VIX JSC (Stock Code: VIX, on HoSE) has just announced the resignation of Ms. Tran Thi Hong Ha from its Board of Directors due to personal reasons.

Ms. Tran Thi Hong Ha, born in 1979, was elected as an independent member of the Board for the term 2021-2026 since June 2021. Her resignation will be approved at the upcoming Annual General Meeting to be held on May 23, 2025.

Prior to this, Mr. Thai Hoang Long had also resigned from the Board. Mr. Long previously served as Chairman of the Board from April 15, 2023, until his dismissal by the Board on September 27, 2024. He was then replaced by Mr. Nguyen Tuan Dung, a Board member assigned to oversee the Board’s duties.

Mr. Thai Hoang Long, born in 1970, holds a Master’s degree in Business Administration and has extensive experience in finance and securities. Before joining VIX, he served as General Director of Nhat Viet Securities and Deputy General Director of VietinBank Securities.

As per the Board’s decision, Mr. Long’s dismissal will be presented at the upcoming General Meeting for approval and will officially take effect after the Assembly’s consent.

Thus, the upcoming Assembly will approve the dismissal of both Mr. Long and Ms. Ha and elect two new members to the Board.

Illustrative image

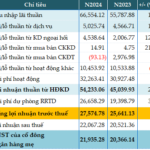

At the upcoming meeting, the VIX Board will present to the shareholders the business plan for 2025, targeting a pre-tax profit of VND 1,500 billion and a post-tax profit of VND 1,200 billion, increasing by 84% and 81%, respectively, compared to the performance of 2024.

Previously, VIX had set ambitious targets for 2024, aiming for a pre-tax profit of VND 1,320 billion and a post-tax profit of VND 1,056 billion. However, the actual results achieved only 62% and 63% of these targets, respectively.

Regarding profit distribution, VIX proposed to pay a 2024 dividend in shares with a ratio of 5%, equivalent to 72.9 million shares. The issuance of shares for dividend payment is expected to be executed by the end of the second quarter to the beginning of the third quarter of 2025. The issued shares will not be restricted from transfer.

If the share issuance is successful, VIX’s charter capital will increase from VND 14,585.1 billion to VND 15,314.4 billion.

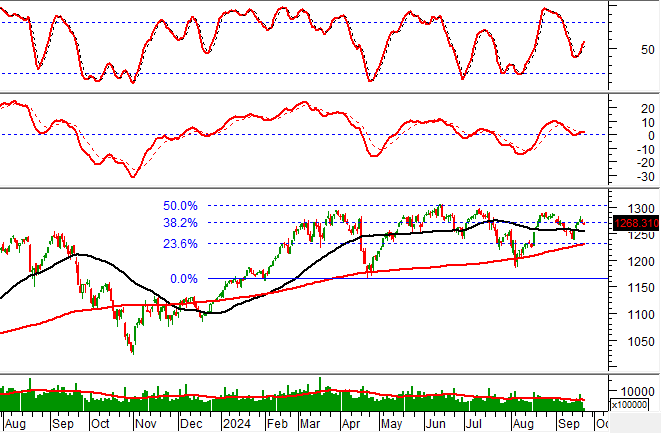

In terms of business performance, according to the first-quarter 2025 financial report, VIX generated nearly VND 980 billion in operating revenue, a 270% increase compared to the same period last year.

The significant growth was mainly driven by proprietary trading activities, which surged by 380% to VND 784.5 billion. Profit from loans and receivables also increased by 40%, reaching VND 160.8 billion. However, brokerage revenue decreased by 48% to VND 21 billion.

Consequently, VIX reported a pre-tax profit of VND 465 billion, more than triple the figure from the previous year. After-tax profit stood at VND 372 billion, a 220% year-over-year increase.

As of March 31, 2025, VIX’s total assets amounted to nearly VND 20,611 billion, up 5.1% from the beginning of the year.

The FVTPL portfolio’s book value was VND 12,008 billion, with a temporary profit of VND 615 billion. Margin lending balance stood at VND 6,215.4 billion, an increase of VND 443 billion compared to the beginning of the year.

The company’s payables increased by 17% from the beginning of the year to VND 4,193.7 billion, mainly comprising short-term borrowings of VND 3,970.5 billion, which were not elaborately explained.

“Agribank Aims for a 3-5% Rise in Pre-Tax Profits in 2025”

According to the 2024 Annual Report, the Vietnam Bank for Agriculture and Rural Development (Agribank) has set an ambitious target for its 2025 pre-tax profit. The bank aims to achieve a 3-5% increase compared to its 2024 performance and strives to meet or exceed the profit plan approved by the State Bank of Vietnam.

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

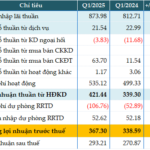

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)