**VN-Index Falls Despite VIC’s Positive Performance**

Despite VIC’s positive performance, the market’s downward trend continued. Following the previous week’s losses, the VN-Index opened lower and faced strong resistance at the 1,300-point mark, ending the session in negative territory.

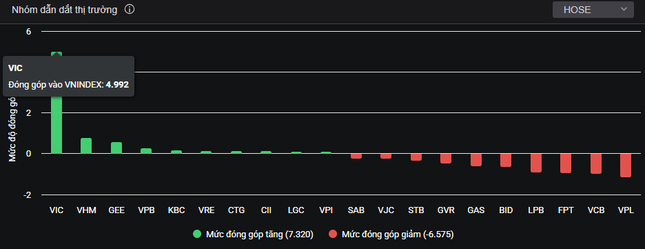

On the HoSE, over 200 stocks declined, doubling the number of gainers. The large-cap VN30 index followed suit, with VPL, VCB, VPT, and LPB among the top losers. Selling pressure remained high around the 1,300-point level.

The banking sector lacked consensus, weighing on the market. Information Technology led sectoral losses with a 2.29% drop, dragged down by FPT and CMG.

VIC contributed nearly 5 points to the main index. Data: Dstock.

Conversely, Vingroup’s VIC surged 7% to VND 85,600 per share, hitting its highest level in three years. This upward move came as the Pacific Construction Group (China) and Vingroup joint venture commenced the construction of the Tu Lien Bridge and its connecting roads, with a total investment of nearly VND 20,000 billion.

VIC’s trading volume doubled from the previous session, with over 9.1 million shares changing hands. Foreign investors also actively bought VIC, resulting in a net buy value of VND 173 billion, the highest on the exchange. Vingroup’s market capitalization exceeded VND 332,000 billion, ranking second on the HoSE.

Other Vin stocks, such as VHM and VRE, also posted gains, while VPL of Vinpearl fell 2.8% to VND 98,100 per share.

At the close, the VN-Index lost 5.1 points (0.39%) to finish at 1,296.29. The HNX-Index declined 1.45 points (0.66%) to 217.24, while the UPCoM-Index rose 0.21 points (0.22%) to 95.71.

Trading liquidity remained unchanged from the previous session, with a matched order value of nearly VND 21,400 billion on the HoSE. Foreign investors net sold VND 475 billion, focusing on VHM, GEX, and MSN.

VietABank Files for Listing on HOSE

The Ho Chi Minh City Stock Exchange (HOSE) has received the listing registration dossier from VietABank, a joint-stock commercial bank currently trading on the Unlisted Public Company Market (UPCoM) under the ticker symbol ‘VAB’.