VN-Index’s intraday performance on May 22 witnessed a surge of nearly 9 points, with multiple stocks, including HVN, GEX, and EIB, reaching their ceiling prices. However, this upward momentum couldn’t be sustained, and the market unexpectedly reversed course in the final moments, closing at 1,314 points—a decline of over 9 points from the previous session.

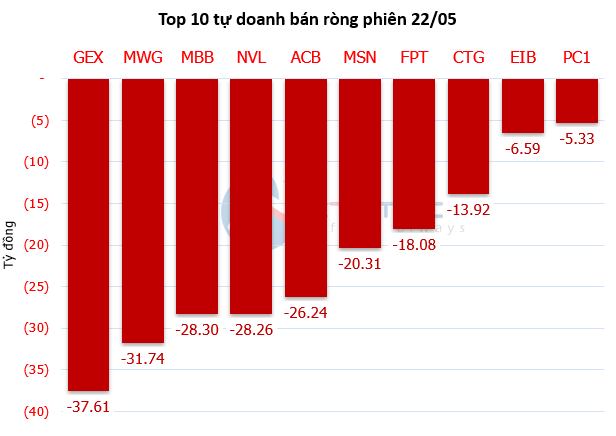

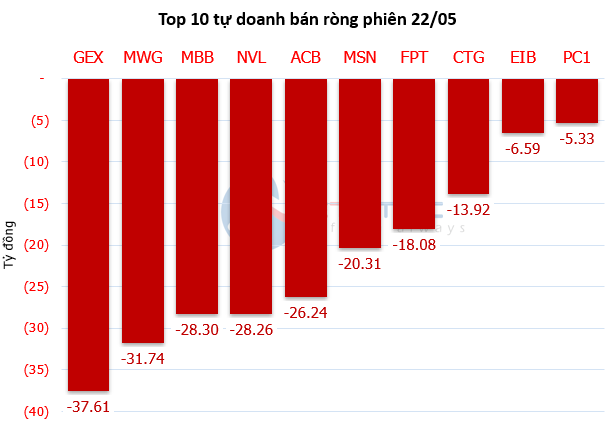

Self-employed traders continued their selling spree on the HOSE for the third consecutive session, offloading stocks worth over 385 billion VND, a slight decrease from the previous session’s 395 billion VND. The selling pressure was concentrated on GEX (38 billion VND), MWG (32 billion VND), MBB, and NVL (approximately 28 billion VND each), along with ACB (over 26 billion VND).

Source: VietstockFinance

|

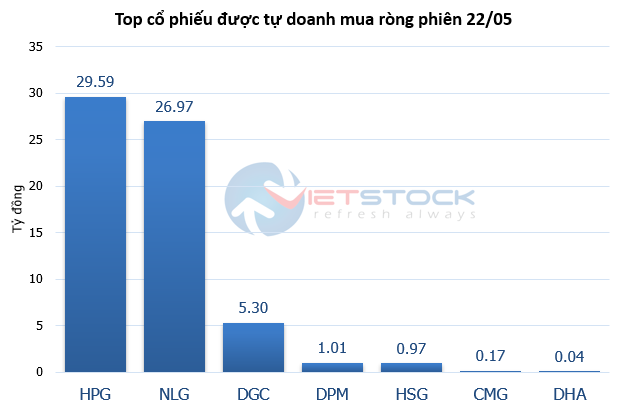

On the flip side, self-employed traders showed notable buying interest in only two stocks: HPG (30 billion VND) and NLG (27 billion VND). Other stocks, such as DGC, DPM, HSG, CMG, and DHA, witnessed negligible net buying.

Source: VietstockFinance

|

Foreign investors maintained their net buying trend but with a significantly reduced value of just over 61 billion VND, a sharp drop from the previous session’s 441 billion VND. Their primary focus was on VIX (nearly 148 billion VND), MWG (134 billion VND), VHM and EIB (around 112 billion VND each), along with STB (90 billion VND), HVN (68 billion VND), and VND (62 billion VND).

| Block trading activities in the last 5 sessions |

Conversely, their top sell-off targets included FPT, with a net sell value of over 131 billion VND, followed by VPB (95 billion VND) and VRE (71 billion VND). Stocks like GMD, GEX, and SSI also witnessed net selling in the range of 42-68 billion VND.

| Top 10 stocks with the highest foreign trading volume on May 22 |

– 6:24 PM, May 22, 2025

Market Beat: VN-Index Holds on to Green, VHM Soars to New Heights

The market closed with the VN-Index up 7.9 points (+0.6%), reaching 1,323.05; while the HNX-Index fell 0.24 points (-0.11%) to 217.46. The market breadth tilted towards decliners, with 397 losers and 337 gainers. The VN30 basket saw a relatively balanced performance, as 13 stocks added value, 12 declined, and 5 remained unchanged.

Market Beat: Profit-Taking Pressures Mount, VN-Index Back to Square One.

The morning session witnessed a cooling of large caps and widespread profit-taking pressures, pulling the VN-Index back towards the reference level. By the mid-session break, the VN-Index had gained just under 1 point, hovering at 1,316.13; while the HNX-Index underwent a more pronounced correction, shedding 0.59% to stand at 216.42. Market breadth was negative with 422 decliners overpowering 227 advancers.

Expert Opinion: Consider VN-Index’s Probability of “Giving Back Points”, Not an Attractive Price Region for Further Investment

The VN-Index is expected to fluctuate and consolidate around the 1,300-point level next week. This neutral scenario predicts a sideways movement for the index, which presents an opportunity for investors to assess their strategies and plan their next moves. With the market showing signs of uncertainty, a cautious approach is advised until a clearer trend emerges.

“Vietstock Daily Recap: Selling Pressure Persists”

The VN-Index witnessed a consecutive decline for the second session, breaching the 1,300-point mark. If this trend persists in the upcoming sessions, the VN-Index could potentially retest the old peak formed in December 2024 (corresponding to the 1,270-1,280 point range). At present, the Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Investors are advised to exercise caution in the near term if the indicator falls out of this zone.