In the third draft of the decree on administrative sanctions for violations in the monetary and banking sector, which is currently open for consultation (amending and supplementing Decree No. 88/2019/ND-CP), the State Bank of Vietnam has proposed stringent fines for violations related to payment accounts.

The proposed fines range from 100 to 150 million VND for the purchase, sale, rental, or lending of payment accounts (bank accounts) or the trading of payment account information, with the number of accounts involved ranging from one to less than ten, provided that it does not reach the level of criminal prosecution.

A fine of between 150 and 200 million VND is stipulated for the act of opening payment accounts for customers or allowing customers to use payment accounts in violation of legal regulations during the provision of payment services.

The sale, purchase, rental, or lending of payment accounts or payment account information involving ten or more accounts, but not reaching the level of criminal prosecution, will incur a fine ranging from 200 to 250 million VND.

Fines for renting, borrowing, buying, and selling bank accounts, e-wallets, and cards have increased significantly compared to current regulations.

A fine of 200 to 250 million VND is stipulated for violations such as opening or maintaining anonymous or impersonated payment accounts, stealing or colluding to steal payment account information, provided that it does not reach the level of criminal prosecution.

The State Bank also proposed increased fines for violations of regulations on payment intermediaries (e-wallet service providers).

The proposed fines range from 50 to 100 million VND for opening or maintaining anonymous or impersonated e-wallets, buying, selling, renting, or lending e-wallets, or stealing, colluding to steal, or trading e-wallet information involving one to less than ten e-wallets.

The fine will increase to between 100 and 120 million VND for the same violations involving ten or more e-wallets.

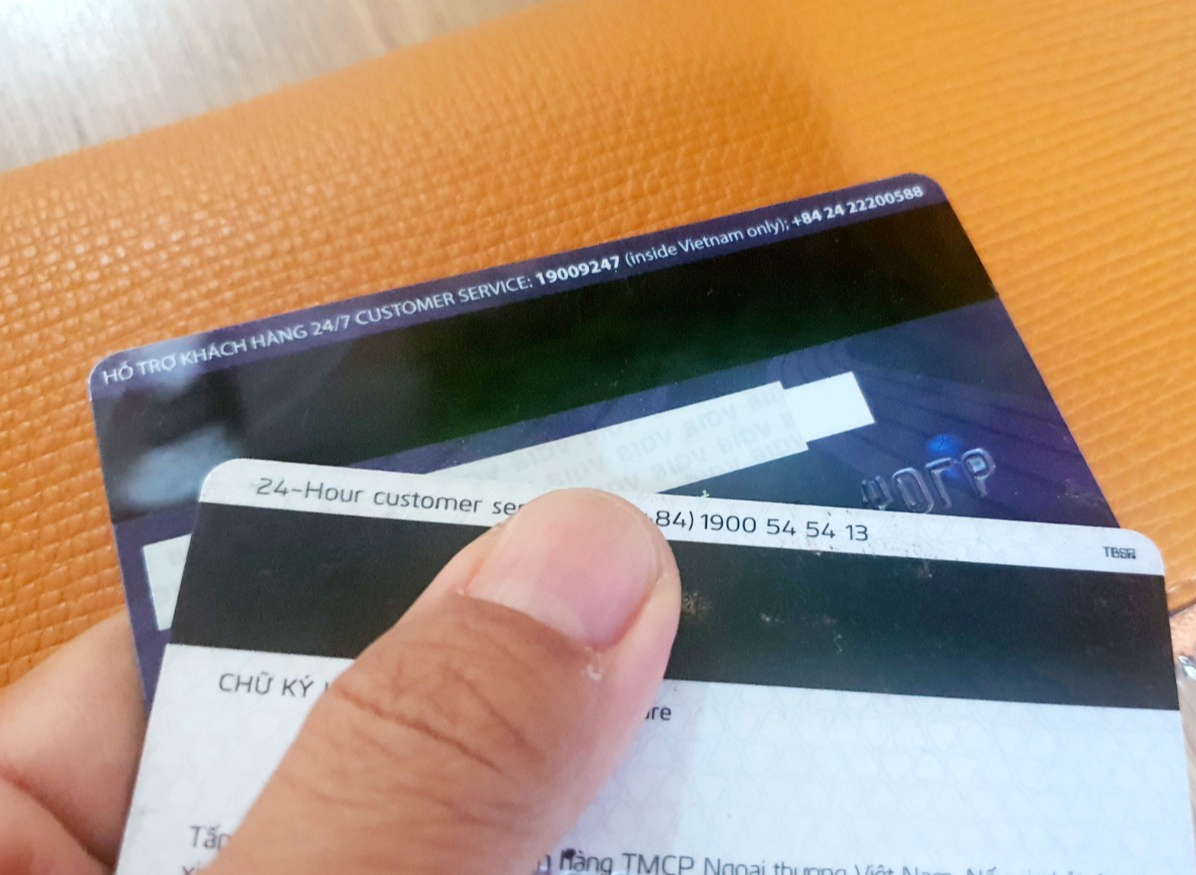

Even for violations in the field of bank cards, the State Bank has proposed fines ranging from 60 to 80 million VND for renting, lending, buying, selling, or opening bank cards (except for anonymous prepaid cards) on behalf of others, with the number of cards involved ranging from one to less than ten.

The fine will increase to between 100 and 200 million VND in cases where the number of cards involved is ten or more but does not reach the level of criminal prosecution.

The highest fine, up to 300 million VND, is stipulated for stealing or colluding to steal bank card information, provided that it does not reach the level of criminal prosecution.

These acts will also be subject to supplementary penalties and remedial measures depending on the specific case of violation. These fines are significantly higher than the current regulations, as law enforcement agencies have recently cracked down on rings specializing in the purchase, rental, and other illicit activities involving bank accounts for fraud and money laundering purposes.

Most recently, in February 2025, public security agencies in Dong Nai, Hanoi, and Da Nang announced the arrest of several individuals involved in the illegal trading of bank account information.

“Commercial Banks Need to Plot a Course for Compliance: Navigating Shareholding Ratios.”

The State Bank is drafting a circular on commercial banks with shareholders, and related parties, who own shares exceeding the ratio stipulated in Clause 55 of the Law on Credit Institutions No. 47/2010/QH12. This has been amended and supplemented with certain provisions under Law No. 17/2017/QH14. The focus is on constructing and implementing a roadmap to ensure compliance with the provisions set out in the Law on Credit Institutions No. 32/2024/QH15.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)