Source: VietstockFinance

|

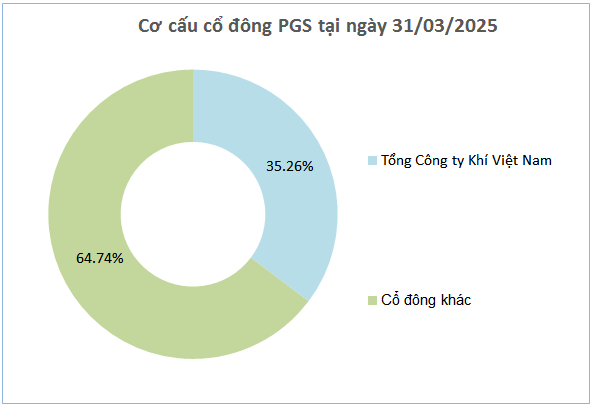

With nearly 50 million shares outstanding, PGS plans to distribute almost VND 100 billion in dividends to its shareholders. Vietnam National Gas Corporation (HOSE: GAS), the major shareholder owning 35.26% of PGS, is expected to receive over VND 35 billion.

Source: VietstockFinance

|

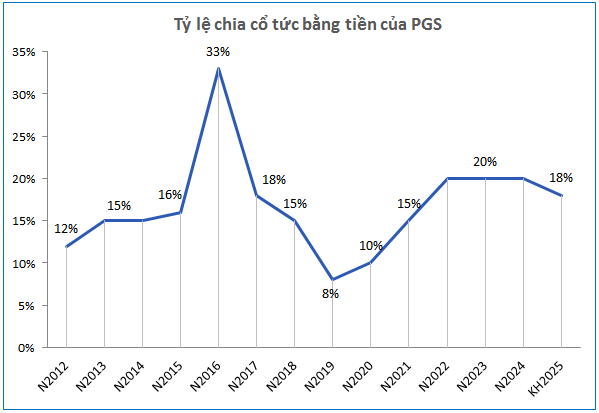

PGS has maintained a consistent policy of cash dividends over the past decade. The highest dividend payout ratio was 33% in 2016, the same year the company achieved a record profit of VND 342 billion. In contrast, the lowest distribution was 8% in 2019, as the company fell short of its profit plan.

| PGS’s Financial Performance Over the Years |

The year 2024 marked the third consecutive year that PGS paid a 20% cash dividend since 2022. The company reported a net profit of VND 116 billion, a 9% increase from 2023 and the highest in the last three years.

For 2025, PGS targets revenue of VND 6,570 billion and pre-tax profit of nearly VND 141 billion, a decrease of 2% and 6%, respectively, compared to the previous year. The expected dividend payout ratio is 18%.

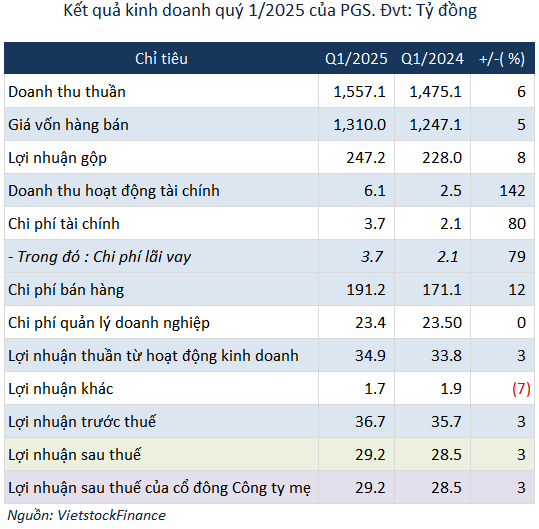

In the first quarter of 2025, PGS recorded revenue of over VND 1,557 billion, a 6% increase year-over-year. Net profit reached over VND 29 billion, a slight increase of 3%, despite a 79% rise in interest expenses and a 12% increase in selling expenses. Compared to the full-year plan, the company has accomplished 24% of the revenue target and 26% of the profit target.

– 08:08 22/05/2025

“PV Gas Allocates Over 13,780 Billion VND for 2023 Dividend Payout”

PV Gas has announced a dividend payout of 60% for 2023, which equates to an estimated cost of over VND 13,780 billion. With approximately 2.3 billion shares in circulation, this substantial payout underscores the company’s strong performance and commitment to returning value to its shareholders.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)