On May 19, VSDC decided to suspend enterprise private bond (TPDNRL) trading and payment activities involving HDS from May 20 to May 26. This decision was made due to consecutive reprimands issued by VSDC to HDS within a two-month period (April-May 2025) for non-compliance in TPDNRL payment processes.

Consequently, VSDC has urged HDS to enhance its operational controls and ensure adherence to prevailing regulations to mitigate errors leading to the exclusion from TPDNRL payments.

Following VSDC’s decision, HDS also faced a comprehensive suspension of its TPDNRL trading activities at the Hanoi Stock Exchange (HNX) by VNX on May 19. This suspension is effective from May 20 to May 26.

HDS’s financial performance in the first quarter of 2025 witnessed a significant decline, largely attributed to bond-related operations.

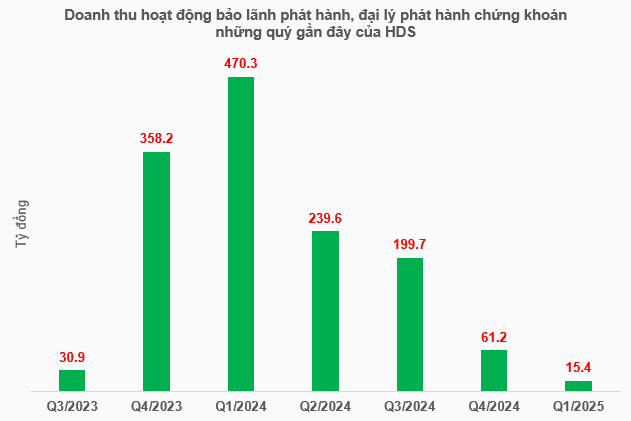

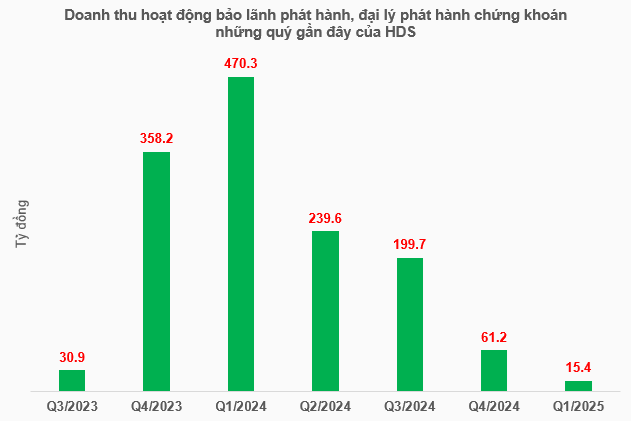

Specifically, HDS generated revenue of over VND 244 billion, a 65% decrease compared to the same period in 2024. This drop was influenced by a decline in underwriting and agency fees, particularly a 97% reduction in bond issuance agency service fees, amounting to just over VND 15 billion.

On a positive note, expenses decreased substantially by 81%, totaling over VND 96 billion. This improvement was mainly due to an 83% reduction in losses on financial assets at fair value through profit or loss (FVTPL) and a 92% decrease in proprietary trading expenses, amounting to nearly VND 7 billion. As a result, proprietary trading yielded a profit of over VND 93 billion, a notable improvement compared to the loss of nearly VND 309 billion in the previous year’s first quarter.

Ultimately, the significant decline in bond issuance agency service fees, a key revenue stream, led to a 43% drop in HDS’s net profit, amounting to nearly VND 79 billion.

Source: VietstockFinance

|

During the Annual General Meeting (AGM) of HDS held in April 2025, several key targets were approved, including a post-tax profit target of VND 1,000 billion and a plan to increase charter capital to VND 4,000 billion.

Specifically, the company aims to generate total revenue of VND 2,428 billion, a 9% increase compared to 2024. With expected cost savings of 8%, totaling VND 1,419 billion, the company forecasts a pre-tax profit of VND 1,008 billion, representing a nearly 50% increase. If realized, this would be the first time HDS achieves the VND 1,000 billion profit milestone.

Regarding the 2024 profit distribution plan, the AGM decided not to allocate funds to the reward and welfare fund. Additionally, the AGM approved the company’s proposal to distribute dividends to organizations that have not yet completed the receipt of dividends according to the resolution of the AGM on March 30, 2023.

The AGM also approved the plan to increase the charter capital in 2025 to VND 4,000 billion through (1) issuing shares to existing shareholders and (2) issuing shares to pay dividends and increase capital contribution from owner’s equity. The Board of Directors is authorized to develop detailed capital increase plans and obtain shareholder approval through written resolutions during 2025.

– 14:40, May 21, 2025

“A Bright Start: PJICO’s Impressive Performance in Q1”

In the recently released Q1 2025 financial report, Petrolimex Insurance Joint-Stock Corporation (PJICO, code: PGI) recorded a total revenue of VND 1,343 billion, a 3.3% increase, amounting to 26% of the yearly plan. The original insurance revenue reached VND 1,114 billion, a slight 1.3% uptick compared to the same period in 2024.

The Great Mid-Year Sale: Slashing Prices, Not Quality

The financial report submitted to the Hanoi Stock Exchange reveals an interesting development. Trungnam Group, a construction and investment company, reported a pre-tax loss of VND 25 billion for the first half of 2024, a significant improvement from the VND 1 trillion loss in the same period last year. Despite a post-tax loss of VND 113 billion, the company is showing signs of a robust recovery.

Harvesting Gold: A Look at the Success of Industry Giants

The pharmaceutical industry witnessed a mixed performance in Q1 2025. While several industry giants thrived through continuous product restructuring and robust business promotions, numerous others experienced significant downturns due to diverse challenges.

The Three Top Executives of Viettel Global Step Down

“Three individuals, united by a serendipitous twist of fate, found themselves entrusted with a new mission from the conglomerate. Their paths converged as they embarked on a journey to uncover the mysteries of their shared assignment. As they delved deeper, they discovered a web of intrigue, where their unique skills and perspectives became their greatest assets. With a collective determination, they set out to leave an indelible mark, driven by a passion to excel and a desire to unravel the unknown.”