The financial results of the fertilizer business group in Q1/2025 showed a 25% growth in revenue compared to the same period, with a notable performance in NPK and DAP fertilizers. Six enterprises in the industry reported a collective increase, outperforming the Ure and Lan segments.

Specifically, DPM’s Q1/2025 revenue reached VND 4,120 billion, a 25% surge, while after-tax profit decreased by 22% to VND 205 billion. This can be attributed to a significant rise in NPK output, which hit 37,409 tons, a 50% increase. In contrast, Ure production slightly dipped by 4%, settling at 236,353 tons, and NH3 experienced a more substantial decline of 23%, totaling 11,719 tons.

DCM’s revenue also witnessed a substantial 24% climb to VND 3,406 billion in Q1/2025, driven by the robust performance of the NPK and wholesale fertilizer segments. NPK revenue soared eightfold, and fertilizer trading revenue tripled, while the Ure segment witnessed a slight 3% dip. The remarkable growth in NPK revenue resulted from the company’s motherland output, which reached 22,950 tons, quadrupling the previous year’s figure, coupled with KVF’s contribution, accounting for 52% of NPK revenue.

Turning to phosphate-based fertilizers, DDV stood out with a remarkable 49% surge in revenue to VND 1,156 billion. This impressive performance was underpinned by a 22.8% increase in output, reaching 13,158 tons, alongside a 10% hike in selling prices to VND 14,700/kg.

Another enterprise in the phosphate-based fertilizer space, LAS, experienced a modest 10% revenue growth. This can be attributed to an estimated 8% rise in output and a slight 2% increase in selling prices compared to the previous year.

