“VPBank Secures International Funding, Demonstrating Strong Financial Confidence”

This international fundraising effort is the largest in the company’s history and clearly demonstrates the strong financial confidence the international financial community has in VPBank’s long-term development potential and sustainable business strategy.

The loan was coordinated by Sumitomo Mitsui Banking Corporation (SMBC) as the sole coordinator, along with the participation of reputable financial institutions, including Maybank, Cathay United Bank, and Standard Chartered Bank, in arranging, booking, and syndicated lending. The involvement of these prominent financial institutions not only enhances the value of the transaction but also underscores VPBank’s capability in connecting with and mobilizing international capital.

The deal also showcases VPBank’s international credibility and trustworthiness, attributed to its transparent corporate governance, robust financial health, and agile adaptability to market fluctuations, despite being a relatively new player in the market.

“The success of this transaction clearly illustrates VPBank’s solid establishment of strong trust among international investors through its firm commitments to transparency, effective governance, and breakthrough business strategies,” emphasized Mr. Vu Huu Dien, Chairman of the Board of Directors and CEO of VPBank. “In the context of a volatile global financial market, successfully raising a large amount of international capital lays a crucial foundation for VPBank to continue asserting its pioneering role in Vietnam’s securities market.”

This syndicated loan will serve as a significant resource for VPBank to boost its investment activities, enhance competitiveness, expand market share, and sustain long-term growth.

VPBank intends to prioritize the utilization of the raised capital to strengthen its financial capacity, diversify its investment portfolio, enhance securities brokerage operations, provide corporate financial advisory services, and develop digital financial products. These initiatives will ultimately contribute to enhancing customer experience and solidifying VPBank’s leading position in Vietnam’s securities industry.

The success of this transaction also paves the way for strategic long-term collaborations with international financial institutions, laying the groundwork for larger capital raisings in the future and cementing VPBank’s growing influence and stature in the global financial market.

VPBank’s financial results for Q1 2025 showcased impressive growth, with total assets surpassing VND 33,700 billion, an increase of over VND 7,000 billion compared to the beginning of the year. With nearly VND 17,700 billion in equity capital, VPBank ranks among the securities companies with the strongest capital base in the market. These figures reflect the company’s robust financial health and sustainable profitability.

As VPBank approaches its 3rd anniversary, it plans to offer a series of practical promotions as a token of appreciation to investors for their unwavering support throughout the journey.

About VPBank

Over the past three years, as the only securities company within the financial ecosystem of VPBank – Vietnam Prosperity Joint-Stock Commercial Bank, VPBank Securities has made remarkable strides. With a chartered capital of VND 15,000 billion, VPBank ranks among the market leaders. VPBank is also among the top 10 securities companies with the largest margin lending balances and has ample room for future growth.

VPBank has meticulously crafted a comprehensive ecosystem, integrating a diverse range of personalized products, platforms, and services tailored to individual risk appetites, thus fulfilling the investment needs of its clientele.

About SMBC

Sumitomo Mitsui Banking Corporation (SMBC) is a leading Japanese and global financial group, under the umbrella of Sumitomo Mitsui Financial Group (SMFG), one of the top three financial groups in Japan. With a presence in over 39 countries and regions, SMBC offers a comprehensive range of commercial and investment banking, corporate finance, capital markets, and asset management services.

SMBC stands out for its robust financial strength, strategic advisory expertise, and commitment to supporting its clients’ sustainable growth. In the Asia-Pacific region, SMBC continuously expands its presence and plays an active role in fostering financial and investment collaboration between Japan and emerging economies.

The Unstoppable Growth of FPT: Breaking Through with a 20% Surge

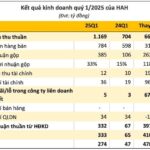

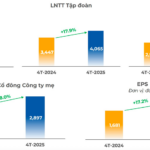

In the first four months of the year, the company’s net profit after tax attributable to shareholders (net profit) rose 18% to VND 2,897 billion.