| VN-Index Plunges in the Afternoon Session |

|

Source: VietstockFinance

|

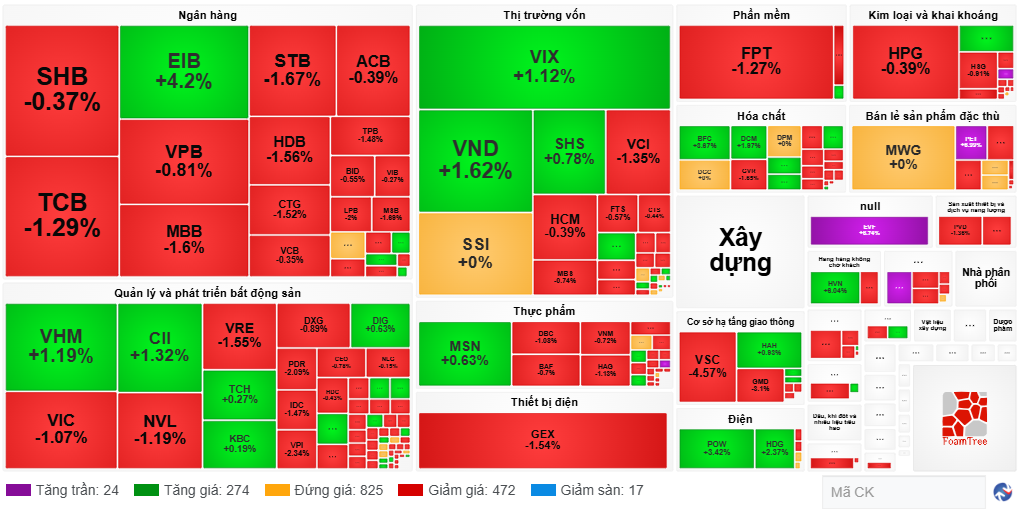

In the afternoon session, the VN-Index witnessed a significant correction around 13:30 and especially at 14:10, with liquidity increasing rapidly. Although it immediately rebounded strongly, the joy was short-lived, and the market closed with a loss of 9.21 points, ending at 1,313.84. The HNX-Index also closed lower, down 0.67 points to 216.79. In contrast, the UPCoM-Index rose 0.31 points to 96.14.

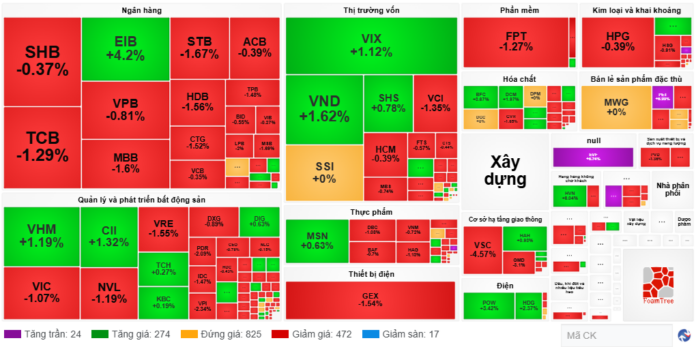

The market was painted in red, with 489 stocks declining, including 17 stocks hitting the floor price, significantly higher than the 298 rising stocks. Meanwhile, 825 stocks remained unchanged.

|

Red dominated the overall market

Source: VietstockFinance

|

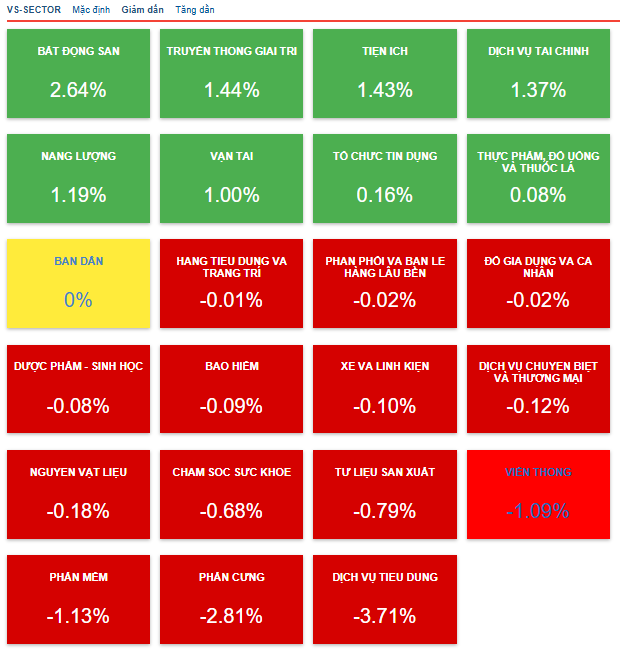

By industry, only five sectors posted gains, including utilities up 1.17%, and entertainment, transportation, household goods, and personal care, and energy, all rising less than 1%.

