SHB Counter Deposit Interest Rates for May 2025

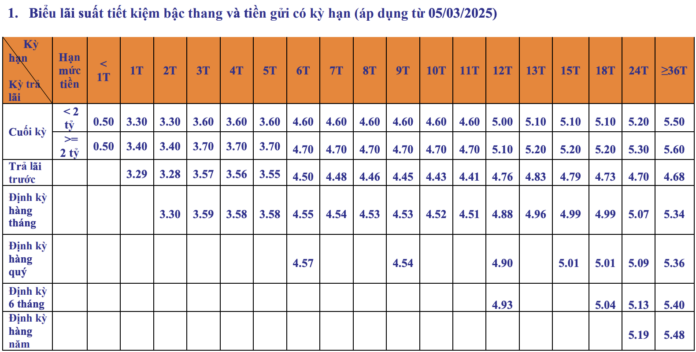

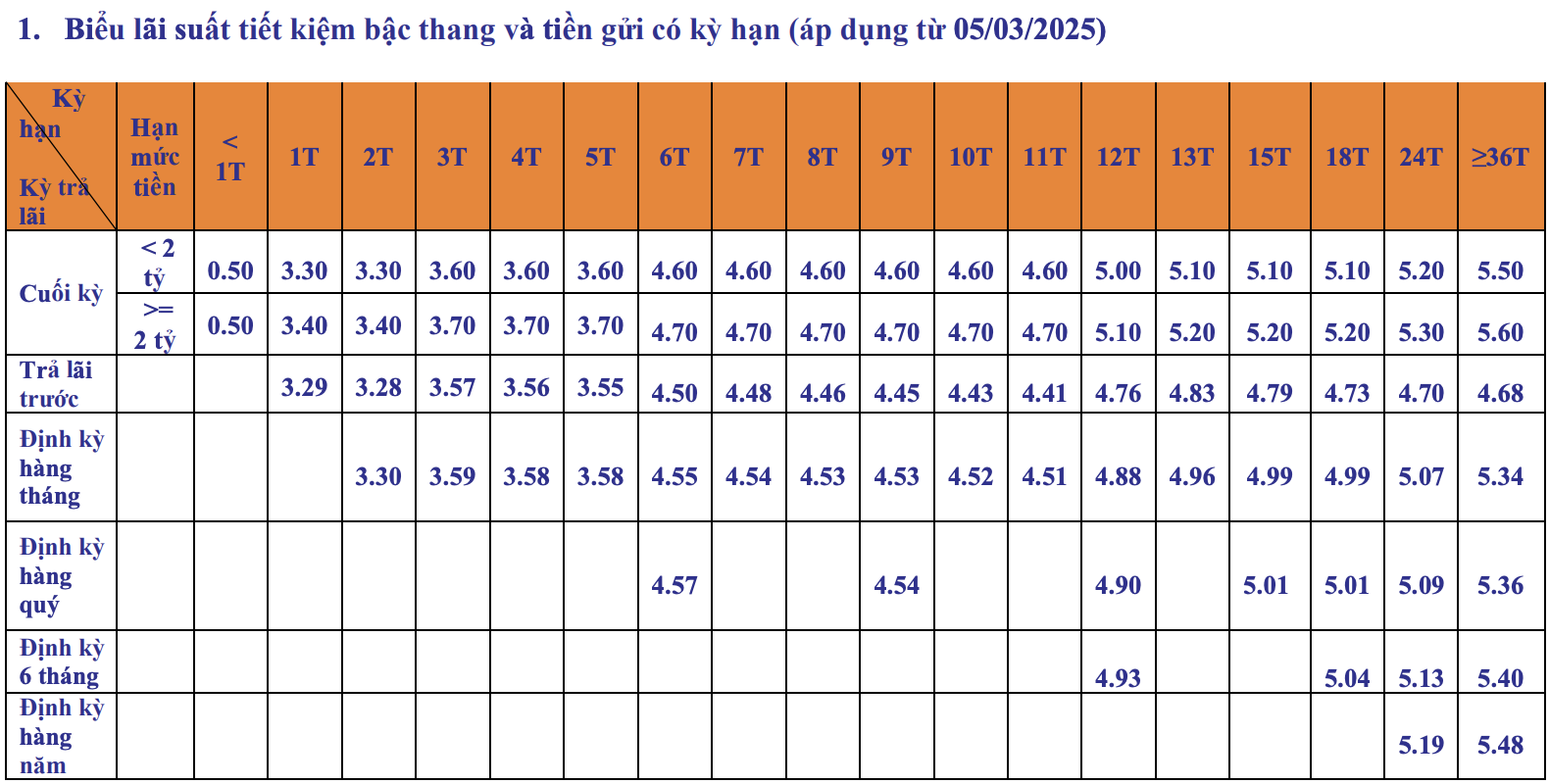

For customers depositing at the counter with a step-up savings product and receiving interest at maturity, SHB will offer two interest rates based on the amount deposited: Below VND 2 billion and VND 2 billion or more.

For deposits below VND 2 billion, interest rates range from 0.5% to 5.5% per annum. Specifically, for a tenure of less than one month, the interest rate is 0.5%/year; for 1-2 months, it is 3.3%/year; 3-5 months, 3.6%/year; 6-11 months, 4.6%/year; 12 months, 5.0%/year; 13-18 months, 5.1%/year; 24 months, 5.2%/year; and for 36 months and above, the highest interest rate is 5.5%/year.

SHB Counter Savings Interest Rate Table for May 2025

For deposits below VND 2 billion, interest rates range from 0.5% to 5.6% per annum. Specifically, for a tenure of less than one month, the interest rate is 0.5%/year; for 1-2 months, it is 3.4%/year; 3-5 months, 3.7%/year; 6-11 months, 4.7%/year; 12 months, 5.1%/year; 13-18 months, 5.2%/year; 24 months, 5.3%/year; and for 36 months and above, the highest interest rate is 5.6%/year.

