Illustration of Vinhomes Wonder City

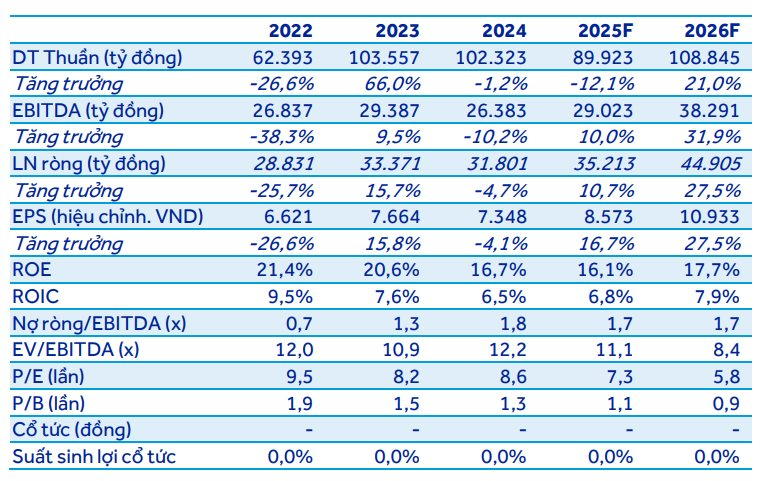

ACBS Securities has released an analytical report on Vinhomes (VHM). In Q1/2025, revenue reached VND 15,698 billion, up 91% year-on-year, while after-tax profit reached VND 2,652 billion, up 193% year-on-year, completing 6% of the profit plan.

Vinhomes’ revenue growth mainly came from deliveries at Ocean Park 2 (VND 4,400 billion), Ocean Park 3 (VND 1,800 billion), and revenue from consulting and sales services for Vinhomes Global Gate and other activities (VND 4,900 billion).

Profit sharing from BCC projects (mainly from Royal Island) also increased more than sevenfold compared to the same period, reaching VND 1,408 billion.

Adjusted revenue (including wholesale and BCC project revenue) was VND 19,300 billion (up 124% year-on-year), completing 11% of the plan.

The gross profit margin for Q1/2025 was recorded at 32.9%, much higher than the 21.6% in Q1/2024, mainly due to the increase in gross profit margin for consulting and sales services and other services from 35.9% to 57.2%.

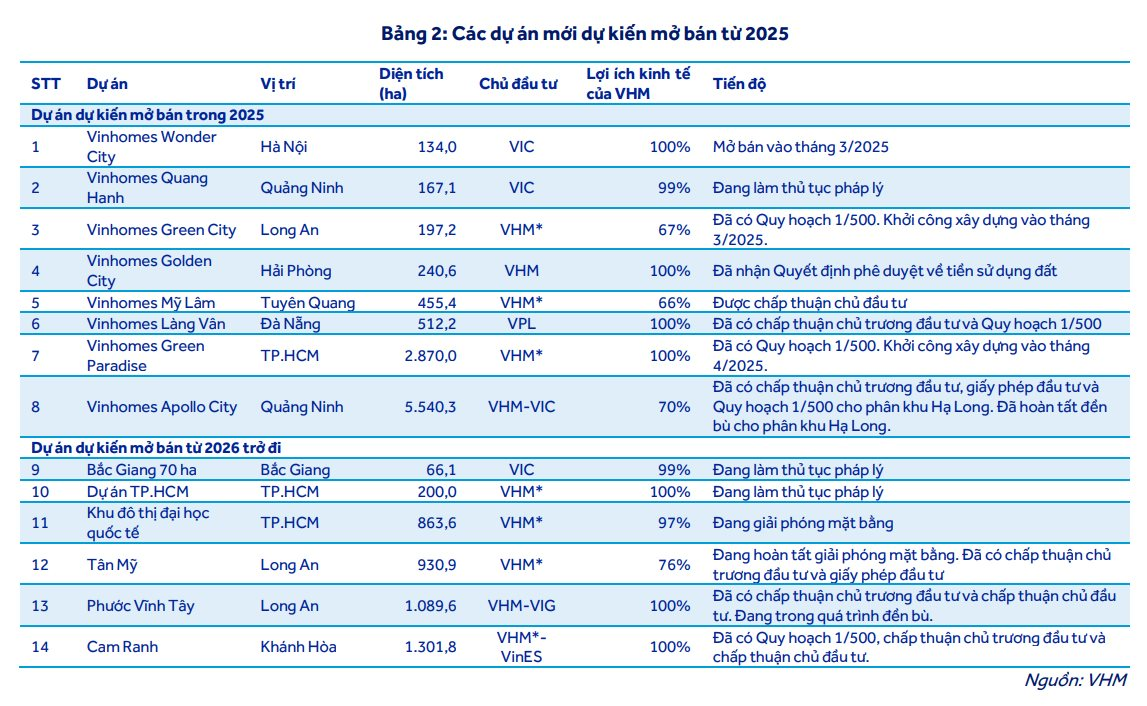

VHM sets a very high sales target for 2025 at VND 150-200 trillion, 44-92% higher than the 2024 result, with plans to launch eight new projects.

In Q1/2025, VHM’s sales value increased by 116% year-on-year to VND 35,000 billion. The main contributor to this figure was the Wonder City project, launched in March, which accounted for about 80% of the total sales value. Wonder City is located in Dan Phuong, Hanoi, and comprises 2,250 low-rise units and 600 apartments. In Q1/2025, approximately 540 low-rise units (retail) and 600 apartments (wholesale) were sold.

ACBS forecasts VHM’s 2025 sales value to reach VND 150,000 billion (up 44% year-on-year), mainly from projects such as Wonder City, Green City, Golden City, Green Paradise, and Apollo City.

Notably, sales not yet recognized as revenue as of the end of Q1/2025 stood at VND 120,000 billion (up 7% year-on-year), with Wonder City accounting for 28% and Royal Island 26%.

Market Beat: VN-Index Holds on to Green, VHM Soars to New Heights

The market closed with the VN-Index up 7.9 points (+0.6%), reaching 1,323.05; while the HNX-Index fell 0.24 points (-0.11%) to 217.46. The market breadth tilted towards decliners, with 397 losers and 337 gainers. The VN30 basket saw a relatively balanced performance, as 13 stocks added value, 12 declined, and 5 remained unchanged.

The Green Grocery CEO Sells Mobile World Shares

Mr. Pham Van Trong, a member of the Board of Directors and CEO of Bach Hoa Xanh at Mobile World Investment Corporation, plans to sell 200,000 MWG shares, reducing his stake to 0.21% of the charter capital. This development comes on the heels of a remarkable 40% surge in Mobile World’s stock value.

“Billionaire Pham Nhat Vuong’s Net Worth Surpasses $10 Billion Landmark.”

According to Forbes, Vietnamese billionaire Pham Nhat Vuong’s net worth stands at a staggering $10.1 billion, a surge of nearly $880 million from the previous day. This significant increase catapults him to the 279th spot on the global billionaire rankings.

“Capital Floods Blue-Chip Stocks as VN30-Index Soars to New Heights”

The HoSE matching liquidity slightly increased by 2.6% compared to the previous session, while the VN30 basket witnessed a more robust 10% surge. Trading of this blue-chip basket accounted for 62% of the entire exchange, with the VN30-Index climbing by 2.01% and setting a new peak since early May 2022.