1,369 billion VND.

This drastic price movement propelled VHM to the third-largest capitalization on the HoSE, right after VIC. Thus, the Vin Group now holds two spots within the top three largest caps. VPL, which rose by 1.32% today, also jumped to the seventh position. Together with VRE’s increase of 4.24%, these three Vin Group stocks contributed nearly 17 points to the VN30-Index’s overall gain of 27.77 points.

Regarding the VN-Index, the influence of VIC and VHM was relatively milder, yet it was complemented by the strength of VPL. The four “Vin family” stocks contributed 10.3 points to the VN-Index’s total increase of 18.86 points.

The VN30-Index closed the morning session with a 1.7% gain and ended the day with a 2.01% increase, not a significant shift. In reality, while 15 stocks in this basket climbed in comparison to the morning session, 11 stocks witnessed price declines. The increase in capitalization was mostly driven by VHM, with FPT also making a notable contribution. This latter stock added 1.02% compared to the morning session and successfully reversed its trend, concluding the day with a 0.85% gain over the reference price. Another impressive performer was BVH, which was down 0.41% at the morning close but experienced a sharp surge in the first few minutes of the afternoon session, mirroring VHM’s trajectory. BVH finished the day with a total increase of 3.01%, corresponding to an afternoon gain of 3.43%. Unfortunately, BVH’s capitalization is relatively modest, ranking 33rd in the VN-Index.

The strength of the blue-chip basket today largely originated from mid-cap stocks. Within the top 10 caps, only TCB witnessed a substantial increase of 4.92%, while CTG and MBB rose by a more modest 1.02%. BID and HPG remained unchanged, and VCB displayed weakness with a minor increase of 0.18%. Conversely, VRE, BVH, GVR, MWG, HDB, STB, MSN, and VIB all recorded gains above 1%. Positively, the capitalization of these mid-cap stocks is relatively substantial in the VN30-Index. For instance, MWG contributed only 0.3 points to the VN-Index but influenced the VN30-Index by more than 1.6 points. This dynamic fueled the VN3-Index’s outstanding performance.

Although the main impetus for the index came from the large caps, the market in the afternoon also witnessed a decent amount of capital pushing prices higher. The breadth of the HoSE at the close showed 181 gainers and 133 losers, not much different from the morning session (170 gainers and 116 losers). However, the number of stocks rising by at least 1% increased to 106, compared to 96 in the morning. The Midcap index closed with a gain of 1.14% (up 0.90% in the morning), while the Smallcap index slightly weakened, rising by 0.72% (up 0.75% at the morning close). VIX, BAF, GEX, VSC, EIB, VND, and DXG witnessed strong gains with liquidity reaching hundreds of billions of VND for each stock.

In the afternoon, the decline was witnessed in a higher number of stocks compared to the morning session, but the main focus of selling pressure remained on NVL. This stock narrowed its loss slightly to 1.66% compared to -2.07% in the morning. Additionally, VTP experienced a sudden surge in selling pressure, resulting in a 1.63% drop, despite being down only 0.86% at the morning close. VTP also exhibited considerable liquidity, with nearly 113 billion VND in trading value. BCG declined by 3.51%, VGC by 1.54%, PC1 by 1.78%, and DC4 by 3.03%, all with relatively high liquidity.

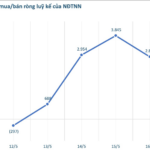

Foreign investors continued to offload VHM in the afternoon, net-selling approximately 233.5 billion VND more, bringing the total net-selling value for the day to 569.4 billion VND. FPT also experienced increased net-selling, amounting to 88 billion VND. However, the overall net position of foreign investors in the afternoon was only -84.4 billion VND due to net buying in other stocks. The actively bought stocks included VIX, MWG, MBB, VIC, BAF, CTG, and DXG.

“Left in the Lurch: The Tale of Privately Placed Shares”

The Binh Duong Business and Development JSC intended to offer 35 million shares, but 7,772,000 shares remained unsold. The Kien Giang Construction Investment Consulting Group JSC has requested a 30-day extension to distribute the unsold shares from the approved plan during the public offering.

The IPO Tsunami: VN-Index Surges Past 1,300

The two market indices continued their upward trajectory during the trading week of May 12-16. The VN-Index climbed a total of 2.69%, reaching 1,301.39 points, despite a minor dip in the final trading session. Similarly, the HNX-Index mirrored this positive performance, gaining 2.13% to close at 218.69 points.