On the other hand, 17 sectors declined, led by consumer services down 5.87% under the pressure of VPL, which fell 6.12%. This was followed by a series of sectors falling more than 1%, such as telecommunications, software, vehicles and components, consumer and decorative goods, healthcare, specialized services and commerce, and materials.

Notably, despite experiencing milder declines, the large-cap banking, real estate, and securities sectors fell by 0.75%, 0.46%, and 0.08%, respectively, negatively impacting the market due to their significant weightage.

Regarding the market’s reversal from green to red, this was evident in the performance of several large-cap stocks, typically in the real estate sector, with VIC shifting from a gain of over 5% to a loss of more than 1%. Banks, which had posted slight gains in the morning session, suddenly turned negative, while securities stocks, which had risen strongly, weakened or even turned negative.

In terms of liquidity, the market recorded a trading value of over 28,446 billion VND, surging in the final trading hours.

Foreign investors also increased their trading activity in the afternoon session, resulting in net buying of over 61 billion VND. Their buying was spread across various stocks, such as VIX, MWG, VHM, and EIB, all exceeding 100 billion VND. On the selling side, FPT topped with a net sell of over 131 billion VND.

Overall, the decline in the Vietnamese market was similar to that of other Asian markets, including All Ordinaries down 0.47%, Hang Seng down 1.28%, and Nikkei 225 down 0.92%. Overnight, US stocks also suffered a sell-off due to the surge in US bond yields, as investors worried that the new US budget bill would add to the country’s already large deficit.

Despite efforts, the Vietnamese market could not escape the general sentiment spreading from global markets.

Morning Session: Vingroup Continues to Support the Market

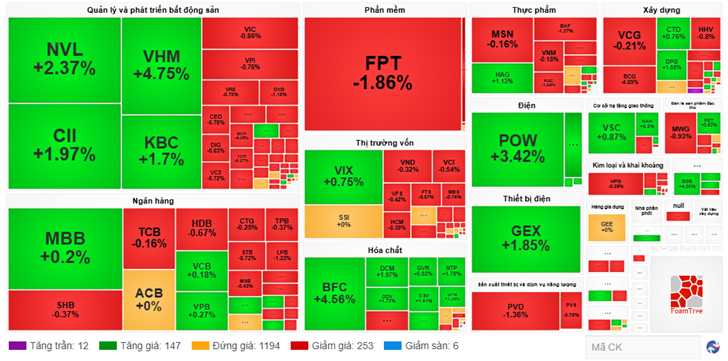

At the morning close, the indices were in the green, but in reality, only 327 stocks advanced, lower than the 347 declining stocks, while 938 stocks remained unchanged. By industry, based on VS-SECTOR, only eight sectors out of 23 posted gains. This suggests that the market’s strength was mainly driven by a few sectors, creating an impression of “green on the outside, red on the inside.”

Among the gaining sectors in the morning session, real estate led with a 2.64% increase, followed by utilities (1.43%), financial services (1.37%), and credit institutions (0.16%). Given their large market capitalization, these sectors’ gains were sufficient to push the market into positive territory, despite the broader market leaning towards declines.

In the real estate sector, industry leaders such as VIC rose 5.24%, VHM gained 4.75%, and NVL climbed 1.19%, driving the sector’s outperformance. Notably, VIC even reversed from red to green during the session.

In financial services, specifically securities, a sea of green emerged, with notable gainers including SSI (up 1.28%), VND (up 2.92%), VIX (up 3.73%), and SHS (up 3.88%)…

As for credit institutions, particularly banks, there was a clear divergence in performance, but the advances in large-cap stocks such as VCB, TCB, VPB, and MBB helped the sector post a slight gain, contributing to the market’s positive performance.

Source: VietstockFinance

|

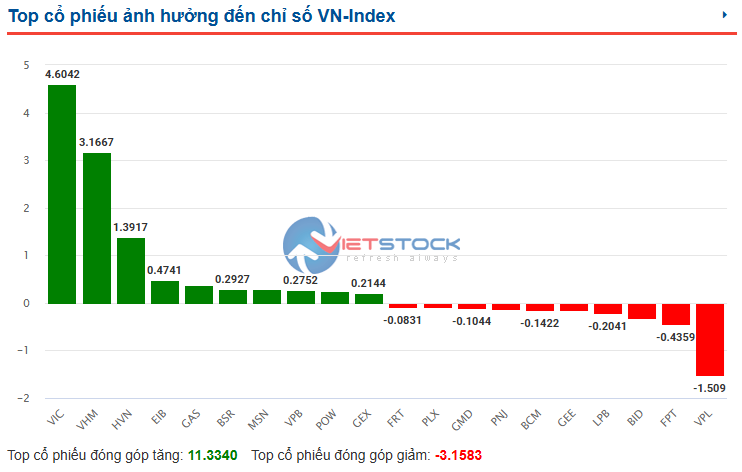

Looking at the top 10 stocks with the most positive impact on the VN-Index this morning, it is evident that several of the aforementioned stocks led the way, with VIC contributing over 4.6 points and VHM nearly 3.2 points.

