The consumer and retail segment is expected to be a key growth driver, along with strategic initiatives and Vietnam’s potential market upgrade, making MSN stock highly promising for the 2025-2026 period.

Growth Pillar: Consumer and Retail Segment

BVSC analysts forecast that Masan (MSN) will achieve 86,955 billion VND in net revenue in 2025, a 5% increase year-over-year, and a net profit of 2,802 billion VND, a 40% surge. This growth is based on the following key drivers:

Masan Consumer is anticipated to be the shining star in the fast-moving consumer goods (FMCG) industry, leveraging its strong brands and innovative product portfolio. In 2025, Masan Consumer plans to further its premiumization strategy in the convenience food sector by introducing a new Omachi line named “Asian Street Food.” Simultaneously, robust brands in the seasoning category, such as CHIN-SU and Nam Ngư, will continue to dominate the market by associating their brands with Vietnamese lifestyles and culinary culture. BVSC forecasts a respective 10% and 9% increase in EBIT for Masan Consumer.

WinCommerce will be one of MSN’s new growth pillars as it accelerates its expansion. According to the company, in April 2025, WinCommerce opened 68 new stores, including 46 WinMart+ Rural stores, bringing the total number of stores to 4,035, with the rural chain reaching 1,500 stores. With a monthly average of nearly 50 new WinMart+ Rural stores, the goal of reaching 1,900 stores by the end of the year is not only feasible but well within the company’s grasp. Given this aggressive expansion strategy, BVSC predicts a 15% rise in WinCommerce’s revenue and a remarkable 106% jump in EBIT.

Customers shopping at WinCommerce’s supermarket system

|

Regarding Masan MEATLife, the current favorable pork prices, coupled with a focus on high-margin processed meat products and cost optimization through increased fresh meat output, are laying a solid foundation for the company’s robust recovery. According to the company, one of Masan MEATLife’s strategic breakthroughs in 2025 is the successful implementation of technology to enhance sow productivity, enabling an expansion of their pig herd by approximately 24,000 pigs per year. With an average finished product value of approximately 7.5 million VND per pig, this increase translates to an additional 180 billion VND in revenue for 2025. BVSC forecasts a 16% rise in MML’s revenue, a 124% surge in EBIT, and a remarkable rebound in after-tax profit.

Phúc Long Heritage (PLH) is undergoing a restructuring by closing down inefficient kiosks and upgrading its products, leading BVSC to predict a 7% increase in revenue and a 30% jump in EBIT.

Stock Market Awaiting Upgrade

2025 is a pivotal year for Vietnam’s stock market, as it aspires to graduate from a frontier market to an emerging market status as outlined in the government-approved stock market development strategy through 2030.

According to a report by Saigon-Hanoi Securities JSC (SHS), about $9 billion in foreign investment could flow into Vietnam following the market upgrade. This includes $800 million from FTSE Russell ETFs, $2 billion from other passive funds, and $4-6 billion from active funds. This influx of capital is expected to primarily target large-cap, highly liquid stocks with sufficient room for foreign ownership.

Based on these criteria, SHS has identified a group of potential stocks likely to be included in the FTSE index and benefit significantly from foreign capital inflows, mainly comprising blue-chip stocks. Notably, consumer and retail stocks are expected to hold considerable potential, and MSN, in particular, is forecasted to directly benefit from positive macro conditions domestically and internationally, boosting its business performance.

Given its scale and large market capitalization, BVSC analysts believe MSN is likely to be a preferred choice for foreign capital. Using a sum-of-the-parts (SoTP) valuation approach, BVSC sets a target price of 89,200 VND/share for MSN. With a projected profit growth of 40% (compared to the price of 62,000 VND/share), a valuation lower than the historical average, and long-term growth drivers, MSN is a strategic choice for mid to long-term investors.

Minh Tài

– 07:55 20/05/2025

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

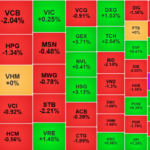

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

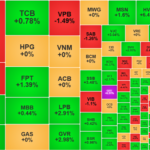

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…

The Masan Way: Building a Powerful Brand

Building a strong and trusted brand is paramount for consumer retail businesses. Masan, a leading industry player, is one of the few domestic enterprises with a well-crafted brand-building strategy that has achieved success in Vietnam and made an impression on the international market.