Oil Prices Slip

Oil prices dipped following comments from Oman’s Foreign Minister about potential new nuclear talks between Iran and the US. The negotiations could lead to the lifting of sanctions on Iran, potentially increasing oil supply in the market.

At the close of trading on May 21st, Brent crude oil fell by 47 US cents, or 0.7%, to $64.91 a barrel. WTI crude oil also decreased by 46 US cents, or 0.7%, ending the day at $61.57 per barrel.

Iran is the third-largest producer among the members of the Organization of the Petroleum Exporting Countries (OPEC). A potential attack by Israel on Iran could disrupt supply from this major producer.

Oil prices faced further pressure as the US government reported increases in crude oil, gasoline, and distillate inventories for the previous week.

Crude oil stocks rose by 1.3 million barrels, gasoline stocks increased by 800,000 barrels, and distillate stocks climbed by 600,000 barrels, according to the Energy Information Administration (EIA).

US Natural Gas Prices Decline by 2%

Natural gas prices in the US fell by 2% as daily production for the month declined less than expected.

The price of natural gas for June 2025 delivery on the New York Mercantile Exchange fell by 5.9 US cents, or 1.7%, to $3.368 per million British thermal units (mmBtu).

Gold Reaches One-Week High, Platinum at One-Year High, and Palladium at Over Six-Month High

Gold prices rose for the third consecutive session, reaching a one-week high. This increase was supported by a weaker US dollar and safe-haven demand amid economic and geopolitical uncertainties.

Spot gold on the LBMA rose by 0.7% to $3,312.77 an ounce. Gold futures for June 2025 delivery on the New York Mercantile Exchange climbed by 0.9% to $3,313.50 an ounce.

The US dollar index fell by 0.6% against a basket of major currencies, making gold more affordable for holders of other currencies.

Major Wall Street indexes fell, and government bond yields rose as investors closely watched the debate over President Donald Trump’s tax cut proposal, raising concerns about the country’s growing debt.

Gold is often seen as a safe investment during times of economic and geopolitical uncertainty. Gold bullion reached a record high of $3,500.05 an ounce last month.

Meanwhile, platinum prices rose by 1.4% to $1,068.16 an ounce after touching its highest since May 2024 earlier in the session. Palladium prices climbed by 0.8% to $1,021.40 an ounce, its highest in over six months.

Copper Prices Climb

Copper prices rose as investors worried about the US’s growing public debt and sought safe-haven assets as the US dollar weakened.

Three-month copper on the London Metal Exchange gained 0.1% to $9,528 a ton.

Copper prices reached a six-week high last week, supported by a 90-day truce between the US and China on most retaliatory tariffs.

Shanghai copper rose by 0.3% to CNY 78,100 ($10,839) a ton.

Dalian Iron Ore Prices Rise, Steel Rebar Falls

Dalian iron ore prices increased, supported by a weaker US dollar and lower demand for steel-making ingredients. However, the gains were limited by the softening Chinese real estate market.

The September 2025 iron ore contract on the Dalian Commodity Exchange climbed by 0.76% to CNY 728.5 ($101.10) a ton.

The June 2025 iron ore contract on the Singapore Exchange rose by 0.45% to $99.85 a ton.

On the Shanghai Futures Exchange, hot-rolled coil and rebar both climbed by 0.2%, stainless steel gained 0.08%, while steel rebar fell by 0.07%.

Iron ore prices were supported by a weaker US dollar, which fell for the second consecutive session against a basket of major currencies. The weaker dollar made commodities priced in the greenback more affordable for holders of other currencies.

In terms of supply, total iron ore imports into China from Australian and Brazilian miners for the week rose by 11.7% from the previous week to 27.1 million tons, according to Mysteel.

Rubber Prices in Japan Continue to Fall

Rubber prices in Japan declined due to expected increases in supply as growing regions enter the harvest season, outweighing stronger demand for tire materials.

The rubber contract for October 2025 delivery on the Osaka Exchange fell by 3.1 Japanese yen, or 0.96%, to 320.2 yen ($2.23) per kg.

Meanwhile, the rubber contract for September 2025 delivery on the Shanghai Futures Exchange fell by CNY 135, or 0.9%, to CNY 14,820 ($2,056.76) a ton.

Butadiene rubber for June 2025 delivery on the Shanghai Futures Exchange fell by CNY 235, or 1.94%, to CNY 11,900 ($1,651.52) a ton.

The rubber contract for June 2025 delivery on the Singapore Exchange fell by 0.5% to 171.7 US cents per kg.

Coffee Prices Show Mixed Trends

Arabica coffee prices on the ICE rose by 1 US cent, or 0.3%, to $3.703 per lb.

Robusta coffee prices on the London market remained steady at $4,903 a ton.

Sugar Prices Climb

Raw sugar prices on ICE rose by 0.36 US cents, or 2.1%, to 17.70 US cents per lb, rebounding from a five-session decline.

White sugar on the London market climbed by 2.2% to $497.70 a ton.

Wheat Prices Reach One-Month High, Soybeans and Corn Climb

Wheat prices on the Chicago market rose to a one-month high, supported by a weaker US dollar and increased buying due to concerns over reduced output.

On the Chicago Board of Trade, July 2025 wheat futures rose by 3-1/4 US cents to $5.49-1/4 a bushel, reaching $5.56-1/4 a bushel during the session, its highest since April 21, 2025. July 2025 soybean futures climbed by 9-3/4 US cents to $10.62-3/4 a bushel, and July 2025 corn futures gained 6-1/2 US cents to $4.61 a bushel.

