Recent Leadership Changes at PVR Hanoi and the Company’s Temporary Halt in Business Operations

Mr. Bui Van Phu, Chairman of PVR Hanoi Joint Stock Company (code: PVR), has recently registered to sell his entire holding of over 2.7 million PVR shares (5.23%) with the purpose of portfolio restructuring. The trading period is scheduled from May 23 to June 20, 2025, and the transaction method will be through matching and order matching.

In a similar move, Mrs. Tran Thi Tham, Mr. Phu’s wife, has also registered to divest her entire 24% stake in PVR, equivalent to 12.5 million shares, for the same reason. The transaction period is from May 15 to June 13, 2025, through matching and order matching.

If both transactions are completed, the Chairman and his wife will have withdrawn almost 15.2 million shares, or 29.28% of the capital, from PVR. Based on PVR’s share price of VND 1,000 per share on May 21, 2025, the total divestment value exceeds VND 15 billion.

Figure 1: Shareholding structure of PVR Hanoi JSC

Temporary Halt in Business Operations

The divestment move by the Chairman and his wife comes at a time when PVR’s business operations are facing challenges. In a notice released in December 2024, the company announced a temporary halt to its business operations for the year 2025 (from January 1 to December 31, 2025), citing a lack of funds to maintain operations. PVR stated the need to reorganize its personnel and seek new business directions to overcome the current difficulties.

Prior to this, in October 2023, PVR had informed that its bank account was frozen due to a legal dispute with Vietnam Oil and Gas Construction Joint Stock Corporation (PVC, code PVX). This resulted in a lack of operating funds, leading to a temporary suspension of business operations from November 2023 to November 14, 2024, while the company worked on reorganizing its personnel and exploring new business directions.

As a consequence of the business halt, PVR did not record any revenue from its core business operations in Q1 2025. Financial revenue was a mere VND 48,000, while financial expenses amounted to nearly VND 322 million, and management expenses were nearly VND 61 million. As a result, the company incurred a net loss of nearly VND 383 million.

As of March 31, 2025, PVR’s total assets exceeded VND 976 billion, but its cash balance stood at just VND 92 million. The majority of its assets are in inventory, with a balance of VND 693 billion (71%) at the end of the period, mainly related to the Ha Noi Time Tower project. Additionally, the company has investments and contributions to other entities totaling over VND 231 billion.

On the capital side, PVR has nearly VND 257 billion in prepayments from customers since 2021 for the Ha Noi Time Tower project, also known as CT10-11 Van Phu (Ha Dong). This project has faced delays since 2013 and remains suspended. PVR has entered into agreements with customers, receiving advance payments through sales contracts, capital contributions, and deposit agreements.

According to our research, PVR was established in November 2006 as a subsidiary of PVC under the Vietnam Oil and Gas Group (PVN). The company operates in the field of real estate investment and trading, sports, entertainment, tourism, and high-end resort services. As of Q1 2025, PVR has accumulated losses of over VND 89 billion.

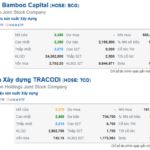

The Dynamic Duo of BCG and TCD: Restricted Trading and Stock “Plummeting”

On May 20, the Ho Chi Minh City Stock Exchange (HOSE) announced that it would transfer BCG from control to restricted trading from May 27, due to a delay in submitting its audited financial statements for 2024, exceeding the regulatory deadline by 45 days. On the same day, another stock belonging to the Bamboo Capital family, TCD, faced similar punitive action from HOSE for the same infraction.

The Three Top Executives of Viettel Global Step Down

“Three individuals, united by a serendipitous twist of fate, found themselves entrusted with a new mission from the conglomerate. Their paths converged as they embarked on a journey to uncover the mysteries of their shared assignment. As they delved deeper, they discovered a web of intrigue, where their unique skills and perspectives became their greatest assets. With a collective determination, they set out to leave an indelible mark, driven by a passion to excel and a desire to unravel the unknown.”