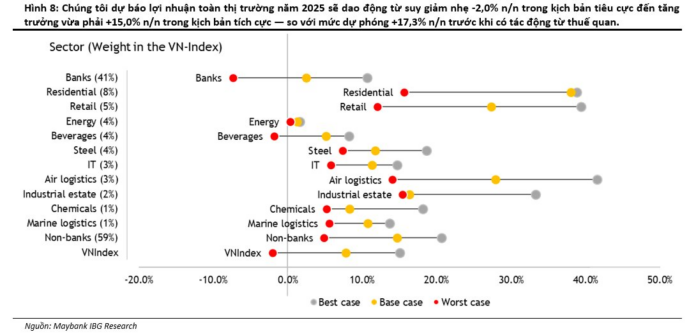

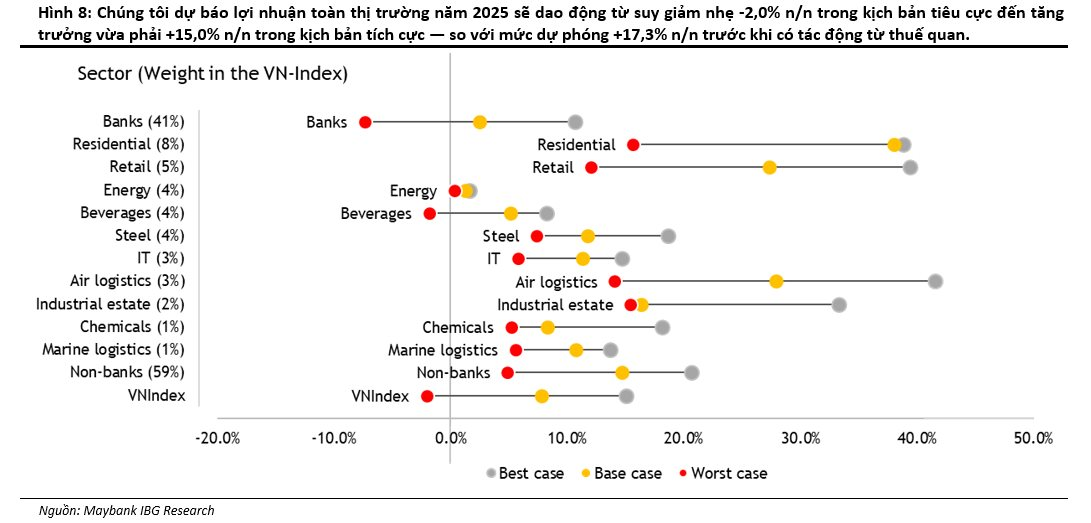

In Maybank Securities’ May outlook report, the firm forecasts a market-wide earnings outlook for 2025 ranging from a 2% decline in a negative scenario to moderate growth of 15% in a positive one. This is a slight decrease from the previous projection of 17.3% before the tariff impact.

According to Maybank, most listed companies reported stable financial results in Q1 2025. However, signs of a slowdown are emerging, mainly due to uncertainties surrounding tariff policies and a changing macroeconomic environment.

Some sectors, such as real estate and aviation logistics, continue to show resilience, with upward profit forecast revisions. In contrast, export-oriented or tariff-sensitive industries face increased volatility.

Overall, Maybank maintains a cautious outlook on the broader market due to ongoing tariff uncertainties but remains selectively optimistic about specific sectors supported by: (1) long-term structural demand in technology and aviation logistics, and (2) government stimulus measures in real estate and steel.

Specifically, for the Banking sector, the analysts assess that banks’ direct exposure to tariff policies is limited, as loans to businesses directly impacted by tariffs (mainly export and US-oriented industrial development) account for only about 1-4% of total loans. While most banks maintain positive profit growth expectations for 2025, some express concerns that indirect effects on domestic consumption could negatively affect credit growth and profit margins, depending on each bank’s target customer base.

Maybank expects credit growth of 14-16% year-over-year, driven by corporate lending in the first half and accelerating in retail lending in the latter part of the year. Net interest margins (NIMs) are likely to remain under pressure in the first half due to significant exchange rate fluctuations and intensified deposit competition but are expected to improve in the second half as credit demand recovers broadly.

In the base case scenario, the analysts adjust their industry-wide profit growth forecast for 2025 downward to 2.5% year-over-year, a 16 percentage point reduction from the pre-tariff impact projection.

Turning to the Retail sector, companies anticipate a slowdown in economic growth, falling short of a full-blown recession. Consumer spending is expected to weaken, affecting revenue and profit margins. However, market leaders view this as an opportunity to expand their market share and strengthen their position by investing in their distribution networks and optimizing operations.

