“Banking for the People”

In 1962, during a visit to the Nam Dinh Textile Factory, President Ho Chi Minh stopped by the Socialist Savings Fund located within the premises. While chatting with three officers of the fund, he inquired about the number of workers who had saved money and asked a seemingly simple question: “Can I deposit one cent if I have one? (as the minimum deposit at that time was one dong).”

Behind this seemingly simple question lies a profound truth and a lesson from the President for the banking sector: Regardless of its level of modernization, a bank must never forget its roots and that it is of the people, by the people, and for the people. Thus, it should primarily aim to serve the people. The story of “one cent” is a reminder not only about deposit policies but also about a philosophy of financial equality, where no one is too small to be served, no amount is too insignificant to be valued, and no one is excluded from accessing banking services.

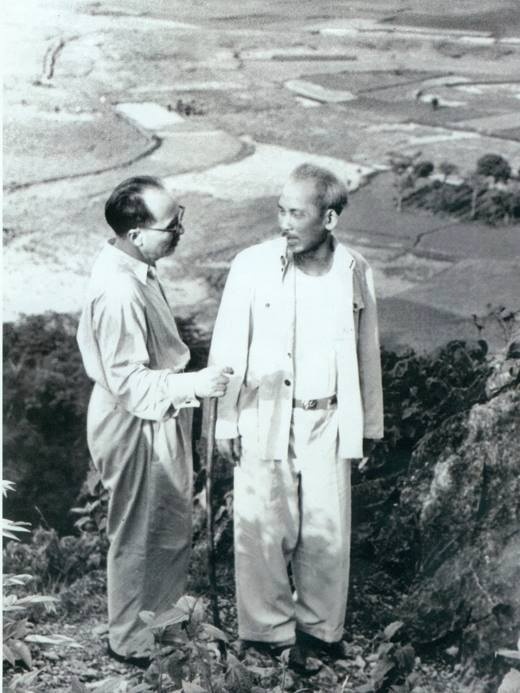

President Ho Chi Minh and the first Governor of the State Bank of Vietnam, Nguyen Luong Bang (photo taken on May 19, 1957)

In the era of digital finance, where algorithms can replace humans, the President’s question still prompts a requirement: Modern banks must have a heart. Intelligent services should go hand in hand with kindness. Financial inclusion should be defined by compassion, not just by metrics. This is also something that the banking industry has been implementing in the past and continues to do so.

The banking system has grown stronger, not only supporting the development of businesses but also serving all segments of society, especially the poor and the vulnerable. Alongside the Vietnam Bank for Social Policies (VBSP), which specializes in implementing credit programs for the poor and targeted groups, there is also the concerted effort of the entire industry. For instance, state-owned commercial banks contribute 2% of their deposits to the VBSP to implement policy credit programs, and many commercial banks, including joint-stock commercial banks, have their own credit policies for the poor and vulnerable groups. Additionally, there are nearly 1,200 people’s credit funds operating effectively across the country, along with microfinance institutions and social security programs, to ensure that “no one is left behind” in the country’s development journey.

Safeguarding Money Means Preserving Morality, Trust, and Justice

In a letter to the Banking Staff Conference in January 1965, the President instructed: “Managing money is a very important task in the cause of building socialism. Bank officials are responsible for keeping the money of the State and the people, so they must learn to manage money well, avoid waste and loss. Every dong invested must ensure an increase in society’s wealth, must circulate quickly, and must not be stagnant. We must actively mobilize idle money for production.”

It is not a coincidence that he used the word “keep” when instructing the banking staff. Keeping is not just a transactional operation, but it implies preserving with responsibility and honor. It signifies a great entrustment from society and the people: entrusting their faith, hopes, and livelihoods to the bankers.

When people deposit their savings, they are not only entrusting their assets but also their trust. When a small business approaches a bank for a loan, they are not just seeking funds but also a helping hand and a pillar of support.

