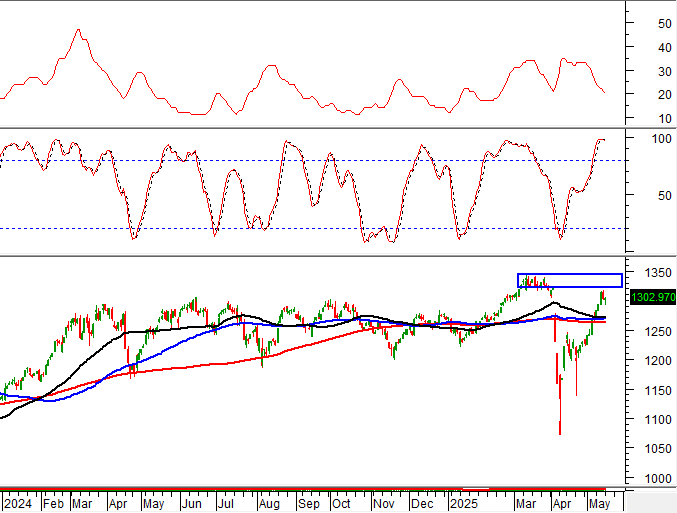

Technical Signals for VN-Index

In the trading session on the morning of May 19, 2025, the VN-Index rose, and a Doji candlestick pattern emerged, indicating investors’ hesitation.

Currently, the ADX indicator continues to weaken and is moving within the gray zone (20 < adx < 25).

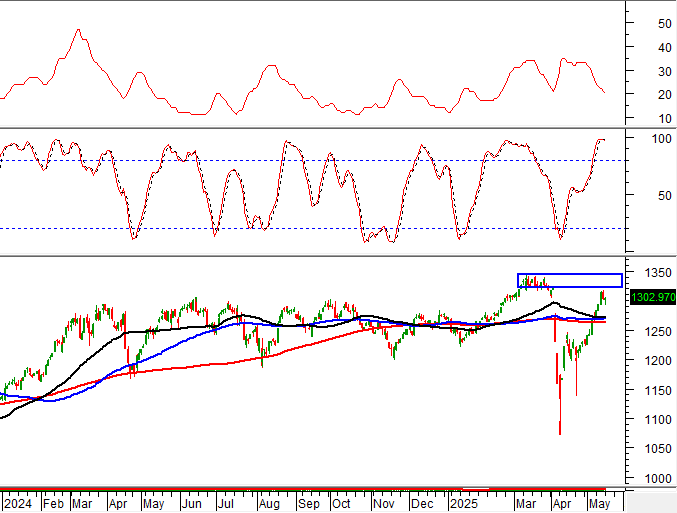

Technical Signals for HNX-Index

In the trading session on May 19, 2025, the HNX-Index declined, and liquidity significantly dropped in the morning session, indicating investors’ caution.

In addition, a ‘Death Cross’ formed on the HNX-Index as the SMA 50-day line crossed below the SMA 100-day and SMA 200-day lines, suggesting that the mid- and long-term outlook is gradually weakening.

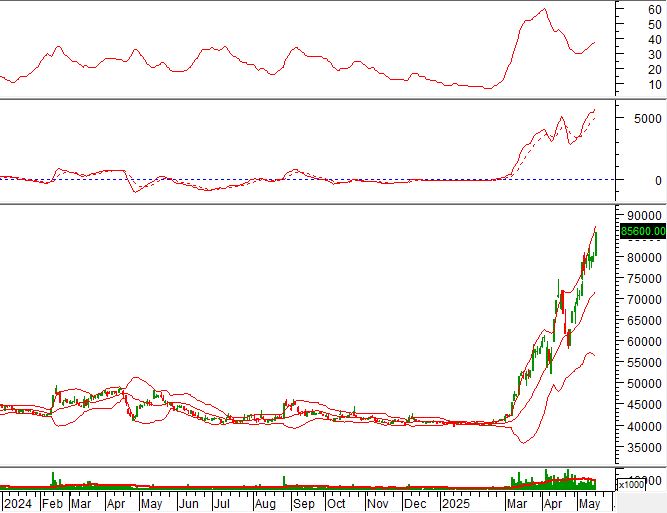

MSN – Masan Group Joint Stock Company

On the morning of May 19, 2025, MSN witnessed a slight decrease in price alongside a significant increase in trading volume, reflecting investors’ cautious sentiment.

At present, the stock price is retesting the 50% Fibonacci Retracement level (equivalent to the 60,000-62,000 range) while the Stochastic Oscillator indicator is showing a sell signal in the overbought region. If the sell signal persists and the price falls out of this range, the risk of a downward adjustment in subsequent sessions will heighten.

VIC – Vingroup Joint Stock Company

On May 19, 2025, VIC reached the ceiling price, forming a White Marubozu candlestick pattern, and trading volume significantly increased, indicating investors’ optimism.

Moreover, the stock price is closely following the upper band of the Bollinger Bands, and the MACD indicator continues to widen the gap with the signal line after previously giving a buy signal, further reinforcing the current upward trend of the stock.

Technical Analysis Department, Vietstock Consulting

– 12:08 19/05/2025

Market Beat: VN-Index Fails to Hold 1,300 Points

The market closed with the VN-Index down 5.1 points (-0.39%) to 1,296.29, while the HNX-Index fell 1.45 points (-0.66%) to 217.24. The sell-side dominated today’s trading with 452 declining stocks versus 287 advancing stocks. Within the VN30 basket, 24 stocks decreased, 4 increased, and 2 remained unchanged, resulting in a sea of red.

“Left in the Lurch: The Tale of Privately Placed Shares”

The Binh Duong Business and Development JSC intended to offer 35 million shares, but 7,772,000 shares remained unsold. The Kien Giang Construction Investment Consulting Group JSC has requested a 30-day extension to distribute the unsold shares from the approved plan during the public offering.

Market Beat: Foreign Investors Scoop Up VIC Shares, VN-Index Recaptures Green

The market regained its positive momentum, led by a few key stocks. By the end of the morning session, the VN-Index rose slightly by 0.12%, reaching 1,302.97. In contrast, the HNX-Index fell by 0.38% to 217.85. Despite the overall gain, the market breadth remained tilted towards decliners, with 369 stocks falling against 276 advancing ones.

“Vietstock Weekly: Uptrend Persists, Setting the Tone for a Bullish Week Ahead”

The VN-Index continued its upward trajectory, maintaining its positive momentum since crossing above the 200-week SMA. Accompanied by strong trading volumes above the 20-week average, this indicates robust participation from investors. This momentum was pivotal in propelling the index beyond the 1,300-point mark. Should the VN-Index sustain levels above this threshold in the coming weeks, it could potentially pave the way for a revisit to the March 2025 highs of 1,320-1,340 points. This zone also coincides with the highest peak since May 2022.

Stock Market Insights: The Short-Term Restructuring Opportunity

The derivatives expiry session yesterday pushed the VN30 to test the peak, reaching exactly 1404 points, but it turned downward today. F1 discounted this scenario early on, and when the bank stocks “confirmed”, the short-term profit-taking pressure increased significantly. This presents an opportunity to restructure and optimize costs.