With FCN’s closing price of 14,750 VND/share on May 15, HDCapital is estimated to have earned over 22 billion VND from the transaction. Previously, the company sold 5 million FCN shares on February 21, earning nearly 77 billion VND.

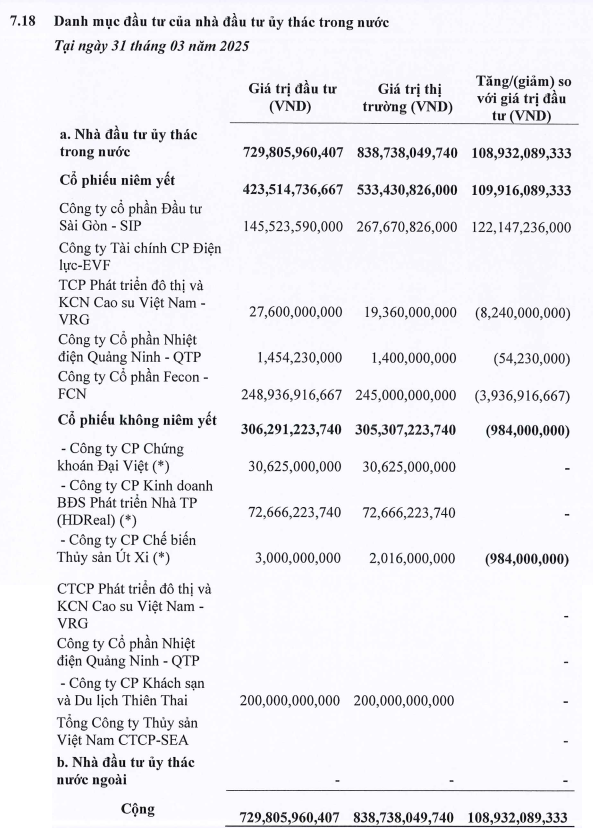

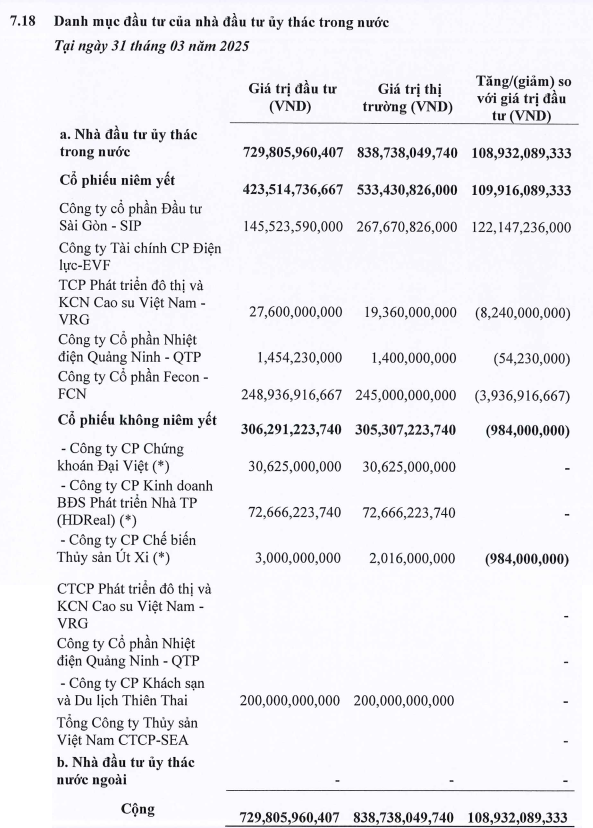

In fact, the investment in FCN was recorded by HDCapital off-balance sheet, specifically in the investment portfolio of domestic entrusted investors. According to the Q1/2025 financial statements, as of March 31, 2025, the market value of the investment in FCN was 245 billion VND, corresponding to 17.5 million shares at a price of 14,000 VND/share. Notably, the market value is 4 billion VND lower than the investment value of nearly 249 billion VND, equivalent to 14,225 VND/share.

| FCN Share Price Movement since the Beginning of 2025 |

Apart from FCN, HDCapital also holds a significant portfolio of listed and unlisted stocks, including SIP of Saigon Investment Corporation with a market value of nearly 267 billion VND, an increase of over 122 billion VND from the investment value; and an investment of 200 billion VND in Thien Thai Hotel and Tourism JSC. Overall, the market value of the entrusted investment portfolio is nearly 839 billion VND, higher than the investment value by 109 billion VND.

Source: Q1/2025 Financial Statements of HDCapital

|

In terms of business results, in Q1/2025, HDCapital generated nearly 573 million VND in revenue, a 28% decrease compared to Q1/2024. The largest contributor was investment portfolio management, followed by fund management and investment consulting.

With revenue unable to cover expenses, the company incurred a net loss of nearly 2 billion VND, higher than the loss of about 1 billion VND in the same period last year.

Contrasting HDCapital’s sell-off, FCN’s Vice Chairman, Mr. Tran Trong Thang, purchased 77,000 FCN shares during April 14-May 13, out of the registered 200,000 shares. The Vice Chairman has frequently traded FCN shares in the past.

In Q1/2025, FCN reported a 34% increase in revenue but still posted a loss of nearly 7 billion VND, marking the second consecutive quarterly loss as financial expenses continued to weigh on performance. This makes the target of earning 200 billion VND this year more challenging.

Huy Khai

– 10:43, May 21, 2025

The Power of Investment: Unveiling a Bold Strategy with a Twist of Fate

The loss was attributed to a provision for diminution in value of investment securities of VND 41.3 billion and the sale of a portion of short-term investments at a loss.

The State ‘Shark’s’ $10 Billion Portfolio: Half in Bank Deposits, Over $1 Billion in Corporate Bonds, Bets on ACB, VNM, VCB Stocks, but Temporarily in the Red

As of December 31, 2024, the company has deposited a substantial amount of 124,567 billion VND in the bank, accounting for nearly 54% of its portfolio. This significant figure reflects a notable increase of almost 12,800 billion VND compared to the beginning of the year.