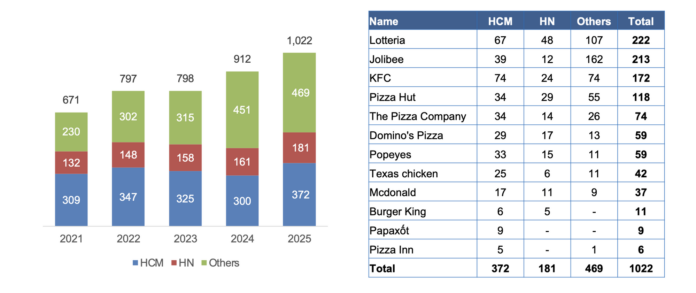

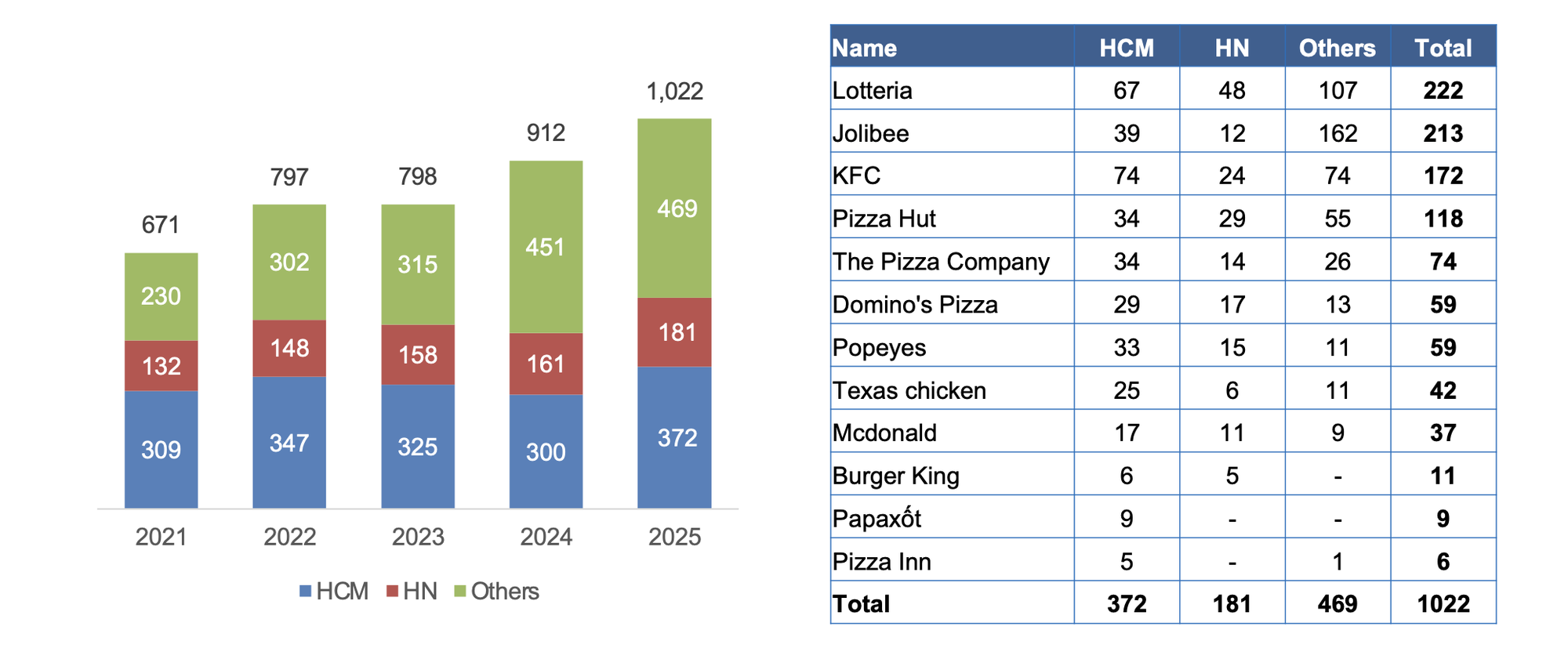

After a stagnant phase due to the pandemic and soaring rental costs, Vietnam’s fast-food market has witnessed a remarkable acceleration in 2025. According to a recent report by Q&Me, a market research unit of Asia Plus Inc., the number of outlets of major fast-food chains across the country surged in the past year, recording an almost 12% increase compared to 2024.

Leading the pack are two familiar names, Lotteria and Jollibee, boasting 222 and 213 outlets nationwide, respectively. Both brands have experienced significant growth in provinces outside of Ho Chi Minh City and Hanoi, indicating a strong push for expansion in these regions after years of focus on large cities.

While Lotteria maintains a relatively even distribution across the three regions, Jollibee’s strategy of targeting provincial areas is more pronounced, with the majority of its outlets located outside the two major urban centers. Focusing on second- and third-tier cities not only helps these brands optimize rental costs but also enables them to tap into the growing young consumer base in these developing areas.

Q&Me Report

Beyond mere numbers, the comeback of fast-food brands signifies a rebound in consumer spending within the quick-service and convenience food sector, which was significantly impacted during 2020–2021. As consumers return to their dining-out habits, coupled with the youthful demographic’s appetite for culinary exploration, international and domestic brands are seizing the opportunity to expand their presence.

Major players such as KFC maintain their wide reach with 172 outlets, evenly split between Ho Chi Minh City, Hanoi, and other provinces. Pizza Hut stands at 118 outlets, reflecting its consistent appeal to young and family audiences. The Pizza Company operates a total of 74 outlets, mainly in city centers, while Domino’s Pizza and Popeyes each count 59 outlets under their belts.

Smaller brands are also quietly expanding their footprints. Texas Chicken has grown to 42 outlets, and McDonald’s now has 37 outlets, primarily in Ho Chi Minh City and Hanoi.

Additionally, improvements in transportation infrastructure, logistics, and the expansion of shopping malls in the provinces have played a pivotal role in supporting fast-food chains’ distribution network growth. No longer confined to large urban malls, many fast-food outlets are now conveniently located along inter-provincial roads, rest stops, and emerging residential areas.

According to forecasts by the market research organization IMARC Group, Vietnam’s fast-food market is expected to attain a compound annual growth rate (CAGR) of 5.65% during 2024–2032. The primary driver of this growth lies in the deepening integration of technology, including mobile app ordering, online delivery, and self-service kiosks at outlets, significantly enhancing convenience and customer experience.

Individual Investors Net Buy Over 500 Billion Dong as VN-Index Surges Past 1,300 Points

Individual investors posted net purchases of VND 189.3 billion, including VND 507.6 billion in net buy orders. In terms of matched orders alone, they net bought in 12 out of 18 sectors, primarily in the Real Estate sector.

Shinhan Securities and FireAnt Sign Investment and Strategic Partnership Agreement

Shinhan Securities, a leading securities company in South Korea and the parent company of Shinhan Securities Vietnam (SSV), has recently expanded its strategic investments in Vietnam. The company has acquired a significant stake in FireAnt, a prominent digital media and services company, marking a pivotal moment for both entities.

“PM Calls for Review of Officials in Areas with Slow Public Investment Disbursement”

Recapping the results of public investment in the first months, with 37 out of 47 ministries and agencies and 27 out of 63 localities having a disbursement rate below the national average, the Prime Minister requested to clarify this issue, identify the causes, and point out the difficulties, obstacles, bottlenecks, and responsibilities of the ministries and sectors. He asked, “Why, with the same conditions and policies, do some places perform well while others do not? Is it due to the people or the leaders?”