In the context of an increasingly complex financial system, money management becomes more challenging, involving not just counting but also accurately assessing risks, correctly valuing, and ensuring safety and transparency in every decision. Today’s approval signature can be a lifeline for a struggling business, but it can also be the beginning of losses and violations if the officer lacks responsibility and fortitude.

Therefore, “keeping the money,” as the President instructed, means preserving professional dignity, upholding integrity as a public servant, and safeguarding morality in a system tested daily by power and temptation.

In the same letter, he emphasized: “Every dong invested must ensure an increase in society’s wealth, must circulate quickly, and must not be stagnant.” This thought implies that the state’s money and the people’s deposits in the bank are not meant to be “kept” or “stored” but to be utilized to create value. This value is not just about profits for the bank and deposit interests for the people but, more importantly, about creating jobs, producing social goods, and transforming people’s deposits into a driving force for economic development.

When a bank officer considers each dong as a “seed of trust,” they will be more cautious in their decisions, more vigilant about risks, and more dedicated to ensuring that this seed “germinates” in people’s lives.

“Frugality, Honesty, Diligence, and Righteousness” Are Not Just Slogans but Principles

In his letter to the Banking Staff Conference in January 1965, the President advised: “Bank officials must always cultivate revolutionary morality, practice frugality, honesty, diligence, and righteousness, thoroughly understand the Party and State’s policies, deepen their theoretical and professional knowledge, and improve their working methods to better serve the production and lives of the people.”

Ho Chi Minh’s thought is proven to be not just about abstract morality. He always linked morality with specific actions, professional positions, and unique environments. For the banking sector, moral requirements are particularly important because bankers frequently deal with money, and without revolutionary morality, they can easily be tempted.

Also, because bankers often come into contact with money, “frugality, honesty, diligence, and righteousness” are not dogmas but a system of vital principles. Frugality means not being indifferent, lazy in learning, or stagnant in innovation. Honesty ensures that not a single dong is misappropriated, and no unethical behavior or vague compromise undermines integrity. Diligence saves time for the people and creates opportunities for the economy. Righteousness means being upright and impartial, free from the influence of personal relationships, vested interests, or pressure “from above.”

It is from this value system that a bank officer can manage assets, safeguard morality, and serve the development of the country.

In a world of increasingly digital, globalized, and volatile finance, what keeps the banking industry steadfast is not technology or capital scale but its people—those with a sense of service, economic wisdom, and moral fortitude to serve the nation and its people. President Ho Chi Minh did not speak much about banking, but every word of his is a “moral design” and a systemic instruction for the industry; educating bankers not just in procedures but also in fostering ideals, tempering characters, and instilling political resolve in every operational behavior.

More than 60 years have passed since the letter to the Banking Staff Conference in January 1965, and 63 years since the “one cent” story. The President’s teachings remain timeless, guiding bank officers to cultivate, study, and practice morality by following his example, contributing to the sustainable development of the banking industry and building a Vietnam that is “more prosperous and beautiful, standing shoulder to shoulder with the powers of the five continents,” as he envisioned.

Withdrawing and Transferring Money Made Easy at the The Gioi Di Dong and Dien May Xanh Stores.

Customers can effortlessly top up their accounts or withdraw cash and transfer money to their loved ones swiftly, conveniently, and time-efficiently without the need to physically visit an ATM or a bank branch.

Gen Z and Their ‘Full-Service’ Payment Methods: How MoMo Became a Pioneer in Digital Finance

As a pioneering financial platform, MoMo is at the forefront of driving digital transformation in Vietnam. With a range of innovative financial services and products, MoMo is empowering people to live smarter and more fulfilling lives. By harnessing the power of technology, MoMo is revolutionizing the way people manage their finances, making it easier and more accessible than ever before. With its user-friendly interface and secure platform, MoMo is the trusted choice for millions of Vietnamese, enabling them to take control of their financial future.