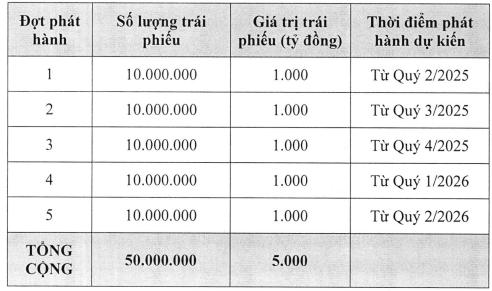

Earlier, on April 26, the ACBS Board of Directors approved the plan to issue public bonds in 2025 with a volume of 50 million bonds, equivalent to a scale of 5 trillion VND, divided into 5 phases from Q2 2025 to Q2 2026.

The bonds are of the non-convertible type, without warrants, and are unsecured. After a successful offering, the principal will be paid in a lump sum at maturity, while interest will be paid periodically every 12 months, determined by the sum of the reference interest rate and the interest rate margin (minimum of 1% and maximum of 3%).

The reference interest rate is the average of individual regular savings deposit interest rates, with a term of 12 months (or equivalent), with interest paid at maturity, announced on the websites of four commercial banks on the interest rate determination date, including Vietcombank, VietinBank, BIDV, and Agribank.

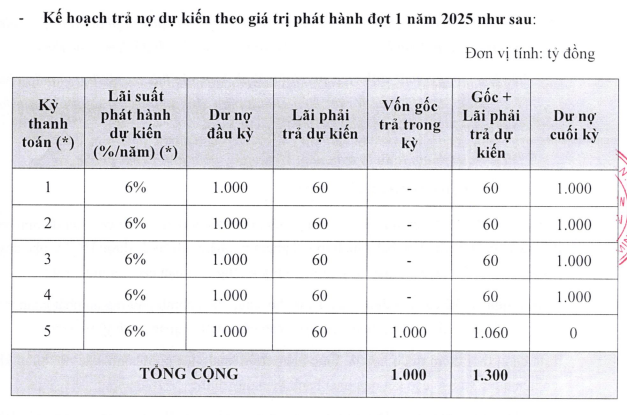

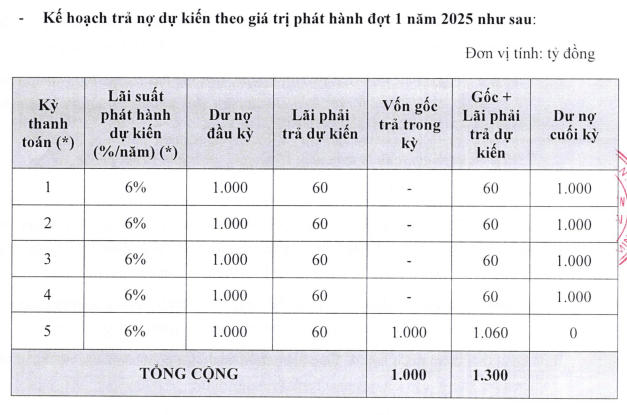

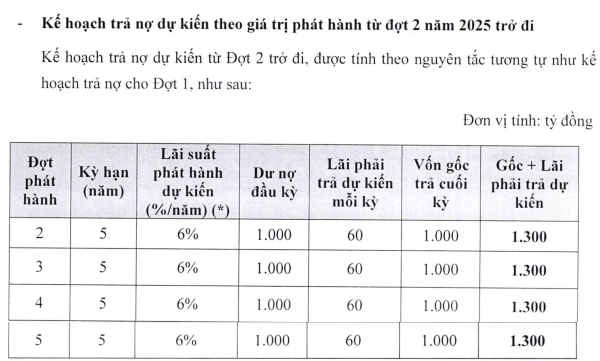

According to the assumptions in the repayment plan, the interest rates for the issuance batches remain at 6% and are maintained during the circulation period, corresponding to an expected profit rate of 10% from the use of the proceeds of the issuances.

