VN-Index Still Has at Least 70% Upside Potential

At the event “Vietnam and the Indices: Prosperous Finance”, Mr. Nguyen Viet Duc, Director of Digital Sales, VPBank Securities Joint Stock Company (VPBankS), asserted that the market will turn positive once the tariff issue is resolved.

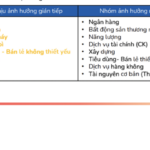

According to the expert, investors should observe tariff-related developments over the next 2–3 weeks. If tariffs are not expected to significantly impact the economic landscape, investors can take advantage of the current correction to buy stocks unaffected by tariffs, such as undervalued bank stocks.

Regarding the resumption of net buying by foreign investors, Mr. Duc pointed out that the Vietnamese market is at an attractive point and could continue to rise. Firstly, the market valuation is not expensive. Secondly, profit growth in recent quarters has not been high, avoiding a FOMO situation. Thirdly, macroeconomic factors continue to support the economy.

“Therefore, it is reasonable for foreign investors to return to net buying at this time. If they don’t come back now, it’s unclear when they will,” the expert emphasized.

Looking back at Vietnam’s stock market history over the past 20 years, there have only been 10 bull and bear markets—periods of a 20% increase or decrease. From 2022 to the present, the market has been in an uptrend and has never seen a 20% decline. However, the current gain of around 38% is the lowest in history, as the economy has underperformed expectations.

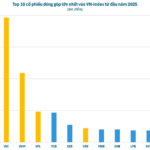

Mr. Duc from VPBankS presented two scenarios for the Vietnamese stock market. In the first scenario, the market will pause its upward momentum and enter a corrective phase. However, in the second scenario, with the current gain of only about 38%, significantly lower than previous bull market cycles, which typically saw gains of over 100%, there is still considerable upside potential, estimated to be at least 70%. This would correspond to the VN-Index reaching 1,900–2,000 points.

Currently, the expert is optimistic about the market witnessing a strong surge similar to 2016–2017, led by large-cap stocks like VPB and VIC, and this outcome could materialize soon.

Focus on Growth Rather Than Value

According to Mr. Duc’s observations, the VN-Index phase from 2023 onwards resembles the 2014–2016 period. During 2014–2016, the VN-Index struggled to surpass the 550-point level. Currently, except for the tariff issue under President Trump, the index has mostly fluctuated between 1,200 and 1,300 points.

When the 50-day moving average (MA50) crosses above the 200-day moving average (MA200), the market will enter an uptrend. After the recent pullback, the MA50 is likely to cross above the MA200 again, signaling a potential upward move. Similarly, in 2016, when the market was deeply pessimistic, the VN-Index witnessed a significant rally, surging from 570 to 1,200 points (over 100%).

“Hence, I anticipate that the next time the MA50 crosses above the MA200, the market could break out. Investors should wait for this current correction to test this hypothesis,” the expert opined.

Regarding investment strategy, when profits are realized, investors should gradually take profits as the stock price rises. Typically, profits are taken in three stages: the first take-profit at 50%, and the second and third at around 25% each. While the first sale may not capture the exact peak, it secures a portion of the gains, allowing continued participation in the remaining uptrend.

For instance, with VIC, if purchased around VND 55,000/share, the first take-profit could be set at approximately VND 68,000–69,000/share. The second take-profit could be at VND 85,000–90,000/share, and the final exit could be when VIC loses its MA50 support on the retest.

For those who doubled or tripled their accounts in the first year, the second year often brings a sense of overconfidence. If this overconfidence leads to maintaining the same investment style, there is a high possibility of significant losses in the following year.

In this phase, Mr. Duc emphasized that investors should not hold more than 70% of their portfolio in stocks. In the event of tariff-related volatility, the remaining 30% can be deployed.

Globally, the most significant factor influencing stock markets is M2 money supply growth. For instance, in the US, M2 growth has closely tracked stock market performance, similar to Vietnam. With the expansion of credit and fiscal policies, a VN-Index valuation of 12–13 times is not overly low compared to history but is significantly more attractive than the peak valuation of 17–18 times during the high-growth phase.

Presently, it is crucial to approach stocks and the economy from a growth perspective rather than a value standpoint. This shift in focus will help identify companies with strong growth potential.

Market Beat: VN-Index Fails to Hold 1,300 Points

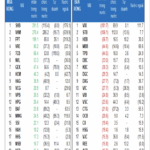

The market closed with the VN-Index down 5.1 points (-0.39%) to 1,296.29, while the HNX-Index fell 1.45 points (-0.66%) to 217.24. The sell-side dominated today’s trading with 452 declining stocks versus 287 advancing stocks. Within the VN30 basket, 24 stocks decreased, 4 increased, and 2 remained unchanged, resulting in a sea of red.

“Upcoming Dividend Dates: Don’t Miss Out on the 100% Cash Payout!”

There are 46 businesses offering cash dividends, with the highest being an impressive 100% and the lowest a modest 1%.