Hanoi Stock Exchange (HNX) Delists Vinam’s Shares Due to Violations

The Hanoi Stock Exchange (HNX) has recently issued a mandatory delisting decision for all of Vinam JSC’s (code CVN) nearly 29.7 million shares due to violations of information disclosure regulations. Specifically, Vinam had been late in submitting its audited financial statements for three consecutive years from 2022 to 2024. The delisting will take effect on May 30, with the last trading day on HNX being May 29.

Prior to this decision, CVN shares had been suspended from trading since September 18, 2024, due to continued violations of information disclosure regulations after being restricted from trading for late submission of its reviewed semi-annual financial statement for the first half of 2024. HNX had warned of the possibility of delisting CVN shares since the end of April and requested Vinam to respond within five working days from April 23.

In its response on April 25, Vinam stated that it had proactively contacted several approved auditing firms to audit its financial statements for the years 2023 and 2024. However, due to the auditors’ busy schedules and a lack of agreement on criteria regarding capabilities, experience, and costs, the company has been unable to sign an auditing contract as of yet.

Vinam requested that the authorities consider the delay in submitting the audited reports as a force majeure event and proposed that the delisting decision be postponed until the Ministry of Finance assigns an auditing firm and the company completes its audited financial statements.

According to its self-prepared financial statements, Vinam recorded a revenue of nearly VND 96 billion and a post-tax profit of VND 2.8 billion in 2024, a decrease of 9% and 73%, respectively, compared to 2023. The company attributed this decline mainly to the scaling down of its business operations and a significant increase in financial expenses.

In the first quarter of 2025, Vinam recorded a revenue of over VND 27 billion, a 48% increase compared to the same period in 2024. However, the company incurred a loss of VND 1.8 billion, in contrast to a profit of VND 480 million in the previous year. Notably, as of March 31, Vinam’s headcount had decreased to just eight employees.

Vinam, formerly known as Vietnam Natural Resources and Energy Investment JSC, was established in 2007 and listed on HNX since August 6, 2010. With a charter capital of nearly VND 300 billion, the company operates in various sectors, including providing medical solutions, distributing health supplements, trading agricultural machinery, and investing in waste-to-energy power plants.

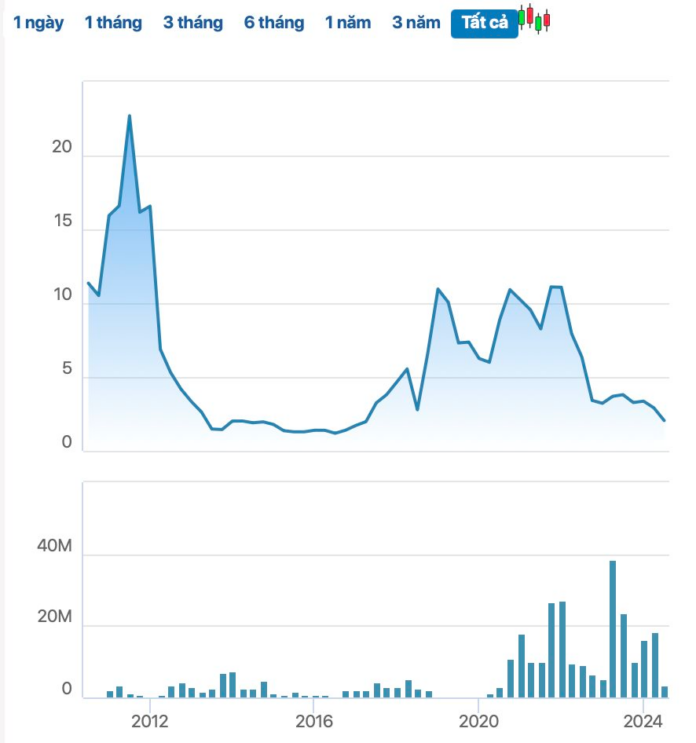

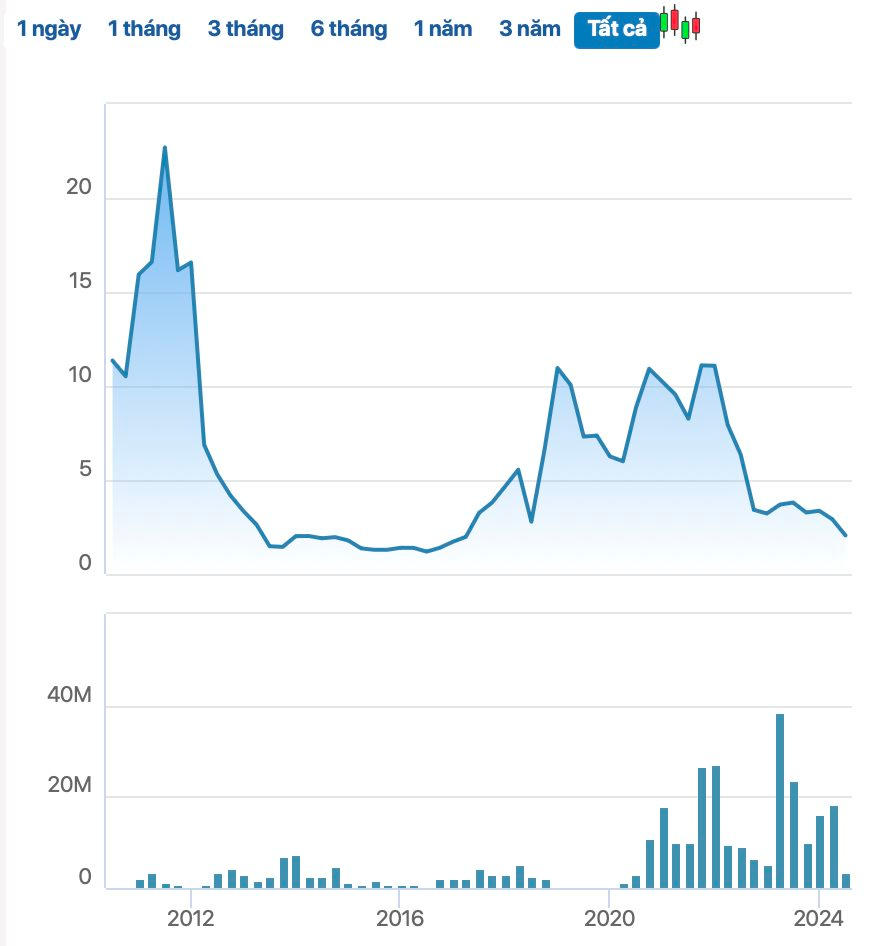

Thus, CVN shares had been traded on the stock exchange for 15 years before their delisting. At the close of the last trading day, CVN shares stood at VND 1,900 per share, reflecting a nearly 90% decline from their peak.

“Phú Long Real Estate Repays Over VND 553 Billion in Principal and Interest on Four Bond Lots”

Phú Long Real Estate has just made a substantial payment of VND 553.6 billion towards its bond obligations, covering both principal and interest for the bond series PLR05202307, PLR05202308, PLR05202309, and PLR05202310.

“A Securities Firm Suspended from Making Payments and Trading Private Bonds for One Week”

On May 20th, HD Securities JSC (HDS) announced that it had received a decision from the Vietnam Securities Depository and Settlement Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend the company’s settlement operations and activities in the private corporate bond market from May 20th to May 26th.

Vingroup Successfully Raises $85 Million in Bond Offering

On May 9, 2025, Vingroup successfully offered a total of VND 2,000 billion ($85 million) in bonds, under the code VIC12505, with a maturity of 24 months.