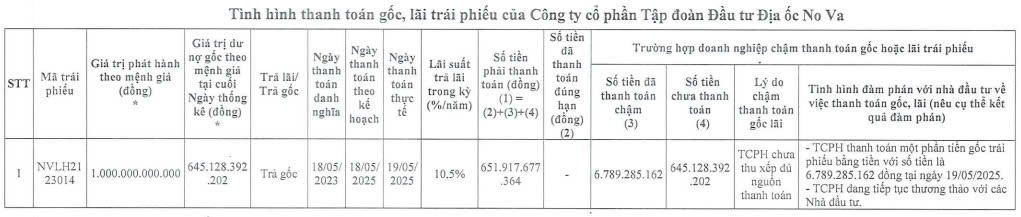

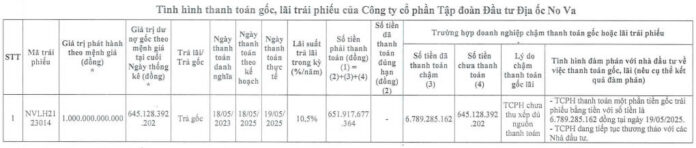

According to a recent announcement by the Hanoi Stock Exchange (HNX), Nova Group Joint Stock Company (Novaland, stock code: NVL, listed on HoSE) disclosed information regarding its bond principal and interest payments.

Per the schedule, Novaland was due to repay over VND 651.9 billion in principal on May 18, 2025, for the bond code NVLH2123014. However, the company has only repaid nearly VND 6.8 billion, with the remaining amount of over VND 645.1 billion unpaid.

In their explanation, Novaland attributed the delay to a lack of available funds and ongoing negotiations with investors regarding the outstanding debt for the aforementioned bond lot.

Source: HNX

The NVLH2123014 bond lot comprises 10 million bonds with a face value of VND 100,000 each, totaling VND 1,000 billion in issuance value. These bonds were issued on November 18, 2021, with an 18-month term and are expected to mature on May 18, 2023.

In a similar development, on April 22, 2025, Novaland had also repaid only VND 622.1 million out of nearly VND 114.7 billion in principal for the bond code NVLH2123007, leaving an unpaid balance of nearly VND 114.1 billion.

The NVLH2123007 bond lot was issued by Novaland on July 23, 2021, but the issuance period ended on October 19, 2021. With a face value of VND 100 million per bond, the total issuance value was VND 137.6 billion, with a 2-year term and an expected maturity date of July 23, 2023.

In another update, Novaland recently disclosed transaction notices for insider trading and related parties.

Accordingly, NovaGroup Joint Stock Company, a major shareholder of Novaland, has registered to sell over 3.9 million NVL shares to balance its investment portfolio and support debt restructuring.

If the transaction is successful, NovaGroup’s ownership of NVL shares will decrease from nearly 338.8 million shares to approximately 334.9 million shares, reducing its stake in Novaland from 17.373% to 17.171%.

Another major shareholder of Novaland, Diamond Properties Joint Stock Company, has also registered to sell over 3.2 million NVL shares for similar reasons of portfolio adjustment and debt restructuring.

Prior to the transaction, Diamond Properties held nearly 168.7 million NVL shares, representing an ownership stake of 8.649% in Novaland. Following the sale, their shareholding will decrease to over 165.4 million shares, equivalent to an 8.483% stake.

Both NovaGroup Joint Stock Company and Diamond Properties Joint Stock Company are entities related to Mr. Bui Thanh Nhon, Chairman of Novaland.

In a related development, Mr. Nhon’s wife and children have also registered to sell a total of nearly 11.6 million NVL shares for personal reasons.

Specifically, Mr. Bui Cao Nhat Quan (son) registered to sell over 2.9 million shares, Mrs. Cao Thi Ngoc Suong (wife) registered to sell 221,133 shares, and Ms. Bui Cao Ngoc Quynh (daughter) intends to sell over 8.4 million NVL shares.

All the above transactions are expected to take place via matching and/or negotiation methods from May 16, 2025, to June 13, 2025.

Consequently, the total number of NVL shares registered for sale by the aforementioned shareholders amounts to nearly 18.8 million.

The Insider’s Guide to Stockpiling Gemadept Shares Amid Market Turbulence Over Tariffs

According to recently released trade reports, a string of insiders at Gemadept Joint Stock Company (HOSE: GMD) snapped up shares of the company as its stock price plummeted amidst market turmoil triggered by retaliatory tariffs.

The Housing Bubble: A Ticking Time Bomb?

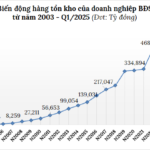

The Vietnamese real estate sector’s inventory picture as of Q1 2025 paints a telling tale, with a staggering figure of over VND 511 trillion, marking a 2% increase since the year’s outset. Notably, nearly a third of this substantial sum is attributable to Novaland, underscoring the significant role it plays in the country’s property landscape.

“Novaland Seeks Shareholder Approval for Debt-for-Equity Swap with Major Investor”

“Novaland seeks shareholder approval for a proposed issuance of additional shares to facilitate a debt-for-equity swap, as requested by its major shareholder. This strategic move underscores Novaland’s commitment to exploring innovative avenues to enhance its financial standing and foster sustainable growth.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)