“**Residential Land Market Heats Up in Provinces Neighboring Ho Chi Minh City**”

“The residential land market in provinces neighboring Ho Chi Minh City is heating up, with Long An, Binh Duong, and Dong Nai attracting investors. Despite a limited land bank for residential development in these areas, compared to Ho Chi Minh City, buyers have more options and are expected to see positive price growth, especially with improved infrastructure connectivity.”

The residential land market outside Ho Chi Minh City remains hotly contested in the second quarter of 2025, with investors turning their attention to the surrounding provinces. This shift indicates a persistent demand for residential land and a positive buying sentiment.

Recent developments in Long An, Binh Duong, and Dong Nai have stirred interest. With limited supply and surging demand for residential land, buyers are looking towards areas with potential for price appreciation. While the land bank for development is shrinking in these provinces, it still offers more options compared to Ho Chi Minh City. The expectation of positive price growth, especially with enhanced connectivity to the city, is a key driver.

In Long An, projects in Long Hau, Tan Lap (Can Giuoc), Duc Hoa, and Ben Luc are attracting attention. Investors are seeking land priced between VND 20-40 million per square meter, located near major roads, anticipating future investment returns. For example, THE 826EC – Long Hau, located on DT826E, has garnered interest even before its official launch. Similarly, Saigon Riverpark in Tan Lap, along Truong Van Bang, has seen active secondary transactions for both end-users and investors, with land prices increasing by 10-20% year-over-year.

In Binh Duong, secondary land plots with ownership certificates in Di An, Tan Uyen, and Bau Bang are witnessing stable transactions. However, the scarcity of affordable land options is making it challenging for brokers to meet investor demands.

In Nhon Trach and Long Thanh (Dong Nai), ready-for-construction residential land plots with ownership certificates remain attractive to investors. According to brokers, there has been a notable increase in demand for residential land in the area since the Lunar New Year. With a decrease in reasonably priced land options, the market has shown signs of slowing down compared to the beginning of the year.

Despite the limited land bank for residential development in provinces neighboring Ho Chi Minh City, buyers have more options compared to the city. Source: DKRA Consulting.

