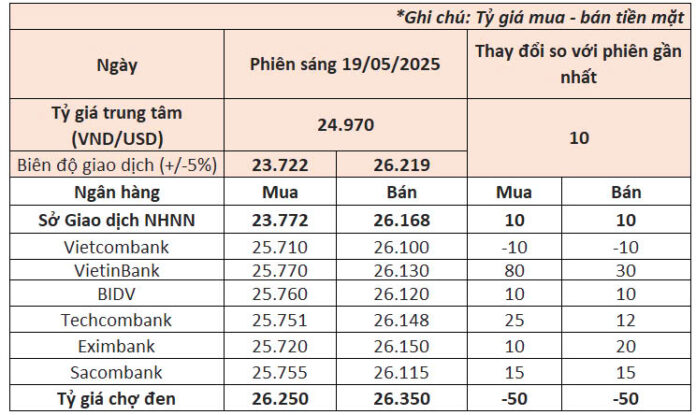

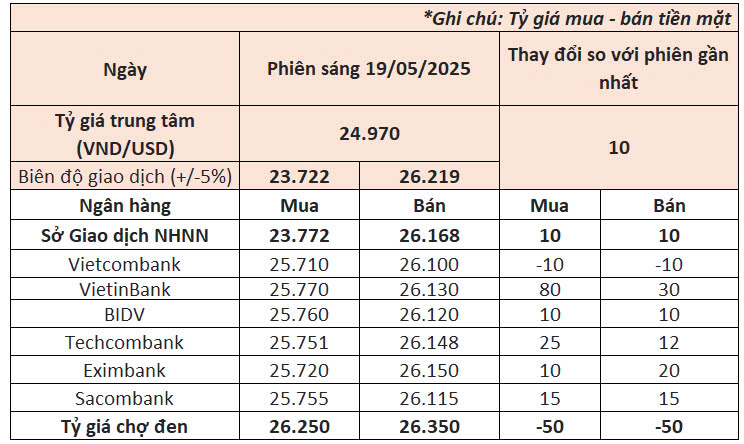

The State Bank of Vietnam set the daily reference exchange rate for the US dollar at 24,970 VND/USD on May 19, an increase of 10 VND from the previous week.

With a 5% fluctuation band, the ceiling and floor rates applied by commercial banks are therefore 23,722 VND/USD and 26,219 VND/USD, respectively.

The State Bank of Vietnam’s trading arm also raised its buying and selling rates to 23,772-26,168 VND/USD.

Commercial banks witnessed mixed movements in USD rates this morning, with an upward trend prevailing.

Vietcombank, the largest lender by foreign currency turnover, bought the greenback at 25,710 VND/USD and sold the greenback at 26,100 VND/USD, down 10 VND from the previous week.

Meanwhile, VietinBank and BIDV raised their buying rates by 80 VND and 10 VND, respectively, and selling rates by 30 VND and 10 VND, respectively.

In the group of private banks, Techcombank added 25 VND to its buying rate and 12 VND to its selling rate. Sacombank raised both rates by 15 VND, while Eximbank lifted the buying rate by 10 VND and the selling rate by 20 VND.

In the unofficial market, the greenback was sold at 26,250-26,350 VND/USD, down 50 VND from the previous week.

Internationally, the US Dollar Index (DXY), which measures the greenback’s strength against other major currencies, hovered around 100.8 points, slightly lower than the closing session on May 16.

The US dollar strengthened slightly last week as the latest economic data showed a recovery in import prices, while consumer sentiment remained concerned about tariffs.

Earlier, the greenback had gained over 1% on Monday as markets were optimistic that the US-China trade deal could ease tensions between the world’s two largest economies. However, the dollar then witnessed a downward trend for most of the week, partly due to lackluster economic data.

Since late April, the US dollar has been recovering against other major currencies as trade tensions between the US and China eased.

Currently, the US dollar remains nearly 3% lower than its level on April 2 when President Donald Trump first announced tariff policies, causing foreign investors to flee the US stock and bond markets.

The Dollar and Gold Prices Plummet: May 15th’s Market Shockwave

The morning witnessed a unanimous drop in USD exchange rates across banks, with fluctuations more pronounced than previous sessions. Domestic gold prices also took a hit, plunging by 2 to 2.5 million VND per tael.

The Golden Outlook: Unveiling the World Gold Council’s Insights on the Year-End Gold Market Trends

The World Gold Council offers insightful recommendations for gold investors, delving into the factors influencing gold prices for the remainder of the year. This insightful analysis provides a strategic outlook for those navigating the precious metal market, offering a glimpse into the potential future of gold investments.

Silver Prices Today: A Sudden Plunge After Positive US-China Trade Tariff Signals

The silver market witnessed a significant downturn following the truce between the US and China, with both nations agreeing to a 90-day pause on new tariffs.