Source: VietstockFinance

|

The market’s trading value in the morning session reached over 12,062 billion VND, lower than the previous day. In this context, foreign investors also traded cautiously, with net selling of nearly 190 billion VND. Their net buying focused on VIC (over 92 billion VND), while net selling was led by FPT (over 144 billion VND).

10:40 AM: Stocks Surge, Green Returns to the Market

The market continued to experience volatile swings, with alternating rises and falls. As of 9:30 AM, green returned to all three exchanges. The market’s recovery was driven by the rebound in securities and several real estate stocks.

At 10:30 AM, the VN-Index rose 0.99 points to 1,324.04, the HNX-Index gained 0.24 points to 217.7, and the UPCoM-Index climbed 0.37 points to 96.2.

The recovery was led by the securities sector, with green dominating most stocks. Notable gainers included VIX (up 3.73%), VND (up 4.22%), SSI (up 1.71%), SHS (up 4.65%), VCI (up 1.08%), FTS (up 1.29%), HCM (up 1.17%), and MBS (up 1.11%)…

Several real estate stocks also contributed positively, with VHM rising 3.42%, NVL gaining 1.19%, VIC up 0.32%, and KBC climbing 1.32%…

Looking at the top 10 stocks with the most positive impact on the VN-Index, VHM led with nearly 2.7 points, followed by HVN with more than 1.1 points, GAS with nearly 0.5 points, POW with nearly 0.3 points, and HPG with over 0.2 points. In contrast, another VinGroup member, VPL, took away nearly 1.6 points, the most among the index constituents.

In terms of liquidity, the market recorded a trading volume of nearly 395 million shares, corresponding to a value of over 8,030 billion VND, significantly lower than the same period yesterday. However, compared to the recent average, typically the 5-day and 10-day averages, liquidity was not unfavorable and even higher than the 1-month average.

Market Open: Volatility Dominates the Early Session

The VN-Index started the trading day with a rapid decline towards the 1,318-point level, equivalent to a loss of nearly 5 points, but it quickly rebounded. As of 9:25 AM, the index was down slightly by 0.66 points to 1,322.39. Red also appeared on the HNX-Index, which fell 0.67 points to 216.79, while the UPCoM-Index rose 0.19 points to 96.02.

The market breadth showed 159 gainers, 259 losers, and 1,194 unchanged stocks. Sector performance was also mixed.

One of the most notable sectors was real estate, with several stocks posting strong gains, such as NVL (up 2.37%), CII (up 1.97%), KBC (up 1.7%), and especially VHM (up 4.75%). Conversely, many stocks fell into the red, including DXG (down 1.18%), CEO (down 0.78%), DIG (down 0.63%), BCR (down 4.35%), and two VinGroup members, VIC (down 0.86%) and VRE (down 0.78%).

Divergence was also evident in other sectors, such as banking, construction, and retail. Meanwhile, some sectors showed a clear trend, such as software declining due to FPT‘s 1.86% fall, partly influenced by foreign net selling of nearly 100 billion VND. In contrast, electricity and electrical equipment stocks rose.

|

The market witnessed mixed performances across sectors

Source: VietstockFinance

|

Globally, Asian markets opened with red dominating, notably All Ordinaries down 0.52%, Hang Seng down 0.5%, Nikkei 225 down 0.84%, and Singapore Straits Times down 0.53%.

Overnight, US stocks suffered a sell-off due to surging US bond yields, as investors worried that the new US budget bill would exacerbate the country’s already large deficit.

At the close on May 21, the Dow Jones fell 816.8 points (or 1.91%) to 41,860.44, the S&P 500 lost 1.61% to 5,844.61, and the Nasdaq Composite dropped 1.41% to 18,872.64.

The yield on the 30-year US Treasury bond recently traded around 5.09%, hitting its highest level since October 2023. The yield on the 10-year US Treasury bond was at 4.59%. Long-term bonds were sold off as investors worried that the new budget bill would worsen the US deficit.

– 16:00 22/05/2025

Market Momentum: Sustaining the Uptrend

The VN-Index continued its upward trajectory, retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume maintained above the 20-day average, indicating positive signs of sustained cash flow participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it retests this range. Currently, the MACD indicator has been signaling a buy since late April 2025. If this status quo persists, the short-term outlook for the index remains optimistic.

Stock Market Update for Week of May 19-23, 2025: Navigating Volatility Around the 1,300-Point Mark

The VN-Index demonstrated resilience by rebounding above the reference level following an extended period of volatility and below-average trading volume. This recovery indicates a cautious sentiment among investors. However, the resumption of net selling by foreign investors has introduced challenges, causing fluctuations around the 1,300-point mark and presenting obstacles to sustaining the upward momentum in the near term.

Top Stocks to Watch Ahead of the Bell on May 22nd

The stock market is a dynamic and ever-changing landscape, and keeping up with the biggest gainers and losers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the rising and falling stocks, providing valuable information for those seeking to make informed investment decisions.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)