The Hanoi Stock Exchange (HNX) has just published information on the status of principal and interest payments on bonds at maturity by Phu Long Real Estate Joint Stock Company.

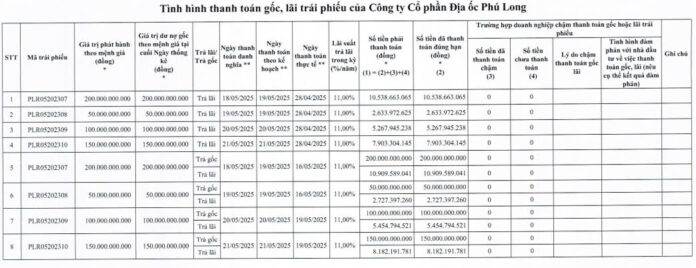

Accordingly, from May 19-21, 2025, Phu Long Real Estate made payments totaling VND 553.6 billion to cover principal and interest for four batches of bonds that matured on those dates.

Specifically, the company paid over VND 221.4 billion in principal and interest for the bond batch with the code PLR05202307; nearly VND 55.4 billion for the batch with the code PLR05202308; over VND 110.7 billion for the batch with PLR05202309; and nearly VND 166.1 billion for the batch with the code PLR05202310.

Source: HNX

These bond batches were issued by Phu Long Real Estate in May 2020, with a five-year term and maturity in May 2025. According to the disclosure on HNX, these bond batches carried an interest rate of 11% per annum.

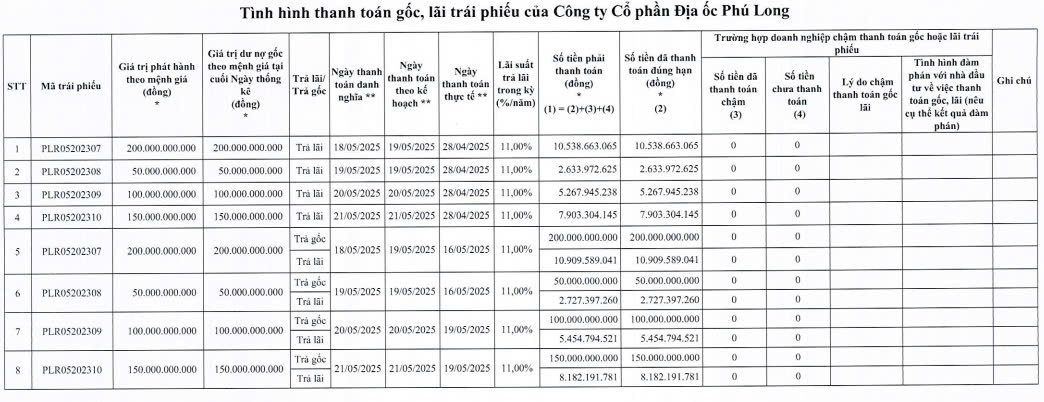

In a similar vein, earlier, from May 8-15, 2025, the company also disbursed over VND 774.1 billion to settle principal and interest for six other bond batches. This included VND 700 billion in principal and over VND 74.1 billion in interest.

Specifically, the company made payments of nearly VND 331.9 billion in principal and interest for the bond batch with the code PLR05202301; over VND 55.3 billion for the batch with the code PLR05202302; more than VND 110.5 billion for the batches with the codes PLR05202303 and PLR05202304 each; nearly VND 55.3 billion for the batch with the code PLR05202305; and over VND 110.7 billion for the batch with the code PLR05202306.

These bond batches were issued by Phu Long Real Estate in May 2020, with a five-year term maturing in May 2025.

In 2024, the company also made timely interest payments for 18 bond batches. Additionally, they prepaid VND 600 billion to redeem two bond batches, PLRL2023016 and PLRL2023017, ahead of their scheduled maturity in August 2025. It is worth noting that both of these bond batches were issued in August 2020, with an original term of 60 months.

Phu Long Real Estate was established in 2007 and primarily engages in the business of real estate and land-use rights, including ownership, leasing, and renting.

Regarding their business performance, as per the disclosed basic financial indicators for the first half of 2024 (as of June 30, 2024), the company’s owner’s equity stood at VND 20,671 billion, reflecting a 2% increase compared to the same period last year.

The debt-to-equity ratio improved from 3.19 to 2.57 times, indicating a reduction in financial leverage. Consequently, Phu Long Real Estate’s total liabilities at the end of the second quarter of 2024 amounted to VND 53,124 billion.

For the first half of 2024, Phu Long Real Estate reported a net profit of over VND 877 billion, representing a significant improvement of nearly 21.5% compared to the same period in 2023. The return on equity (ROE) also increased from 3.5% to 4.3%, indicating a more efficient utilization of shareholders’ capital.

A Transformational Year for PGBank: Rising to New Heights

In 2025, PGBank aims to build on its transformative progress in 2024 and forge ahead with robust, efficient, and sustainable growth. This ambitious goal will be achieved through a continued focus on process optimization, strategic expansion, vigorous brand-building, and enhancing the customer experience.

“A Securities Firm Suspended from Making Payments and Trading Private Bonds for One Week”

On May 20th, HD Securities JSC (HDS) announced that it had received a decision from the Vietnam Securities Depository and Settlement Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend the company’s settlement operations and activities in the private corporate bond market from May 20th to May 26th.

“A Bright Start: PJICO’s Impressive Performance in Q1”

In the recently released Q1 2025 financial report, Petrolimex Insurance Joint-Stock Corporation (PJICO, code: PGI) recorded a total revenue of VND 1,343 billion, a 3.3% increase, amounting to 26% of the yearly plan. The original insurance revenue reached VND 1,114 billion, a slight 1.3% uptick compared to the same period in 2024.

The Great Mid-Year Sale: Slashing Prices, Not Quality

The financial report submitted to the Hanoi Stock Exchange reveals an interesting development. Trungnam Group, a construction and investment company, reported a pre-tax loss of VND 25 billion for the first half of 2024, a significant improvement from the VND 1 trillion loss in the same period last year. Despite a post-tax loss of VND 113 billion, the company is showing signs of a robust recovery.