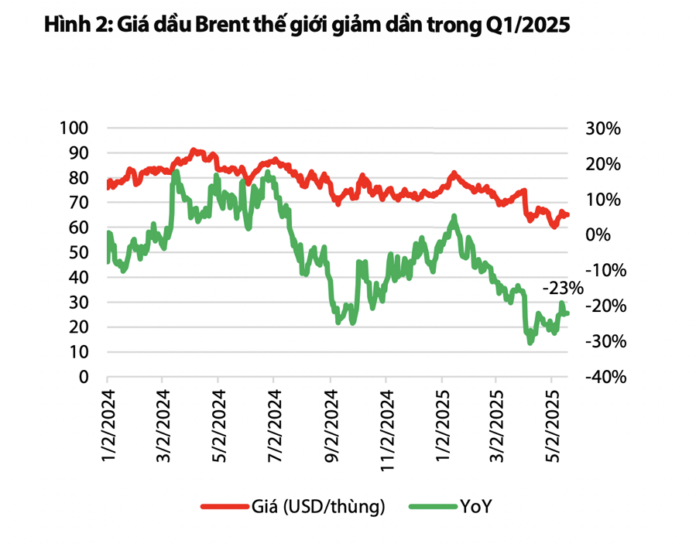

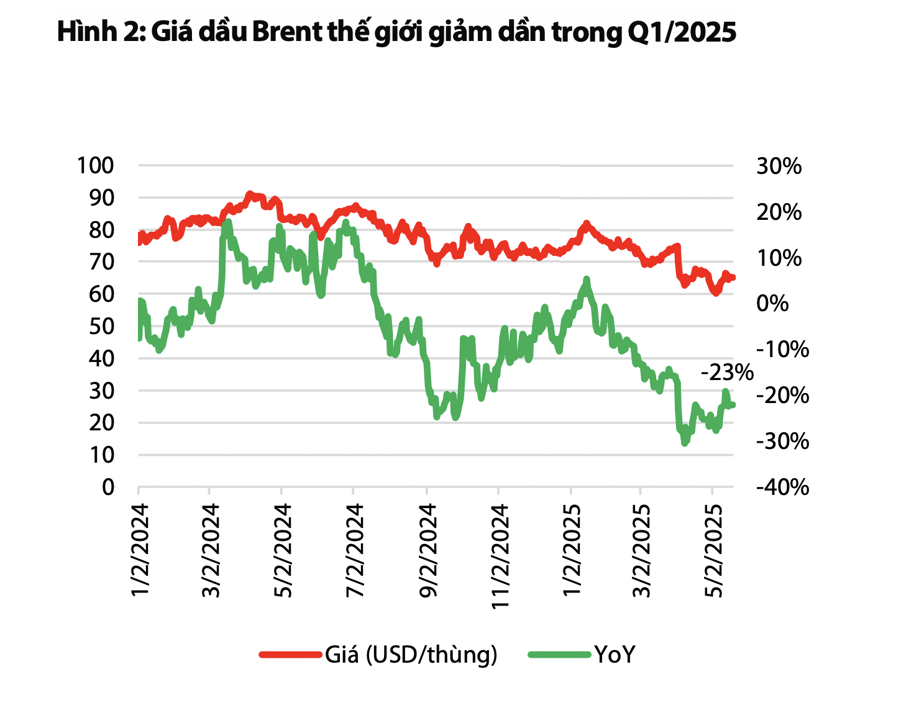

Looking ahead to Q2/2025, VDSC anticipates positive growth prospects for the fertilizer group, driven by selling prices. For businesses dealing in Ure fertilizers, Q2/2025 financial results are expected to be robust due to low Ure output prices and high Brent oil-linked gas input prices in the previous year.

From December 2024 to February 2025, global Ure fertilizer prices climbed due to the Middle East’s high fertilizer prices, influenced by soaring TTF gas prices during winter and pipeline issues in the EU.

In Q2/2025, despite a downturn in TTF gas prices, US tariffs indirectly impacted Ure fertilizer prices in other regions. Short-term Ure fertilizer prices surged rapidly from March 4, when the US imposed a 25% tariff on imports from Canada for all fertilizers except Kali (10%). This caused US Ure prices to rise to USD 451/ton in April 2025 (+50%), a 22% increase since March 4.

With Ure fertilizer prices remaining elevated, domestic Ure fertilizer prices are projected to grow by 5%-10% for the full year, surpassing the previous estimate of a 2% increase.

VDSC also foresees robust performance for businesses dealing in other fertilizers like DAP and Lan in Q2/2025, benefiting from sustained high selling prices. As of April 24, 2025, DPM’s Ure selling price stood at VND 11,300/kg (+19%), DCM’s at VND 12,200/kg (+19%), and BFC’s NPK 16-16-8+13S at VND 12,200/kg (+6%). DDV’s DAP selling price on May 20, 2025, was VND 15,400/kg, an estimated 14% increase from May 23, 2024.

However, there are potential risks of fertilizer price reductions in the upcoming period due to China’s planned resumption of exports. Reports suggest that China intends to resume Ure and Phosphate exports until the end of Q3/2025, which could trigger a short-term downward trend in fertilizer prices as global prices are currently higher than those in China.

China’s decision to export Ure is influenced by port inventory levels surpassing safe limits by 1.5 times and domestic prices being 40% lower than global prices (Middle East) and half of those in Vietnam. In contrast, China’s phosphate exports are likely to be minimal as they aim to restrict exports of products derived from non-renewable Apatite ore.

In the short term, if China increases its exports, it could lead to declining Ure prices and negatively impact the stock prices of DCM and DPM, which are sensitive to short-term fluctuations in Ure prices. However, enterprises like DDV and LAS, focused on phosphate-based fertilizers derived from Apatite ore, are expected to be less affected by China’s small-scale exports of DAP, MAP, and Lan fertilizers.

The Golden Triangle: CTX Holdings Divests from Hanoi’s Prime Real Estate Project

The Vietnam Construction and Import-Export JSC (CTX Holdings, UPCoM: CTX) has announced its decision to transfer the entire Constrexim Complex project – a prime, three-frontage location in Cau Giay District, Hanoi.

The Big Spend: Why Businesses Fork Out Big Bucks to Own Schools

The Ho Chi Minh City Hung Vuong University is set to become a subsidiary of Dang Thanh Tam’s Kinh Bac City Development Corporation ecosystem. The esteemed university is the latest addition to the growing list of educational institutions being acquired by corporations. With tuition fees proving to be a lucrative investment, it’s no surprise that conglomerates are forking out billions to get a slice of the pie.

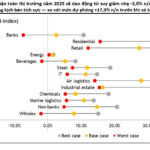

The Tech, Steel, Retail, Banking, and Industrial Real Estate Sectors: Unlocking Post-Tariff Growth Potential

Most listed companies reported stable financial results in Q1, but signs of a slowdown are starting to show.