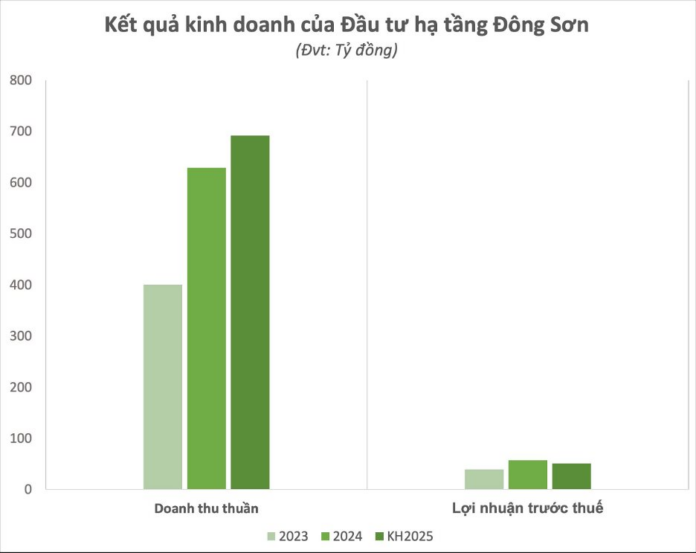

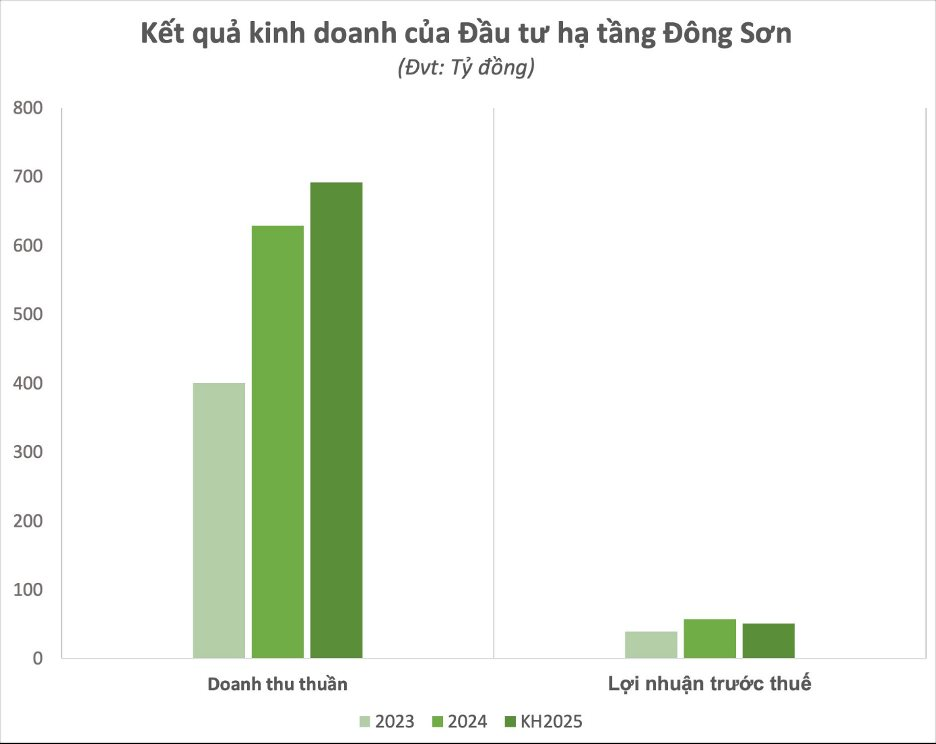

On May 16, 2025, Dong Son Infrastructure Investment JSC (coded DSH) successfully organized its 2025 Annual General Meeting of Shareholders. Shareholders approved the 2025 business plan with a target of a 10% increase in net revenue to VND 692 billion. Pre-tax profit is expected to reach approximately VND 51 billion. This year’s dividend ratio is expected to be 20%.

According to the company’s management, the business plan is built on cautious assumptions about the current state of business operations, the impact of macroeconomic factors on politics, society, and closely follows the company’s strategic orientation in the medium and long term.

Specifically, in the construction segment, Dong Son Infrastructure Investment continues to implement five ongoing projects according to the committed schedule with the investor, including the expansion of Hoang Hoa Tham Street to Cong Hoa Street in Ho Chi Minh City; the renovation and upgrade of National Highway 14B in Da Nang city; the construction of Dong Hoi Bridge in Xuan Quang 1 commune, Dong Xuan district, Phu Yen province; the construction of a bridge over the Day River connecting Ninh Binh and Nam Dinh provinces as part of the Ninh Binh – Nam Dinh – Thai Binh – Hai Phong expressway; and the construction of the new Nam Dinh – Lac Quan – Coastal Road route. In addition, in 2025, the company intends to approach and participate in government-prioritized construction project bids and packages where the company has a high level of competitiveness in terms of price and construction capacity.