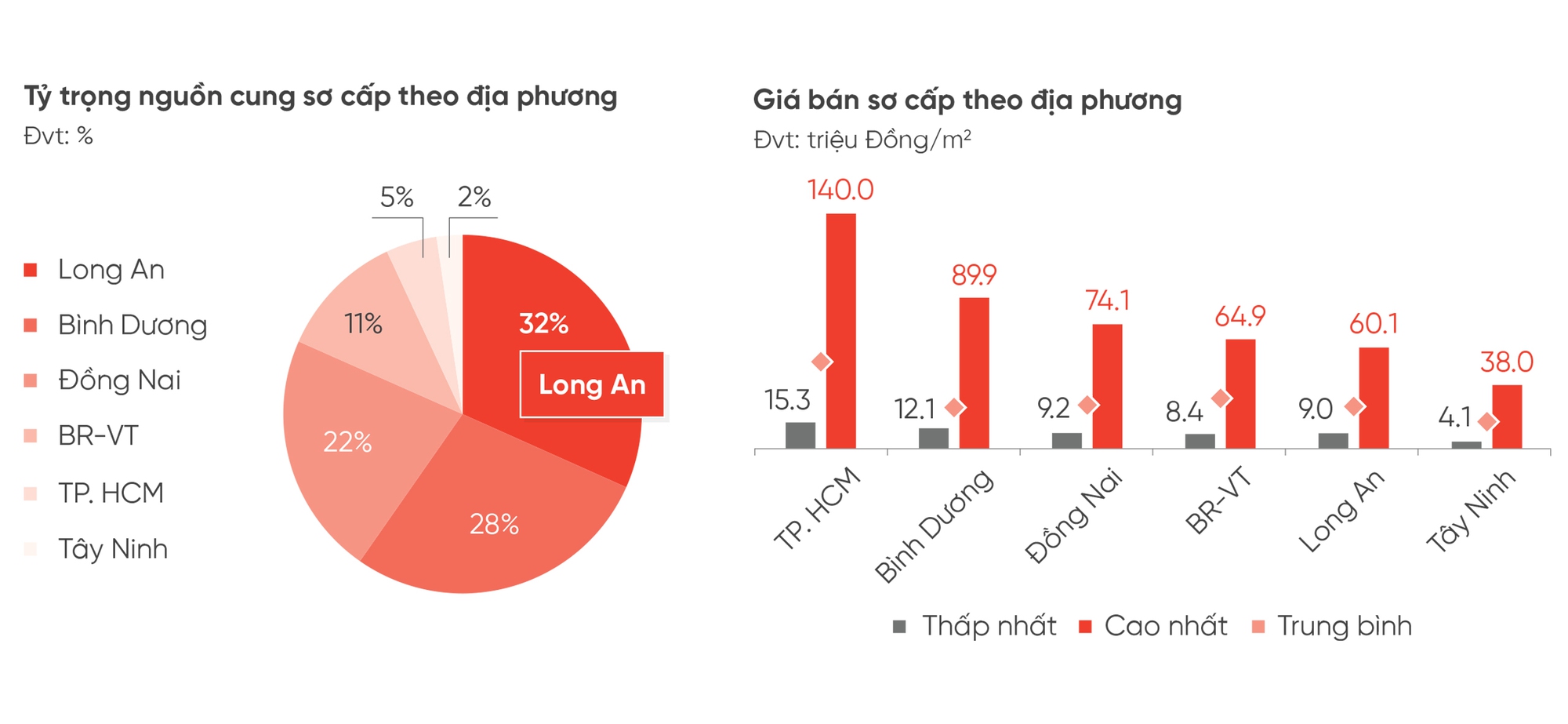

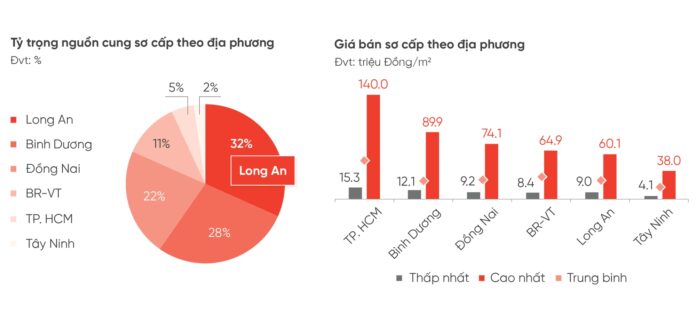

The DKRA Consulting report for the first quarter of 2025 highlights that the southern land market is predominantly concentrated in Long An, Binh Duong, and Dong Nai, accounting for approximately 82% of the primary supply. These three markets offer around 5,336 products currently available for sale.

New supply in these areas remains scarce, accounting for only 16% of the primary supply, a decrease of 28% compared to the same period in 2024. Notably, the market demand has shown a strong recovery, with consumption volume increasing sixfold compared to the first quarter of 2024. Primary prices have also increased by 2-6% in some areas, reflecting the market dynamics and the level of urban and infrastructure development in these localities. The continuous investment in infrastructure has stimulated demand for residential land in these provinces.

According to DKRA Consulting, the secondary residential land market is entering a vibrant recovery phase compared to the end of 2024. Secondary prices have increased by 12-16% on average, and there have been instances of land speculation in provinces with rumored plans for merger into Ho Chi Minh City, resulting in price hikes of 20-30%.

Data from Batdongsan.com.vn further supports this trend. In the first months of 2025, the land segment led the recovery with a 50% increase in searches from February to March. Meanwhile, searches for shophouses, detached houses, and apartments increased by 32%, 26%, and 15%, respectively. Additionally, the number of land listings increased by 34%, second only to detached houses, which saw a 37% rise.

Investors Riding the Wave

It is understandable that many investors are willing to commit capital one to three years in advance to ride the wave of the residential land market in the neighboring provinces, even going so far as to anticipate infrastructure projects. With limited land supply and high prices in Ho Chi Minh City, the flow of investment capital to the neighboring provinces reflects their belief in future price appreciation. The continuous investment in infrastructure in these areas further reinforces this confidence and encourages investors to allocate their capital accordingly.

