Following the Prime Minister’s dispatch on implementing effective measures to manage the gold market, the State Bank of Vietnam (SBV) – Branch 2 has consecutively issued documents requesting gold enterprises and credit institutions to comply with regulations related to gold bullion.

Cracking Down on Illegal Gold Bullion Trading

Accordingly, at gold bullion trading locations, units must inform customers and the public about their authorization from the SBV to trade gold bullion. They are also required to publicly display a certified true copy of their gold bullion trading license…

On May 21, reporters from NLD Newspaper observed that several branches of gold companies in Ho Chi Minh City had put up signboards announcing themselves as “SJC Gold Bullion Trading Points.” This measure aims to ensure that the public can identify legal gold bullion trading locations, distinguishing them from jewelry and gold art businesses. “People are only allowed to trade SJC gold bullion at authorized units. Gold enterprises that are not licensed to trade gold bullion are prohibited from trading gold bullion with individuals or organizations, and violators will be subject to penalties,” said Mr. Nguyen Duc Len, Deputy Director of SBV – Branch 2.

The SBV not only demands compliance from these units but also advises the public to be cautious and prudent when buying or investing in gold to avoid risks due to volatile gold prices. It also emphasizes the importance of adhering to regulations in gold trading.

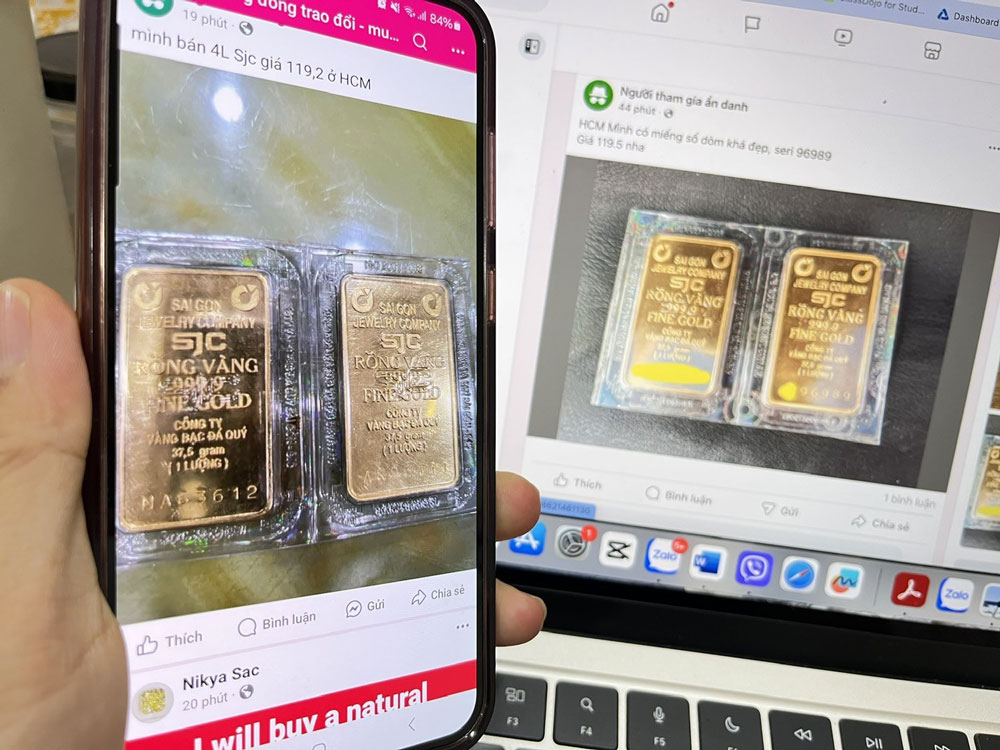

Online advertising and trading of gold bars and rings remain rampant.

Meanwhile, on social media, advertising and trading of SJC gold bars and rings, as well as other brands such as DOJI, Bao Tin Minh Chau, and PNJ, are still thriving. In a Facebook community with over 93,000 members dedicated to gold exchange, individuals frequently advertise the sale of 99.99% pure gold rings and gold bars from various brands. “Selling 1 tael of DOJI gold at 114 million VND, negotiable; 10-finger Bao Tin Minh Chau gold rings for 118 million VND in Vinh Yen, Vinh Phuc; selling 8 taels of SJC gold bars in Hanoi; selling 2 taels of SJC gold bars for 120 million VND…” are among the publicly advertised posts on social media.

