Amid the stock market’s corrective state after surpassing the 1,300-point mark, the shares of Power Construction Consulting Joint Stock Company 2 (PECC2, code: TV2) , in which the Vietnam Electricity Group holds 51% of the capital, unexpectedly surged.

TV2’s market price soared to the ceiling in the last session of the previous week, reaching its highest point in ten months before making a slight adjustment in the May 19 session to VND 38,300/share. Notably, the stock still recorded a 24% gain after just two weeks. Market capitalization reached nearly VND 2,600 billion.

Despite the strong gains, TV2 is still 24% away from its historical peak in June 2024. At that time, after peaking, the shares plummeted relentlessly from a market price of over VND 50,000/share to below VND 30,000/share, corresponding to a loss of nearly 40% in just about two months.

The downward spiral of TV2 at that time stemmed from the Ministry of Industry and Trade’s issuance of Document No. 4579/BCT-DL dated July 1, 2024, notifying the Hau Giang Thermal Power Company Ltd. about the termination of the BOT contract for the Hau Giang Thermal Power Project.

The BOT contract for the Hau Giang Thermal Power Plant Project was signed between the Ministry of Industry and Trade, Toyo Ink Group Berhad (investor), and Hau Giang Thermal Power Company Ltd. (project enterprise) on December 29, 2020.

This project was expected by Vietcap analysts to commence in early July 2024 and contribute a total revenue of VND 26,500 billion to Power Construction Consulting Joint Stock Company 2 (code: TV2) during 2024-2028, equivalent to 70% of the company’s total revenue during the same period.

Despite the cancellation of the Hau Giang Thermal Power Project, the company’s business results remained promising in 2024.

In 2024, TV2’s net revenue reached VND 1,336 billion. Specifically, revenue from goods and services contributed VND 1,217 billion, revenue from mechanical engineering activities brought in VND 100 billion, and revenue from electricity sales exceeded VND 19 billion. As a result, the company’s pre-tax profit was VND 88 billion, up 22% over the previous year and exceeding the annual profit target by 21%.

In the first quarter of 2025, Power Construction Consulting Joint Stock Company 2 continued its growth momentum with net revenue of nearly VND 300 billion, up 26% over the same period last year. After deducting expenses, profit after tax reached nearly VND 15 billion, up 27% over the first quarter of 2024.

According to the recently published Annual Report, PECC2 set a cautious revenue target with a growth rate of about 3% compared to the 2024 revenue plan (VND 1,272 billion), equivalent to VND 1,310 billion. In addition, the corresponding financial indicators will continue to be maintained, helping the expected pre-tax profit not to be lower than VND 66 billion, the same as the 2024 plan.

To achieve this goal, the company will focus on key projects such as completing the commissioning of the Hau Giang Biomass Power Plant and the Thac Ba 2 Hydropower Plant; proactively researching and consulting for EVN on the potential development of new energy projects to create a proactive job source.

At the same time, TV2 will approach the implementation process of the Vietnam High-Speed Railway Project, nuclear power, and offshore wind power to participate in providing services with PECC2’s strengths.

Furthermore, in 2025, PECC2 will continue to research and develop new projects in the production field, such as green hydrogen and NH3, pumped hydro storage, and exporting clean energy to foreign markets. Notably, the company will expand its project development consulting services to other investors and participate in the electricity market through the DPPA mechanism.

In parallel, TV2 will also monitor and review the adjusted Power Development Plan 8 (PDP8) and its implementation plan to seek business and investment opportunities in projects; collaborate with domestic and foreign partners to explore cooperation possibilities in developing renewable energy projects and new business areas such as operating port – maritime/logitech services, etc.

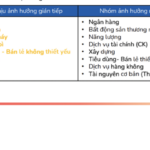

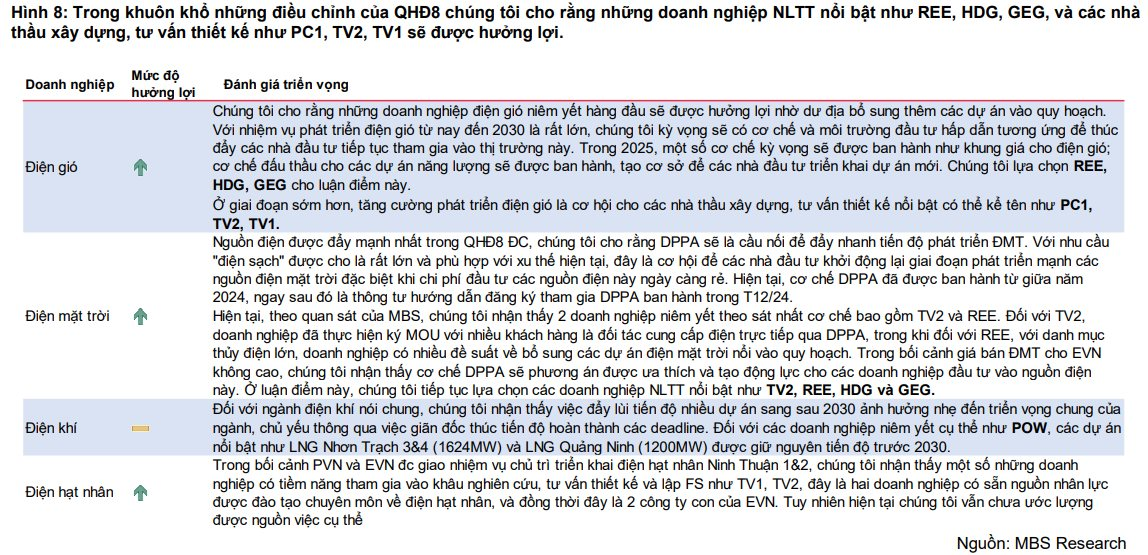

In a recent update on the power sector, MBS Securities (MBS) stated that the adjusted PDP8 provides an updated outlook on Vietnam’s electricity consumption growth, expected to reach 10.3% in the base scenario and 12.5% in the high scenario from now until 2030.

Accordingly, the MBS analysis team believes that this will be a pervasive argument to promote the prospects of the power industry in general from 2025, supporting the mobilization of all power sources, especially thermal power. Construction contractors and design consultants, including TV2, are expected to benefit from this development.

“VN-Index Upside Potential: VPBankS Experts Predict a 70% Rise, Targeting 1900 to 2000 Points”

“It is, therefore, understandable that foreign investors have returned to net buying. If they don’t return at this point, it’s hard to tell when they will,” the expert emphasized.

Market Beat: VN-Index Fails to Hold 1,300 Points

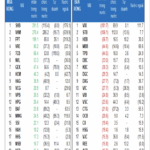

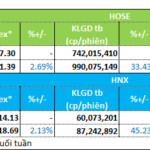

The market closed with the VN-Index down 5.1 points (-0.39%) to 1,296.29, while the HNX-Index fell 1.45 points (-0.66%) to 217.24. The sell-side dominated today’s trading with 452 declining stocks versus 287 advancing stocks. Within the VN30 basket, 24 stocks decreased, 4 increased, and 2 remained unchanged, resulting in a sea of red.