Mr. Tran Khanh Quang, a real estate investment expert, recently shared his insights on the impact of infrastructure development on land values. He noted that a piece of land could increase in value by three to four times within three to five years, mainly due to improved connectivity. The expansion of infrastructure from Ho Chi Minh City to the neighboring provinces will drive up land prices. In the future, the potential for real estate development may extend beyond Binh Duong, Long An, and Dong Nai to provinces like Ninh Thuan, Binh Thuan, and Lam Dong.

Since the second quarter of 2025, the residential land market in the provinces has been buzzing, thanks to improved buyer sentiment and robust infrastructure development. Photo: TB

Mr. Quang affirms that the southern land market is evolving as predicted, with Ho Chi Minh City leading the recovery, followed by the neighboring provinces. Since the second quarter of 2025, the residential land market in these provinces has rebounded after a period of stagnation, driven by improved buyer sentiment and robust infrastructure development.

He emphasizes that residential land remains a traditional form of real estate investment or asset accumulation. Approximately 70% of buyers choose land for asset accumulation purposes. The demand for residential land for end-users, long-term investment, or worker accommodation construction persists. He cites the example of Ho Chi Minh City, where a 100-square-meter land plot costs VND 50-70 million per square meter, while a plot located 10-15 kilometers away would cost only VND 20-30 million per square meter. This price disparity drives investment capital to the provincial markets.

“In the next two to three years, as infrastructure projects are completed, there will be a noticeable impact on real estate prices,” Mr. Quang stressed. “In the next six months, land prices in Ho Chi Minh City are expected to increase by 15-20%, and in the short term, prices in surrounding areas are also projected to rise by a minimum of 10-15%.”

However, he underscores that the impact of infrastructure development must be timely, location-specific, and appropriate. Not all areas with new infrastructure will experience a real estate boom. The future of the land segment lies in the city center and areas within a 20 to 50-kilometer radius. The importance of infrastructure connectivity to real estate is not just measured in kilometers but also in travel time.

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, assesses that the real estate market is on the path to recovery. The potential for price appreciation is a key factor driving investment decisions. Segments with high profitability potential, such as land and project villas, will attract interest. However, when investing in land based on planning information, investors should exercise caution. The hype around provincial mergers should also be approached with caution, as travel distances may not significantly change post-merger. Buyers should prioritize areas with long-term price appreciation potential, avoid excessive borrowing, and thoroughly research the legal framework and liquidity of each locality.

“Japanese and Middle Eastern Conglomerates Eye $6 Billion Investment in Ho Chi Minh City”

“Huge investments are pouring into Ho Chi Minh City, with foreign conglomerates committing a staggering 6 billion USD for various projects. This significant influx of capital underscores the city’s thriving business landscape and its appeal as a prime investment destination.”

Shinhan Securities and FireAnt Sign Investment and Strategic Partnership Agreement

Shinhan Securities, a leading securities company in South Korea and the parent company of Shinhan Securities Vietnam (SSV), has recently expanded its strategic investments in Vietnam. The company has acquired a significant stake in FireAnt, a prominent digital media and services company, marking a pivotal moment for both entities.

“Double Your Returns: Invest in Cash-Flow Positive Properties in the Heart of Tuy Hoa Beach”

Amidst the “wave” of portfolio restructuring, the financial world is shifting its focus towards assets that offer consistent returns and sustainable value. In line with this trend, commercial beachfront real estate in emerging destinations such as Tuy Hoa, Phu Yen, is becoming a “hotspot” for investors seeking lucrative opportunities.

Just Broke Ground on a $1.6 Billion Mega-Project, Sun Group Proposes a String of Additional Large-Scale Investments in Ba Ria – Vung Tau

Let me know if you would like me to tweak it or provide multiple options!

The Sun Group’s leadership has proposed an array of exciting investment projects, including the Mũi Nghinh Phong commercial and service complex, the Cù Lao Bến Đình new urban area, and the island-based urban and tourism hub of Gò Găng. Additionally, they have envisioned the Bắc Phước Thắng eco-tourism area, the Tây Nam Bà Rịa new urban area, and several developments on the island of Côn Đảo. These projects promise to be transformative, offering new opportunities for the community and enhancing the region’s appeal as a tourist destination.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)