Malaysian Palm Oil Prices Retreat After Two Sessions of Gains

Malaysian palm oil prices fell after two consecutive sessions of gains due to pressure from rising production and inventory levels. However, losses were limited by firmer prices of rival vegetable oils and stronger export data.

The palm oil contract for August 2025 delivery on the Bursa Malaysia Derivatives Exchange fell by 12 ringgit, or 0.31%, to 3,896 ringgit ($913.05) a ton.

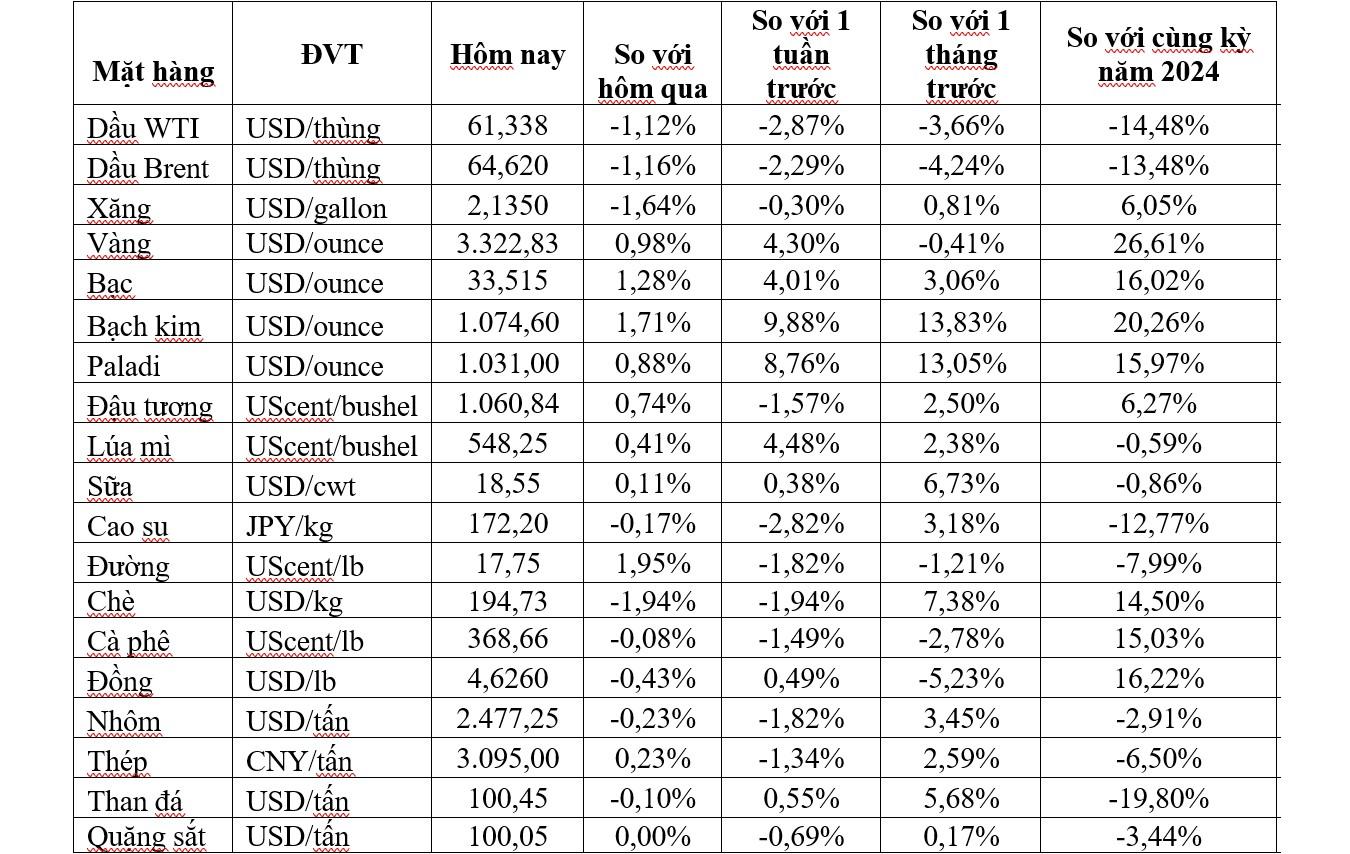

Prices of Key Commodities on May 22nd:

The Market on May 23: Oil, Natural Gas, Gold, Copper, and Coffee Prices All Decline

As of May 24, 2025, the commodities market witnessed a broad decline with oil, natural gas, gold, and coffee prices all trending downward. The drop was significant enough to push the value of certain commodities to multi-week lows: copper hit its lowest point in three weeks, lead touched a two-week trough, and Indian rice futures plunged to their weakest level in nearly two years.

“Petrovietnam Targets ‘A New Facility Launch Every Month’ to Sustain Growth”

In April and the first four months of 2025, despite market challenges, the Vietnam National Oil and Gas Group (Petrovietnam) maintained stable production and business operations. The group ensured the progress of key projects, setting a monthly target to commission a new facility while expanding its market reach. This strategic approach aims to accomplish the mandate assigned by the Ministry of Finance.

The Golden Opportunity: Unveiling the Rising Trend of Gold Ring Prices on May 22nd

The gold ring price this afternoon, May 22, at some brands, still surged by an average of VND 200,000 to VND 500,000 per tael compared to the opening of the trading session this morning.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)