Illustration

Oil Prices Rise

Oil prices are on the rise, fueled by increased buying activity ahead of the long Memorial Day weekend holiday, amid concerns about the latest nuclear negotiations between the US and Iran.

On May 23rd, Brent crude oil prices closed 34 US cents higher, or 0.54%, at $64.78 per barrel. WTI oil also saw an increase of 33 US cents, or 0.54%, ending the day at $61.53 per barrel.

The Memorial Day holiday marks the beginning of the summer driving season in the US, a period of high fuel demand.

US Natural Gas Prices Climb 2%

Natural gas prices in the US rose by 2%, influenced by lower production this month and forecasts of hotter-than-usual summer weather, which is expected to increase the use of gas-fired power plants to meet air conditioning demands.

The June 2025 natural gas contract on the New York Mercantile Exchange climbed 7.4 US cents, or 2.3%, to settle at $3.327 per million British thermal units. For the week, natural gas prices fell by 1% after a 12% drop in the previous week.

Gold Prices Surge, Platinum Reaches 2-Year High

Gold prices surged over 2% and posted their biggest weekly gain in six weeks as investors sought the safe-haven asset amid US President Donald Trump’s continued threats of tariffs and a weaker US dollar.

Spot gold on the LBMA rose 2.1% to $3,362.70 an ounce. For the week, gold prices climbed 5.1%. Gold futures for June 2025 on the New York Mercantile Exchange also increased by 2.1%, settling at $3,365.80 per ounce.

Global stock markets declined after Trump proposed tariffs of 50% on goods from Europe, effective June 1, 2025. Trump also stated that Apple would pay a 25% tariff on iPhones assembled in America.

The US dollar weakened by 0.9%, making gold priced in the currency cheaper for buyers holding other currencies.

Meanwhile, platinum prices on the London market rose 1.2% to $1,094.05 an ounce, after hitting its highest since May 2023 earlier in the session.

Copper Hits 3-Week High

Copper prices surged to their highest level in more than three weeks, buoyed by a weaker US dollar and concerns about issues at a major mine in Congo.

Comex copper prices climbed 3% to $4.82 per pound – the highest since April 30, 2025.

Three-month copper on the London Metal Exchange advanced 1.2% to $9,617 a ton, its highest since May 14, 2025.

The decline in the US dollar made the metal cheaper for buyers holding other currencies.

Copper’s price rise was also driven by worries about the Kamoa-Kakula mine in Congo – Africa’s largest copper producer and one of the world’s biggest – which is facing potential production issues.

Additionally, copper prices were supported by falling inventories in Shanghai, which dropped 9% this week to 98,671 tons, and in London, where stocks fell 8% to 164,725 tons.

Dalian Iron Ore, Steel Prices Drop

Iron ore prices on the Dalian Commodity Exchange fell, weighed down by a weak Chinese property sector and reduced demand for the metal.

The September 2025 iron ore contract on the Dalian Commodity Exchange dropped 1.24% to 718 Chinese yuan ($99.73) per ton. For the week, iron ore prices declined by 1.51%.

The June 2025 iron ore contract on the Singapore Exchange also fell, dropping 0.76% to $98.25 per ton. Prices fell 1.81% for the week.

China’s property sector is expected to remain weak this year, with home prices falling nearly 5% and stagnation predicted for 2026.

On the Shanghai Futures Exchange, steel rebar dropped 0.42%, hot-rolled coil fell 0.75%, galvanized wire dropped 0.15%, and stainless steel fell 0.04%.

Japanese Rubber Prices End Week Higher

Japanese rubber prices ended the week in positive territory, influenced by unfavorable weather in top producer Thailand, although gains were limited by the start of the harvest season and lower oil prices.

The October 2025 rubber contract on the Osaka Stock Exchange (OSE) fell ¥1.9, or 0.59%, to ¥320 ($2.23) per kg. For the week, rubber prices climbed 2.11%.

Meanwhile, the September 2025 rubber contract on the Shanghai Futures Exchange dropped 350 Chinese yuan, or 2.35%, to ¥14,535 ($2,019.03) per ton.

Butadiene rubber futures for June 2025 on the Shanghai Futures Exchange fell ¥365, or 3.01%, to ¥11,750 ($1,632.17) per ton.

Singapore’s June 2025 rubber contract fell 1.5% to 168.8 US cents per kg.

Arabica Coffee Hits 1-Month Low

Arabica coffee prices on the ICE exchange dropped to a one-month low due to improved harvest prospects in top producer Brazil.

Arabica coffee for July delivery on ICE changed hands at $3.61 per pound, after touching a one-month low of $3.5525 earlier in the session. For the week, coffee prices fell 4%.

Robusta coffee for July delivery on the London market was also steady at $4,790 per ton.

Sugar Prices Extend Losses

Raw sugar futures on ICE fell 0.6% to 17.29 US cents per lb.

