The market is reflecting investors’ positive expectations regarding the potential retaliatory tariffs that the US may impose on Vietnam after the conclusion of negotiations. Vin Group’s stocks performed exceptionally well, with both VHM and VIC reaching the ceiling, pushing the VN-Index to a strong close of 18.86 points, just shy of the previous peak of 1,315, a gain of 1.45%.

However, the breadth wasn’t entirely impressive, with 133 declining stocks out of 193 gainers. While most sectors were in the green, this indicates a high level of differentiation within industries, and capital is concentrating in large-cap stocks.

Real estate made a rare historical move today, with both Vin Group stocks, VIC and VHM, surging to the maximum limit. These two stocks alone contributed nearly half of the VN-Index’s points. VRE also rose sharply by 4.24%, while SIP gained 2.89% and DXG climbed 2.77%. Other real estate stocks saw more modest gains or even significant losses, such as NVL and SNZ.

There was stronger consensus in the financial sector, encompassing securities and banking. Several securities stocks witnessed notable gains, including VIX (+3.91%), VND (+2.36%), and SHS and BSI, both rising over 1.50%. In banking, TCB soared by 4.98%, alongside Vin Group, contributing an additional 2.37 points to the VN-Index. Numerous other banks posted gains above 1%, including CTG, STB, VIB, and HDB.

The export and logistics sectors breathed a sigh of relief due to optimistic expectations from the tariff negotiations. KSV hit the ceiling with a 10% gain, MVB rose 9.69%, MTA surged 14.84%, MSR climbed 4.09%, and BMP increased by 2.13%. Steel and fertilizer sectors didn’t fare as impressively. Transport stocks witnessed a strong performance, with HAH reaching the ceiling, and GMD, ACV, PHP, and VSC also posting substantial gains. The market is currently led by large and mid-cap stocks, while small-cap stocks, residential real estate, utilities, and other sectors unaffected by tariffs faced profit-taking.

The fact that the VN30-Index is ahead of the VN-Index, surpassing the March peak earlier, underscores the prominent role of large-cap stocks. However, these stocks have maintained high liquidity and consistently accounted for a significant proportion of total liquidity in recent days. This confirms the substantial movement of large capital.

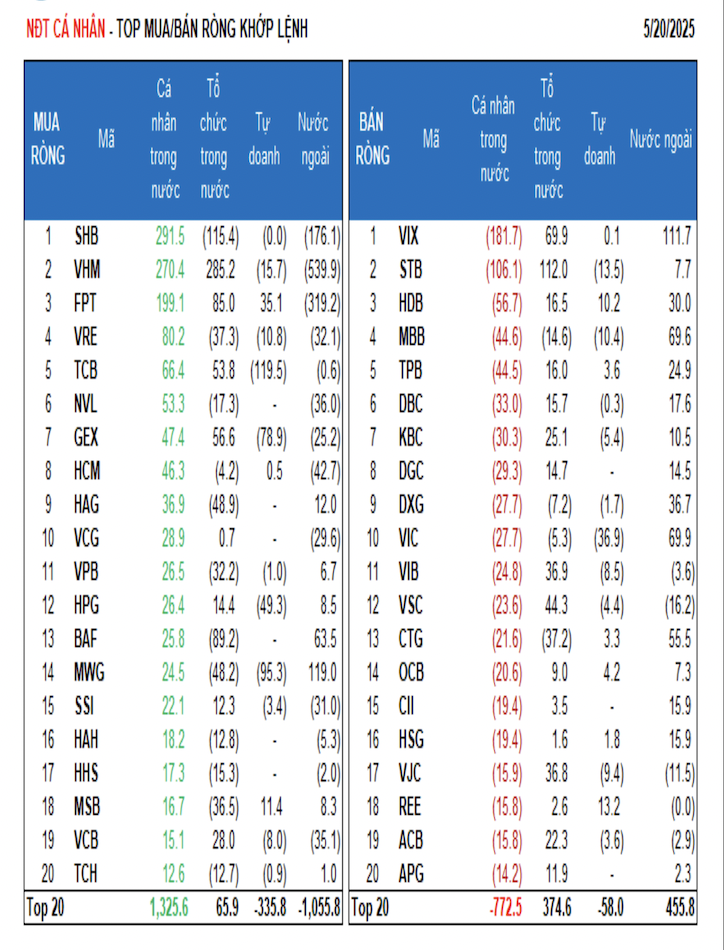

The combined trading volume of the three exchanges reached VND24 trillion, with foreign investors net selling VND564.3 billion. Specifically, they net sold VND475.2 billion in matched orders. Their top matched order purchases included FUEVFVND, MWG, VIX, VIC, MBB, BAF, CTG, DXG, HDB, and TPB.

On the selling side, foreign investors offloaded real estate stocks in matched orders. Their top matched order sales included VHM, FPT, SHB, HCM, NVL, GMD, VRE, SSI, and VCG.

Individual investors net bought VND189.3 billion, including VND507.6 billion in matched orders. In matched orders, they net bought 12 out of 18 sectors, mainly focusing on real estate. Their top purchases included SHB, VHM, FPT, VRE, TCB, NVL, GEX, HCM, HAG, and VCG.

On the selling side, they offloaded stocks in 6 out of 18 sectors in matched orders, primarily in financial services, tourism, and entertainment. Their top sales in matched orders included VIX, STB, HDB, MBB, TPB, DBC, DGC, DXG, and VIC.

Proprietary trading arms net sold VND575.8 billion, including VND472.4 billion in matched orders. In matched orders, they net bought 5 out of 18 sectors. Their largest purchases were in personal & household goods and information technology. Their top buys in matched orders included PNJ, FPT, GMD, SBT, NLG, KDH, E1VFVN30, REE, MSB, and VHC. Their top sales were in financial services, including FUEVFVND, TCB, MWG, GEX, HPG, VIC, VNM, VHM, MSN, and STB.

Domestic institutional investors net bought VND907.0 billion, including VND440.0 billion in matched orders. In matched orders, they net sold 6 out of 18 sectors, with the largest sales in food & beverage. Their top sales included SHB, BAF, HAG, MWG, VRE, CTG, MSB, PNJ, VPB, and SBT. Their largest purchases in matched orders were in real estate, including VHM, STB, FPT, VIX, GEX, TCB, VSC, VIB, VJC, and VNM.

Today’s trading value via put-through transactions reached VND2,897.1 billion, up 2.3% from the previous session, contributing 11.8% to the total trading value. Notably, there was a significant put-through transaction in TCB, with nearly 11.4 million shares worth VND334.7 billion purchased by domestic institutions from individual investors.

Additionally, individual investors continued to trade in banking stocks (STB, MSB, OCB), GEX, FPT, DSE, and HAH.

The capital allocation ratio increased in real estate, banking, retail, warehousing, logistics, and investment funds, while decreasing in securities, construction, chemicals, agricultural & marine products, and software.

Specifically, in matched orders, the capital allocation ratio increased in large-cap stocks (VN30) and decreased in mid-cap stocks (VNMID), while remaining unchanged in small-cap stocks (VNSML).