Vietnam Aviation Corporation (ACV) has just announced the results of its written shareholder vote on the plan to distribute undistributed post-tax profits up to the end of 2023 (with a balance of VND 21,192 billion).

The profit distribution plan was approved by 78 shareholders, representing 96.465% of the total outstanding shares. In addition, there were 6 abstentions (0.062%) and no objections.

According to the plan, ACV will allocate VND 7,130 billion to the development investment fund, and the remaining VND 14,000 billion will be distributed as stock dividends. ACV expects to issue approximately 1.4 billion shares, a ratio of 64.58% (owning 100 shares will receive 64.58 new shares).

This is the first time ACV has paid stock dividends since its equitization and listing on the stock exchange in 2016. The aviation “giant” once had a period of consistently paying cash dividends with a ratio of 6-9% in the first three years of listing, before suspending dividend payments in 2019.

If successful, ACV’s chartered capital will increase from VND 21,771 billion to VND 35,830 billion. According to the ballot count, as of May 7, ACV has a total of 10,653 shareholders. Of which, the Ministry of Finance is the largest shareholder, holding nearly 2.08 billion ACV shares, accounting for up to 95.4%. The ACV Trade Union also owns more than 3 million shares.

ACV currently has a monopoly on providing aviation services to domestic and foreign airlines, such as security services, ground handling, passenger services, take-off and landing services, etc. The Corporation is in charge of managing, coordinating the activities and investing in the operation of a total of 22 airports across Vietnam, including 9 international airports and 13 domestic airports.

As of December 31, 2025, ACV’s total assets amounted to VND 75,595 billion. Cash and cash equivalents decreased significantly to VND 3,011 billion, while deposits also decreased from VND 20,248 billion to VND 17,500 billion.

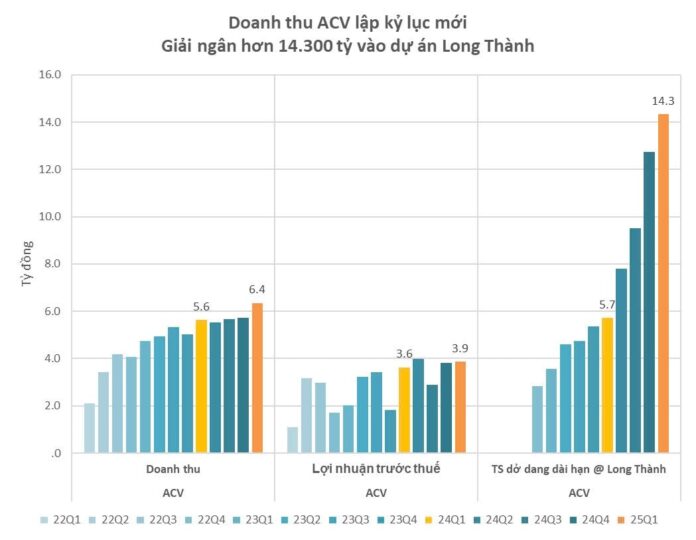

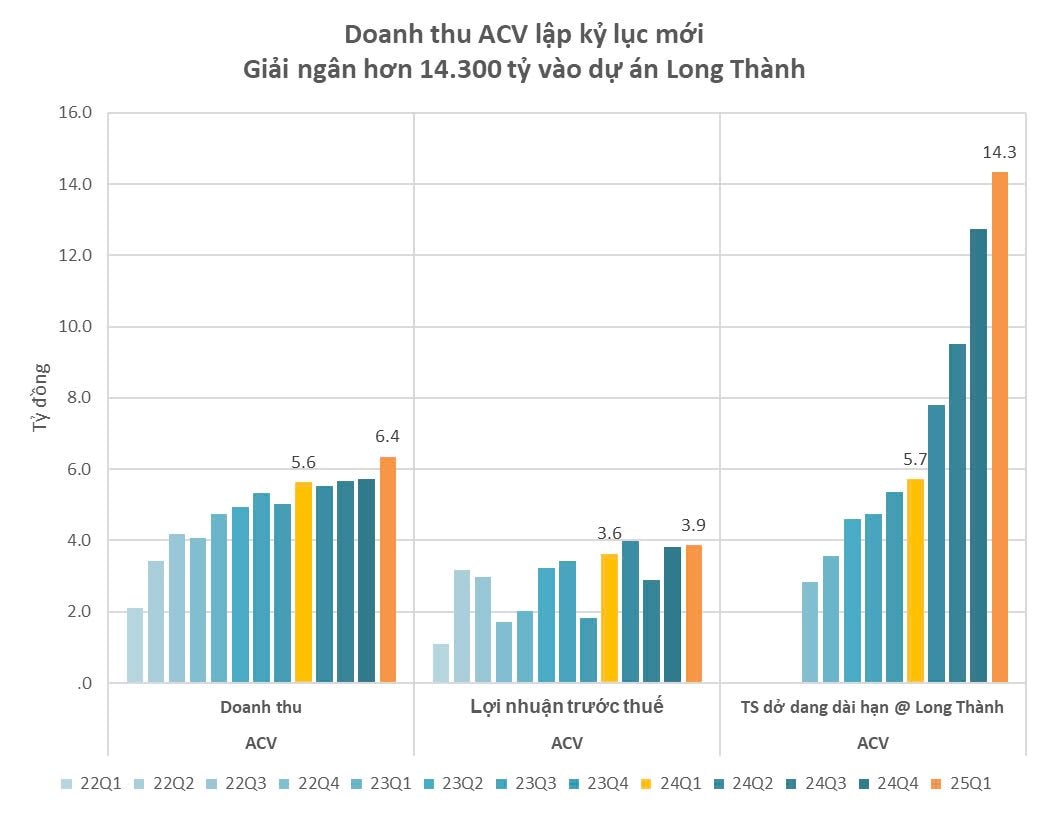

In terms of business results for the first quarter of 2025, ACV recorded revenue of over VND 6,368 billion, up more than 12% compared to the same period last year. After deducting cost of goods sold and expenses for the period, ACV recorded a post-tax profit of VND 3,014 billion, an increase of about 6% compared to the previous year.

In another development, on May 29, ACV will finalize the list of shareholders eligible to attend the 2025 Annual General Meeting of Shareholders. The meeting is expected to be held in late June. The main agenda items include reporting on 2024 results and 2025 business directions, profit allocation plan, proposals on salaries and allowances, approval of auditors, etc.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.

“OCB to Issue 197.2 Million Bonus Shares to Boost Chartered Capital”

OCB is set to issue a bonus share dividend, offering 197.2 million new shares to its shareholders. This move will increase the bank’s charter capital from VND 24,657.8 billion to VND 26,630.5 billion.

“Unanimous Shareholder Approval: ACV’s 96% Dividend Payout in Stock”

“As per the plans, ACV will allocate VND 7.13 trillion to the development investment fund, leaving approximately VND 14 trillion for dividend payout in shares. ACV expects to issue around 1.4 billion new shares, representing a ratio of 64.58% (for every 100 shares held, shareholders will receive 64.58 new shares).”

The Foreign Independent Director Resigns Following Đức Long Gia Lai’s Sale of its Electronics Component Business

Mr. Paul Anthony Murphy, a British national, has tendered his resignation from his role as a Board Member of DLG Group Joint Stock Company (HOSE: DLG). This development comes as a notable move shortly after DLG divested its entire stake in its electronic components subsidiary, a business area under Mr. Murphy’s stewardship.