With over 223 million shares currently in circulation, the upcoming issuance corresponds to an execution ratio of 10:1 (shareholders owning 10 shares will receive 1 new share). The ex-rights date is June 11, and the issuance is expected to be completed in the second or third quarter of 2025.

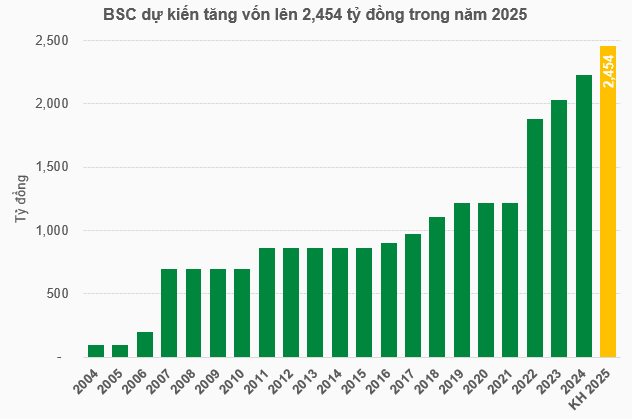

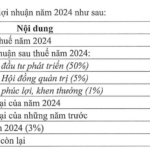

The company stated that it will use undistributed post-tax profits from the audited financial statements for 2024 for this issuance. Through this issuance, the charter capital will be raised to nearly VND 2,454 billion. The purpose of the issuance is also clearly stated as serving the needs of business development.

Source: VietstockFinance

|

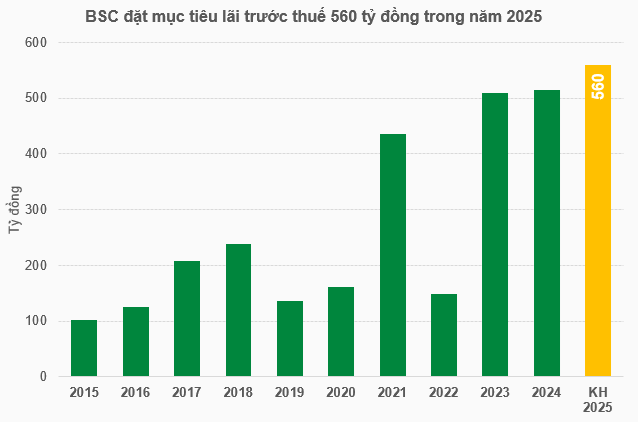

The plan to issue more than 22.3 million shares to pay dividends was approved at the 2025 Annual General Meeting of Shareholders held on April 18. In addition, shareholders also approved the 2025 business plan with a pre-tax profit target of VND 560 billion, up nearly 9% compared to the performance in 2024. Besides, the Company also set a target of maintaining the capital adequacy ratio at over 260%.

Source: VietstockFinance

|

In response to shareholders’ questions about BSC’s actions in the face of major changes when the market is upgraded, the Company’s management said that the Company has made thorough preparations to seize new opportunities when the Vietnamese stock market is upgraded.

In terms of products, the Company is preparing the technological foundation to diversify financial products, develop derivative products, structured products, and products/services dedicated to foreign investors.

Regarding technology, BSC has invested in a new system capable of handling larger transaction volumes and with unlimited scalability. In addition, the Company has also prepared its personnel for this transformation.

On another “hot” issue related to actions to cope with tax risks, BSC’s management said that the Company will devote more time and resources to analyzing the impact on a sector and enterprise basis. In addition, the Company will strengthen internal management and optimize proprietary trading, focusing on commercial bonds of large banks and enterprises in Group A.

At the meeting, BSC also shared plans to collaborate with strategic shareholder Hana Securities to promote the digital transformation process and cooperate with Edmond de Rothchild to contribute capital, joint venture, and establish a fund management company, which are making good progress.

The 2025 Annual General Meeting of Shareholders of BSC, held on April 18, discussed and approved several critical issues.

|

– 6:45 PM, May 23, 2025

“Novaland Seeks Shareholder Approval for Debt-for-Equity Swap with Major Investor”

“Novaland seeks shareholder approval for a proposed issuance of additional shares to facilitate a debt-for-equity swap, as requested by its major shareholder. This strategic move underscores Novaland’s commitment to exploring innovative avenues to enhance its financial standing and foster sustainable growth.”

“Refinancing Our Debt: A Novaland Story”

“In a bid to rescue Novaland Group from its financial woes, a group of shareholders associated with Mr. Bui Thanh Nhon offered up their shares for the company to sell, thereby reducing their ownership stake from 61.4% to 38.7% of the charter capital. As a result of this noble effort, Novaland is now seeking to issue shares to swap debt for equity with its major shareholder.”

The Green Land Group Plans to Issue Over 148 Million Bonus Shares to Shareholders

The Dat Xanh Group plans to issue over 148 million bonus shares to its shareholders at a ratio of 100:17, thereby increasing its charter capital to over VND 10,206 billion.