Right below these posts, there is a flurry of interactions, with people inquiring about purchases or requesting contact information, despite the SBV’s regulation that people are only permitted to trade SJC gold bullion at authorized units. This indicates that peer-to-peer trading of SJC gold bullion online is illegal and subject to penalties. Moreover, there is a risk of being scammed when engaging in online gold transactions.

According to experts, to curb the rampant free trading on social media, it is necessary to devise solutions that enable gold enterprises to meet the legitimate demands of the public.

Significant Price Differential Persists

Another notable development is that despite directives from regulatory authorities to rectify the gold market, domestic gold prices remain high. At the end of May 21, SJC gold bullion was quoted by enterprises at 118.5 million VND per tael for buying and 121 million VND per tael for selling, an increase of 1.7 million VND compared to the previous day.

At the same time, world gold prices surged to 3,312 USD per ounce, an increase of about 90 USD per ounce compared to the previous session (equivalent to about 2.8 million VND per tael). After conversion, world gold prices are currently lower than domestic gold ring prices by about 10.7 million VND per tael and lower than SJC gold bullion prices by up to 16.7 million VND per tael.

Some enterprises and experts attribute the high gold prices to the scarcity of supply. SJC staff shared that while there is no limit to the amount of SJC gold bullion customers can purchase, the availability depends on the timing of the transaction. Meanwhile, gold rings are sold with a maximum limit of one finger per customer. Other companies also sell gold bullion only when they have stock and depending on the actual situation.

Financial expert Phan Dung Khanh assessed that SJC gold bullion prices could follow the downward trend of world gold prices but not in the short term. The price differential between domestic and world gold prices is currently very high and unreasonable. “With the measures taken by the authorities, narrowing this gap will take time and cannot be achieved overnight. The policy’s goal is to bring domestic gold prices closer to world prices, not to make them equal,” said Mr. Khanh.

According to Associate Professor Dr. Nguyen Huu Huan from the University of Economics Ho Chi Minh City, to narrow the significant gap between SJC gold bullion prices and world gold prices, the management agency needs to increase the gold supply in the market, as done in 2024. In fact, for many years, the SBV has not increased the supply of SJC gold bullion, leading to a disconnect between domestic gold prices and world prices. “From April 2024 to the end of 2024, the SBV intervened in the gold market through auctions and direct gold bullion sales, significantly reducing the price differential from over 20 million VND per tael to 2-3 million VND per tael,” Associate Professor Huan analyzed.

Mr. Nguyen Tu Mi, Director of Mi Hong Gold Company, suggested that, in the long run, the domestic gold industry needs more fundamental and comprehensive solutions to ensure a stable supply, from import mechanisms to domestic production. When the market operates transparently and has sufficient goods in circulation, gold prices will self-regulate at reasonable levels. This will reduce risks for businesses and give consumers more confidence in their buying and selling decisions.

Fraud Alert

There have been numerous cases of fraud in online gold transactions. Recently, the Da Nang Police had to issue a warning about individuals creating fake Facebook accounts to join groups related to gold exchange, trading, and networking to find potential victims. Therefore, they advised the public to transact only with large and reputable gold shops with clear origins and valid business licenses. They also urged people to be vigilant and cautious when buying, exchanging, or networking for gold online, as it poses risks of fraud and scams.

Gold Prices Falter as the US Dollar Rallies and SPDR Gold Trust Adds Four Tons

Recent reports suggest that gold prices have found a strong support level at the $3,300 per ounce mark and are poised to reach the $4,000 per ounce milestone this year.

The Golden Jump: How Gold Prices Surged by 2% and More in a Week

Compared to last weekend, spot gold prices surged over 5%, marking the strongest weekly gain since mid-April. The impressive rally pushed spot gold prices to nearly VND 5 million per tael…

“Investors Lose Hundreds of Millions in a Matter of Days: The Risky Business of Gold”

“Once considered a ‘safe haven’, gold is now a volatile asset. In today’s ever-changing economic landscape, the value of gold is subject to rapid fluctuations, making it an uncertain investment choice. With global markets in a constant state of flux, investors are seeking more stable havens for their wealth.”