“OCB Plans Share Issuance to Boost Capital”

Orient Commercial Joint Stock Bank (OCB) is planning to issue approximately 197.3 million new shares, equivalent to an 8% ratio, to its shareholders. The share issuance will be executed at a ratio of 100:8, meaning that for every 100 shares owned, shareholders will receive 8 new shares.

The additional capital will be sourced from the bank’s equity capital as of December 31, 2024, as per the audited separate and consolidated financial statements for 2024. The timing of the issuance is set for 2025, pending approval from the competent authorities.

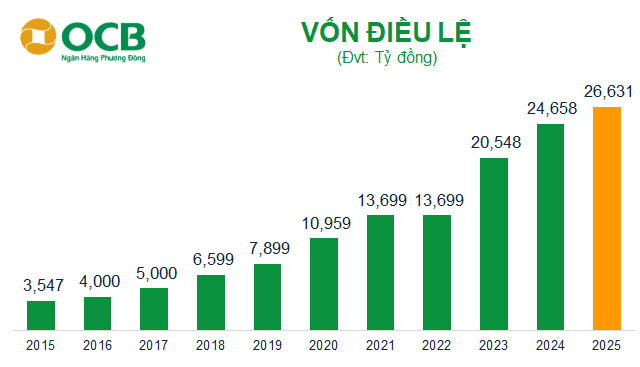

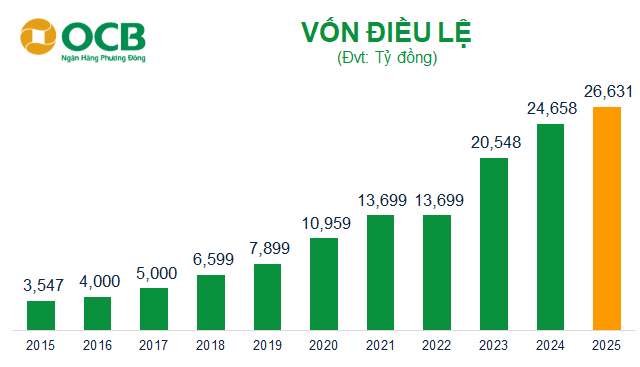

Upon successful completion of the share issuance, OCB’s charter capital is expected to increase from VND 24,658 billion to VND 26,631 billion.

Source: VietstockFinance

|

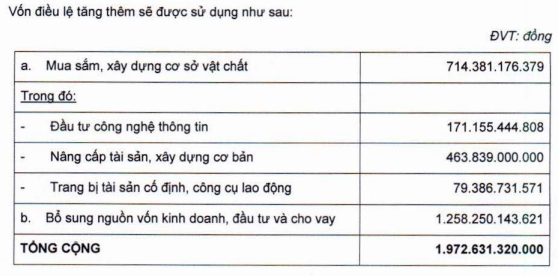

OCB intends to utilize the additional capital for investments in information technology, asset upgrades, construction, supplementing its operating capital, and providing loans.

This plan to increase charter capital was approved by the Annual General Meeting of Shareholders in April 2025.

On the HOSE, OCB shares are currently trading at around VND 10,800 per share (as of May 22, 2025 morning), similar to the beginning of the year, with an average daily trading volume of 2.8 million shares.

| OCB Share Price Movement Since the Beginning of the Year |

Hàn Đông

– 11:58 22/05/2025

The Business Highlights of SCIC’s 2025 Annual General Meeting

The government’s ambitious 8% GDP growth target sets a challenging yet achievable goal for businesses in a year of anticipated economic hurdles. The determination to strive towards this target was evident in the recent round of shareholder meetings, with enterprises partially or wholly owned by the State Capital Investment Corporation (SCIC) leading the charge.