White sugar futures for August delivery on the London market dropped $4.50, or 0.9%, to $483.60 per ton, after touching a four-month low of $482.70 earlier in the session, pressured by lower crude oil prices.

Corn, Soybean, and Wheat Prices Decline

Corn and soybean prices on the Chicago Board of Trade fell after US President Donald Trump proposed tariffs of 50% on imports from Europe.

July soybean futures on the Chicago Board of Trade fell 7-1/4 cents to $10.61-1/4 per bushel. July corn futures dropped 3-1/2 cents to $4.59-1/2 a bushel, and July wheat fell 2 cents to $5.42-1/2 per bushel.

Malaysian Palm Oil Prices Rise

Malaysian palm oil prices climbed, posting weekly gains, although expectations of higher production limited the upside.

The August 2025 palm oil contract on the Bursa Malaysia Derivatives Exchange rose 7 ringgit, or 0.18%, to 3,827 ringgit ($905.16) per ton. For the week, palm oil prices gained 0.18%.

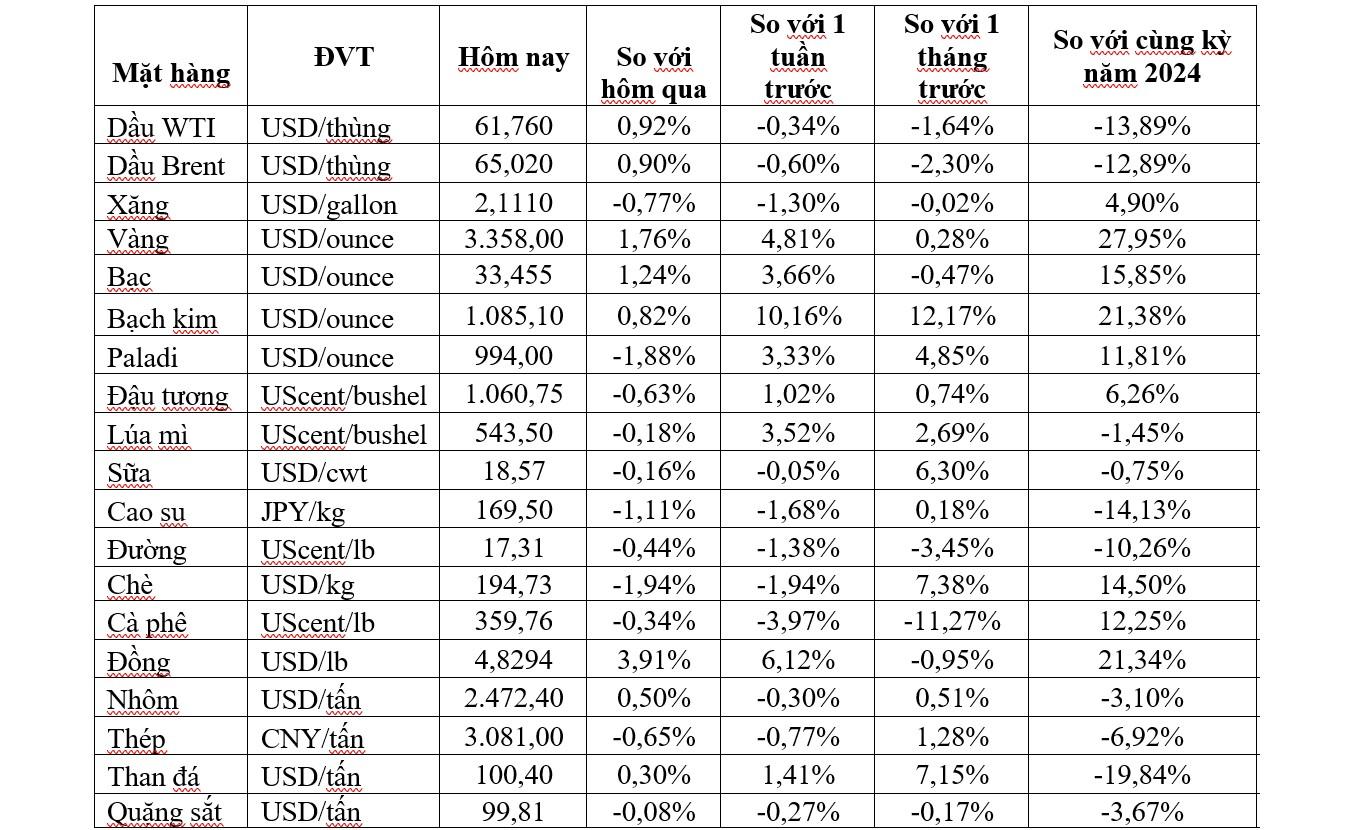

Key Commodity Prices as of May 24, 2025

Unveiling the Treasure Trove: Exploring the Most Lucrative Investment Channels

People’s deposits are flowing into other investment channels such as gold, real estate, and stocks. The gold investment channel, in particular, has emerged due to its excellent rate of return.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)