Looking ahead to 2025, tariffs are expected to continue weighing on consumer sentiment and purchasing power. However, Maybank believes that government support measures, such as waivers on tuition and medical fees, along with potential personal income tax reforms, will partially offset these effects.

Consequently, market leaders like MobileWorld (MWG) in ICT, electronics, and food retail, FPT Retail (FRT) in pharmaceuticals, and Phu Nhuan Jewelry (PNJ) in gold jewelry, will further expand their market share through aggressive network expansion strategies. In the base case scenario, Maybank revises the industry-wide profit growth forecast for the fiscal year 2025 downward by 15 percentage points compared to pre-tariff projections, now standing at 27.3% year-over-year.

In the Steel industry, the MSVN analysts note that the impact largely depends on each company’s exposure to exports to the US. While companies aim to diversify their export markets, they also anticipate benefiting from Vietnam’s ongoing infrastructure push and the imposition of anti-dumping duties on Chinese steel. Overall, businesses predict a continued recovery in the steel sector, although they remain cautious about increasing uncertainties.

Maybank expects domestic steel manufacturers’ recovery to persist this year due to: (1) the ongoing rebound in the domestic real estate market, (2) the 19%-28% anti-dumping duties on hot-rolled steel coils imported from China effective since March 2025, and (3) the government’s infrastructure drive to support the economy. In the base case scenario, MSVN revises the industry-wide profit growth forecast for the fiscal year 2025 downward by 10 percentage points compared to pre-tariff projections, now standing at 11.7% year-over-year.

Regarding the Technology sector, the MSVN analysts point out that IT services are not subject to retaliatory tariffs. The trade war is unlikely to derail the digital transformation trend and, in fact, helps companies reduce operating costs. This trend will continue to be the primary growth driver for global IT services providers like FPT. Specifically, for FPT, a potential trade agreement between Japan and the US could boost IT demand in Japan, FPT’s largest IT services market.

Meanwhile, President Trump’s efforts to bring manufacturing back to the US may also increase IT demand there, FPT’s second-largest IT outsourcing market. In the base case scenario, Maybank revises the industry-wide profit growth forecast for the fiscal year 2025 downward by 15 percentage points compared to pre-tariff projections, now standing at 11.3% year-over-year.

On the other hand, the report highlights that Industrial Real Estate businesses are significantly impacted by tariffs. While existing factories continue to operate normally, new investors are delaying disbursements, and ongoing negotiations for new land leases are being reconsidered as stakeholders await the outcome of trade negotiations between Vietnam and the US.

In the base case scenario, Maybank Securities analysts adjust their industry-wide profit growth forecast for the fiscal year 2025 downward by 17 percentage points compared to pre-tariff projections, now standing at 16.3% year-over-year, also downgrading their outlook due to ongoing tariff uncertainties.

Additionally, the tariff impact on the Port sector is expected to materialize soon, given that the US accounts for 30% of Vietnam’s total exports. The consequences for individual companies will depend on the destinations of the goods transported by their vessels or handled at their ports. Domestic shipping companies anticipate minimal impact. While most companies still expect growth in 2025, the longer-term outlook beyond 2025 remains limited.

Maybank expects the current export momentum to extend into the first half of 2025. Reflecting this, in the base case scenario, MSVN revises the industry-wide profit growth forecast for the fiscal year 2025 upward by 13 percentage points compared to pre-tariff projections, now standing at 10.2% year-over-year. However, import-export activities are likely to slow significantly afterward, depending on the final outcome of the trade negotiations.

The Credit Growth Picture in Q1: A Snapshot

The financial landscape has witnessed a positive shift this year, with a strong growth in credit right from the get-go. This is in contrast to the modest growth observed in the first quarter of last year. However, consumer credit has yet to show significant improvement despite the efforts of the State Bank to implement policies geared towards boosting credit growth in this sector.

“Viconship Acquires Over 1 Million Additional Shares of Haiphong Shipping and Stevedoring Company (HAH)”

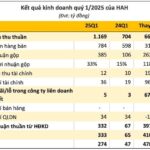

A group of shareholders associated with Viconship has increased their ownership to 11.61% of the charter capital in Hai An Transport and Stevedoring.

The End of Easy Profits: What’s Next for Banks to Sustain Profitability?

In the first quarter, banks navigated a challenging environment marked by a continuing compression in net interest margins (NIM). Lending rates were lowered to support the economy, while funding costs remained relatively high to attract deposits. This squeeze on interest rate margins impacted the core income stream from credit activities, directly affecting the bottom line of banking institutions.

Bad Debt Rises: Bank’s Non-Performing Loans Surge 16% in Q1 2025

The rise in non-performing loan ratios for banks in Q1 2025 can be attributed to a multitude of factors, including the lingering effects of the COVID-19 pandemic, natural disasters, the conclusion of Circular 02, and a lack of uniformity in secured debt management systems.