Lendable has previously provided multiple financing facilities to F88 in 2022 and 2023, ranging from $5 to $10 million. With this new $30 million loan, the total financing provided by Lendable to F88 now stands at nearly $70 million. The significant increase in the credit line demonstrates the strong trust, risk management capabilities, and long-term growth prospects of F88 in the eyes of international investors.

“Lendable provides debt capital to fintech and microfinance institutions with the aim of expanding access to finance for the unbanked and underbanked. F88 is the first company in Vietnam to receive such a large and long-term loan from Lendable, reflecting our confidence in their strategic direction, operational efficiency, and risk management capabilities,” said a senior representative of F88.

According to F88’s representative, the new loan from Lendable will be utilized to boost business operations and expansion, targeting a 30% revenue growth and a 30% increase in total customers by 2025. Achieving these goals will strengthen F88’s position on the UPCoM exchange. On May 6, 2025, the State Securities Commission confirmed that F88 met all the requirements to become a public company.

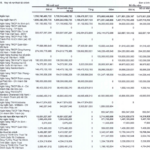

The financial report for the first quarter of 2025 showed that F88 maintained its high growth trajectory for the fifth consecutive quarter. In the first three months of this year, F88 disbursed VND 3,284 billion (up 25% year-on-year), achieved revenue of VND 820 billion (up 21.5%), and recorded a pre-tax profit of VND 132 billion (up 204.2%). In the second quarter of 2025, disbursements and pre-tax profits are expected to increase by 5%–10% and 20%, respectively, compared to the first quarter.

Currently, the company operates 888 stores nationwide. Additionally, F88 has established strategic partnerships with Military Commercial Joint Stock Bank (MB) to diversify its financial products and services, and with a logistics company that owns over 10,000 transaction offices to expand its alternative financial product distribution network.

In early April 2025, credit rating organization FiinRatings upgraded F88’s outlook from “Stable” to “Positive,” citing improved asset quality, flexible capital mobilization capabilities, and market leadership in alternative lending. FiinRatings acknowledged F88’s effective diversification of capital sources and plans to increase charter capital in 2026 while reducing average capital mobilization costs. The loan from Lendable reinforces FiinRatings’ positive assessment of F88. In addition to Lendable, F88 also collaborates with other international financial partners, including Lending Ark Asia Secured Private Debt Holdings Limited and GreenArc Capital, with total borrowing limits exceeding $170 million.

|

About F88: F88 is Vietnam’s leading chain of affordable financial services stores, specializing in alternative finance. F88 focuses on providing secured loans through vehicle registration, insurance distribution, and other financial services. Their target customers are those who do not meet the requirements of traditional banks or financial companies and belong to the mass-market segment. As of the end of April 2025, F88 operated 888 stores nationwide. About Lendable: Lendable is a leading debt capital provider to fintech companies across frontier and emerging markets, enabling access to new financial products and services for the unbanked and underbanked. Lendable finances fintech companies supporting consumer credit, micro, small, and medium enterprise (MSME) lending, asset finance, payments, remittances, and digital markets. Headquartered in London, Lendable currently operates in 17 countries and territories worldwide. |

– 09:46 21/05/2025

The Perennial Borrower: Nhựa Việt Thành’s Spiraling Debt Saga

The Board of Directors of Vietnam Plastics Production and Trading Joint Stock Company (HNX: VTZ) has approved a resolution to secure a VND 100 billion working capital loan, including issuing guarantees and opening L/Cs for its business operations with SeABank – Thu Duc Branch.

FPT Retail and Vietcombank Collaborate to Launch Payment Agency Model

“The partnership between FPT Retail and Vietcombank to launch a payment agency model is a groundbreaking step forward in expanding financial accessibility for customers nationwide. This collaboration aims to provide swift, seamless, and secure financial services, offering a convenient and reassuring experience to all customers.”

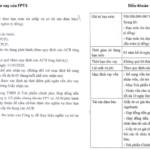

Two Securities Firms Receive a Combined Limit of VND 2,500 Billion from ACB

On May 15, the Board of Directors of FPT Securities (FPTS, HOSE: FTS) approved a short-term borrowing limit of VND 2,000 billion at Asia Commercial Joint Stock Bank (ACB). On the same day, the Board of Directors of Agribank Securities (Agriseco, HOSE: AGR) also approved a limit of VND 500 billion at ACB, with similar terms and conditions regarding purpose and collateral.

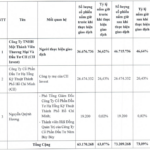

A Strategic Stake: CII Invest Acquires Over 10 Million Shares in NBB, Now Holding a Commanding 47% Stake

“In two sessions held between May 9 and May 12, 2025, CII Invest, a renowned private trading and investment company, successfully acquired over 10 million shares of NBB, a leading investment company listed on the HOSE, from My Steel Trading and Services Co., Ltd. This strategic move was executed without the need for a public offering, as per the resolution of the 2025 Annual General Meeting of Shareholders.”