On June 2nd, Petroleum Machinery JSC (code: PMS) will finalize the list of shareholders to distribute a 30% cash dividend for the year 2024 (1 share will receive VND 3,000). The expected payment date is June 16, 2025.

With 7.2 million shares circulating, Petroleum Machinery will have to spend approximately VND 22 billion on this dividend.

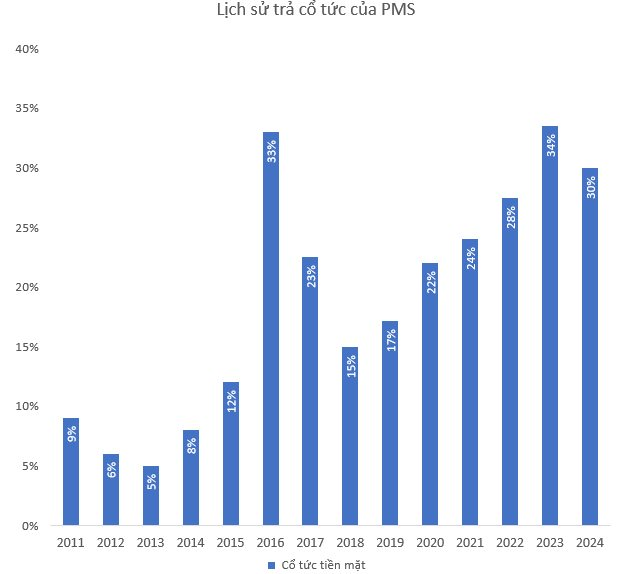

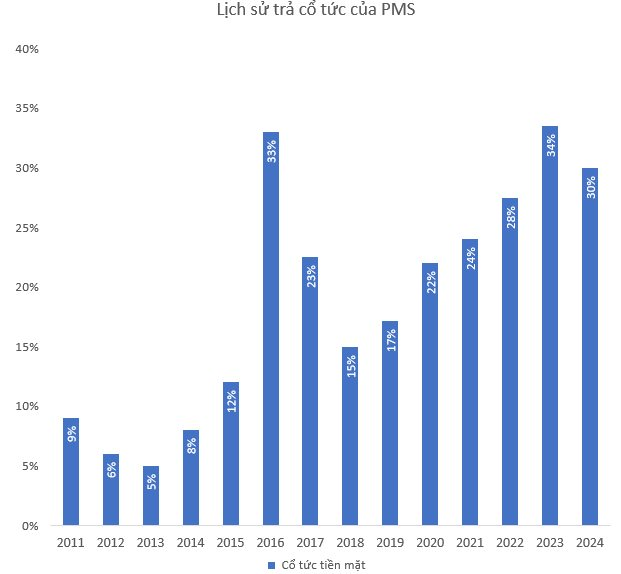

Notably, the company has a consistent track record of cash dividend payments over the past two decades. Since 2005, PMS has never missed a year of dividend distribution, with rates ranging from 5% to 33%. In 2023, the company paid out a record-high dividend of 33.5%, which was adjusted to 30% for 2024, still a high rate compared to the 2017-2023 period.

Tracing its roots back to October 22, 1975, Petroleum Machinery JSC was formerly known as Thong Nhat Mechanical Workshop, under the Ministry of Supplies. The company was nationalized by merging two companies, Binh Loi and Khai Thac Ky Nghe Semi. In 1999, it underwent privatization, with Vietnam National Petroleum Corporation becoming the largest shareholder, holding 35% of the charter capital.

In terms of business operations, PMS manufactures and trades barrels, tanks, branded sea bins, tanker trucks, fire equipment, petroleum equipment, and provides construction services.

As of now, Petroleum Construction and Trading One Member LLC (a subsidiary of Petrolimex – PLX) holds 16.3% of PMS’s capital and is the largest shareholder.

For the first quarter of 2025, revenue reached nearly VND 250 billion, a significant 32% decrease compared to the same period last year. However, profit from joint ventures and associates nearly doubled, contributing VND 3.5 billion, resulting in a 24% increase in after-tax profit to nearly VND 9 billion. The company attributed this to the successful advance procurement of raw materials at good prices by Petroleum Machinery GAS P.M.G. Joint Stock Company, which added over VND 1.6 billion to the consolidated profit for the quarter.

For the full year 2025, PMS targets revenue of VND 1,300 billion and pre-tax profit of VND 32 billion. After the first quarter, the company has achieved 19% of its revenue target and 32% of its profit target. The expected dividend for 2025 is at least 12%.

In the stock market, PMS shares are trading near their all-time high. At the close of May 21, PMS stood at VND 37,400 per share, 2% lower than its peak of VND 38,100 in early June last year. Since the beginning of the year, the stock has surged approximately 17% in value, with a market capitalization of around VND 270 billion.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.

The Foreign Independent Director Resigns Following Đức Long Gia Lai’s Sale of its Electronics Component Business

Mr. Paul Anthony Murphy, a British national, has tendered his resignation from his role as a Board Member of DLG Group Joint Stock Company (HOSE: DLG). This development comes as a notable move shortly after DLG divested its entire stake in its electronic components subsidiary, a business area under Mr. Murphy’s stewardship.

“ACBS Forecasts Vinhomes (VHM) to Rake in Over $1.5 Billion in Net Profit; 8 New Projects Slated for 2025 Launch”

ACBS forecasts that VHM’s sales value for 2025 will reach an impressive VND 150,000 billion, marking a significant 44% increase year-over-year. This optimistic projection is largely attributed to the anticipated success of their flagship projects: Wonder City, Green City, Golden City, Green Paradise, and the highly anticipated Apollo City.