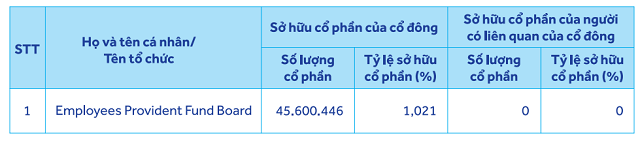

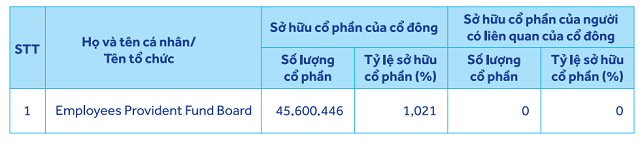

Employees Provident Fund Board (EPF), one of Malaysia’s largest retirement funds, established in 1951, has a significant stake in ACB. With over 45.6 million shares, they hold 1.021% of the bank’s capital.

EPF functions as a financial management organization, offering mandatory savings and retirement programs for private-sector employees.

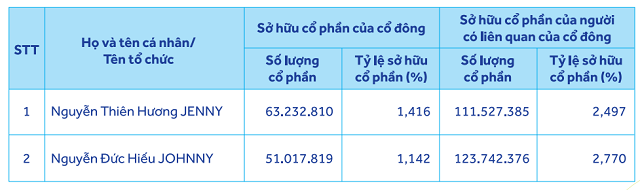

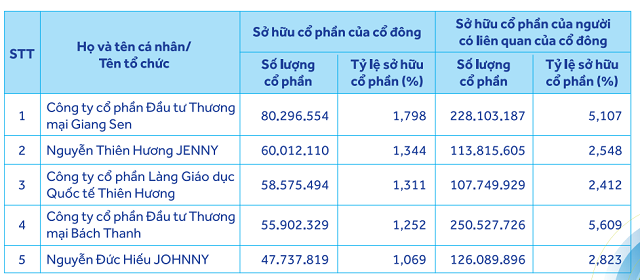

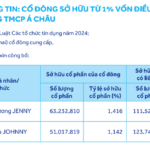

As of April 29, 2025, Nguyễn Thiên Hương Jenny held over 63.2 million shares of ACB, amounting to 1.416%. Her affiliated group holds a combined total of more than 111.5 million shares, representing 2.497% of the bank.

Nguyễn Đức Hiếu Johnny also increased his stake in ACB to over 51 million shares, equivalent to 1.142%. His affiliates now hold over 123.7 million shares, or 2.77% of the bank’s capital.

Nguyễn Thiên Hương Jenny and Nguyễn Đức Hiếu Johnny are the children of Ngô Thu Thúy, Chairman of Âu Lạc Joint Stock Company.

According to ACB’s shareholder update as of September 10, 2024, International Education Village Thiên Hương Joint Stock Company held nearly 58.6 million shares of ACB, equivalent to 1.311% of its capital. Their affiliated group holds over 107.7 million shares, representing 2.412% of ACB’s capital.

International Education Village Thiên Hương Joint Stock Company, represented by Ngô Thu Thúy, has been operating since 2015 and specializes in real estate and land-use rights.

The three shareholders linked to the Âu Lạc group now collectively hold 3.869% of ACB.

On the HOSE exchange, ACB shares have been attracting attention, with an average daily trading volume of 17 million shares over the past two weeks. On May 23, the ACB share price hovered around 21,350 VND, similar to the beginning of the year, with an average daily trading volume of nearly 10 million shares.

| ACB’s share price movement since the beginning of the year |

– 08:58 23/05/2025

Week 19-23/05: Riding the Dividend Wave

Another week, another deluge of dividends for investors as companies continue to shower their shareholders with cash. From May 19 to 23, a staggering 48 businesses will be finalising their dividend payouts, with rates as high as 100% (10,000 VND per share). And that’s not all; numerous entities are also offering dividends with rates exceeding 60%. It’s a bonanza for investors as they reap the rewards of their investments.

The Stock Market’s “Royal” Attractions

The stock market witnessed a surge in numerous stocks that demonstrated robust momentum and witnessed a boom in trading volume. This rally was further fueled by substantial net buying from foreign investors, indicating their confidence in the potential of these stocks.

“ACB Approved to Raise Capital to Nearly VND 51,400 Billion”

“ACB has received the green light from the State Bank of Vietnam to boost its charter capital by issuing bonus shares, taking its total capital to an impressive VND 51.4 trillion. This move underscores ACB’s strong position and ambitious growth strategy, rewarding shareholders with increased value and setting a new precedent for Vietnam’s dynamic banking sector.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)