Source: ACBS

|

Going back to the recently approved bond offering registration documents on May 16, there is the appearance of a decision dated May 13 of the General Director on the implementation of the public bond issuance in 2025 (Batch 1), indicating that ACBS is about to implement the first offering batch with a scale of 1,000 billion VND in the coming time (planned for Q2 2025). In addition, a notable document is the bondholder representative contract dated May 13, No. 01/2025/DDNSHTP/KAFI-ACBS.

|

ACBS plans to issue bonds through 5 batches

Source: ACBS

|

Regarding capital mobilization activities, earlier on March 20, the ACBS Board of Directors also approved the decision to borrow capital from Agribank and BIDV, with respective limits of up to 3 trillion VND and 10 trillion VND, totaling a maximum of 13 trillion VND, mainly to supplement working capital and invest in government bonds and securities.

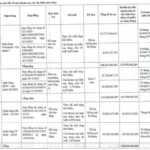

As of March 31, 2025, ACBS‘s assets were mostly financed by debt, with a ratio of over 55% of total capital sources, equivalent to nearly VND 16.8 trillion, slightly up from the beginning of the year. The main lending banks to ACBS include BIDV with nearly VND 5.7 trillion at an interest rate of 3.8 – 5.5%, Eximbank with over VND 2.8 trillion at an interest rate of 4.4 – 5%, and Vietcombank with over VND 2.5 trillion at an interest rate of 4 – 4.3%.

|

Short-term loans as of March 31, 2025, of ACBS

Source: Q1/2025 Financial Statements of ACBS

|

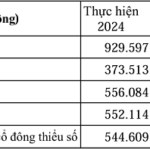

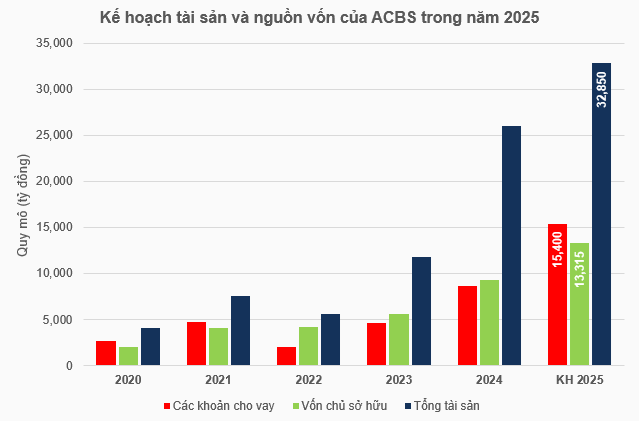

In 2025, the ACBS Board of Directors also approved significant business orientations with figures never seen before.

Specifically, the total asset size is expected to increase sharply to nearly VND 32.9 trillion by the end of 2025, up more than 25% compared to the end of 2024, strongly promoted through the target of margin lending value reaching VND 15.4 trillion, up over 75% compared to the end of 2024. The plan is largely supported by equity capital, with a target of over VND 13.3 trillion, up over 40%. All are new milestones in the operating history of ACBS.

The plan put forward by ACBS also mentions a profit-before-tax target of VND 1.35 trillion, up over 60% compared to the 2024 performance.

Source: VietstockFinance, compiled by the author

|

– 21:58 19/05/2025

“Insider Shareholder Plans to Exit SaigonBus, Stock Plunges”

The share price of Saigon Bus Joint Stock Company (SaigonBus, UPCoM: BSG) plummeted to its floor price of VND12,200 per share during the morning session on May 15, following a series of registration for divestment by major shareholders related to Mr. Tran Ngoc Dan, a member of the company’s Board of Directors.

Vingroup Successfully Raises $85 Million in Bond Offering

On May 9, 2025, Vingroup successfully offered a total of VND 2,000 billion ($85 million) in bonds, under the code VIC12505, with a maturity of 24 months.