Alongside prioritizing the development of the construction sector, the company will also strengthen its search for investment opportunities in industrial real estate projects, social housing projects, etc.

In 2024, Dong Son Infrastructure Investment recorded positive growth. Net revenue for the year exceeded VND 629 billion, an increase of over 57% compared to the previous year. More than 78% of this came from construction contracts. Pre-tax profit in 2024 reached over VND 57 billion, an increase of 45%. Earnings per share (EPS) increased from VND 3,783/share (in 2023) to VND 5,299/share.

As of December 31, 2024, the company’s total assets reached VND 695 billion, with undistributed profit after tax exceeding VND 125 billion. In addition to construction, DSH also invests in a transport project in the form of BOT, which is the project for improving and upgrading National Highway 1 from Hanoi to Bac Giang. The project has a total investment of nearly VND 4,200 billion, in which DSH contributes 25% of the capital, and profits from this investment are stable at VND 20-42 billion/year, recognized as a share of profit in the associated company.

Recently, DSH announced that it won the My Dinh – Ba Sao – Bai Dinh road package bid. Specifically, the Project Management Unit for Transport Construction Works in Hanoi has announced the results of the selection of contractors for the XL Package for Construction and Traffic Safety Assurance of the road from Km35+870 to Km49+095 (including Day River Bridge, Ngoai Do Canal Bridge, lighting system, traffic organization, and traffic lights). The package belongs to Component 2 of the My Dinh – Ba Sao – Bai Dinh Road Investment Project (the connecting section from the southern axis road to the Huong Son – Tam Chuc road), My Duc and Ung Hoa districts of the project with the same name (total investment of VND 2,080 billion).

12.5 km route map (the drawing is for reference only, according to the planning).

Overcoming the technical evaluation stage, the winning contractor for the above project is a joint venture of 12 members, including Urban Infrastructure Development and Investment Corporation – Dong Son Infrastructure Investment Joint Stock Company – Vietnam Hung Technical Construction and Service Joint Stock Company – Dong Do Group Joint Stock Company – 471 Joint Stock Company – Song Da Hanoi Joint Stock Company – Dong Tien Construction Joint Stock Company – Thang Long Corporation – Hoa Phu Urban Construction Joint Stock Company – Hai Ly Investment Construction Consulting Joint Stock Company – Bridge 14 Joint Stock Company – Thanh Phat Construction Co., Ltd.

The winning bid price was VND 1,338.035 billion (estimated price VND 1,352.468 billion); the contract implementation period is 690 days, and the contract is based on an adjustable unit price.

Dong Son Infrastructure Investment was established in 2009 under the initial name of Investment and Trading 319 Joint Stock Company, based on the contribution of three enterprises: Corporation 319 – Ministry of National Defense, Vina Invest Joint Stock Company, and Chau Au Steel Joint Stock Company. After its establishment, it operated as a subsidiary of Corporation 319. Its current charter capital is VND 100 billion.

On April 22, 10 million DSH shares were officially traded on the UPCoM. At the closing price on May 20, DSH shares reached VND 14,000/share.

“US Tariffs Threaten FDI Appeal: Is Industrial Real Estate at Risk?”

The recent announcement of tariffs by the US, imposing up to 46% on exports from Vietnam, presents a significant challenge for various economic sectors, particularly industrial real estate. This industry has traditionally thrived on foreign direct investment and the demand for expanded production capabilities.

The Capital’s Upcoming Housing and Infrastructure Projects: Unveiling Hanoi’s Vision for Tay Ho and Ha Dong Districts

The Hanoi authorities have announced the inclusion of nine new key projects in the Tay Ho district and six in Ha Dong district. These projects are set to be transformative, including the construction of the Tu Lien Bridge, the replenishment of West Lake’s water supply, and the development of the new Thanh Ha A and B urban areas by Cienco 5.

The Housing Bubble: A Ticking Time Bomb?

The Vietnamese real estate sector’s inventory picture as of Q1 2025 paints a telling tale, with a staggering figure of over VND 511 trillion, marking a 2% increase since the year’s outset. Notably, nearly a third of this substantial sum is attributable to Novaland, underscoring the significant role it plays in the country’s property landscape.