In addition to receiving interest at maturity, customers can choose from various other interest payment options: Advance interest payment; Monthly interest payment; Quarterly interest payment; Semi-annual interest payment; Annual interest payment.

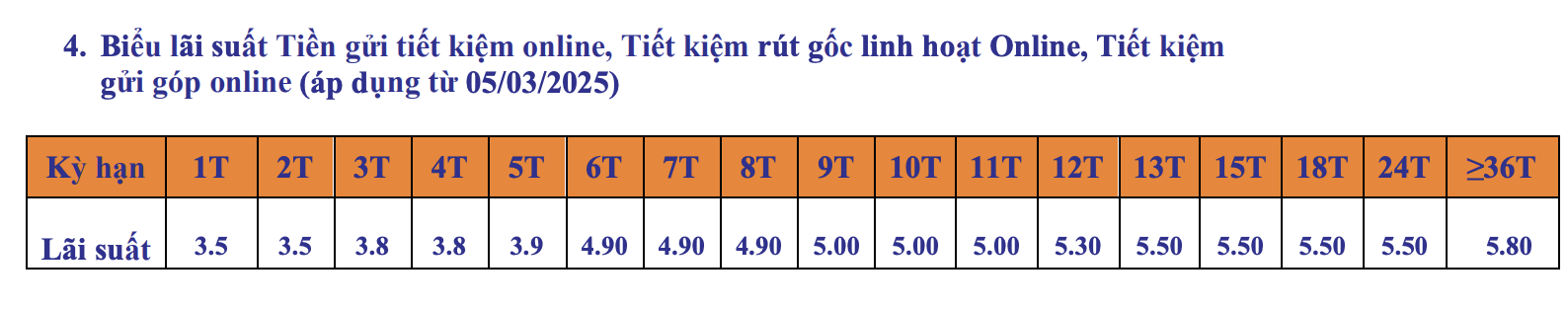

SHB Online Deposit Interest Rates for May 2025

For online deposits, SHB offers interest rates ranging from 3.5% to 5.8% per annum.

Specifically, for a tenure of 1-2 months, the interest rate is 3.5%/year; 3-4 months, 3.8%/year; 5 months, 3.9%/year; 6-8 months, 4.9%/year; 9-11 months, 5.0%/year; 12 months, 5.3%/year; 13-24 months, 5.5%/year; and for 36 months and above, the highest interest rate is 5.8%/year.

SHB Online Savings Interest Rate Table for May 2025

Is There an End in Sight to the Declining Interest Rates?

According to analysts, deposit interest rates have continued their downward trend, albeit at a slower pace. It is predicted that input interest rates will gradually increase towards the end of the year, with expectations of positive economic growth and credit growth reaching or even surpassing the set target of 16%.