Market Capitalization Exceeds $2 Billion, Expanding Regional Presence

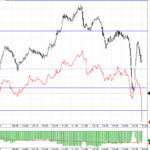

On the stock market, SHB shares traded around 13,500 VND each, up nearly 40% since the beginning of the year. It is also one of the most liquid stocks in the market, with an average monthly volume of over 83 million shares traded in the past month. The appeal of SHB stock has attracted foreign investors, with net foreign buying in the tens of millions of units per session since the beginning of the year. SHB stock is currently in the VN30 – the group of stocks with the largest market capitalization.

By mid-May, SHB’s market capitalization reached nearly VND 54,900 billion, equivalent to over $2 billion. Charter capital stood at VND 40,658 billion, solidifying its position in the Top 5 largest private banks in Vietnam.

Image 1: SHB share price up nearly 40% since the beginning of the year (Source: Trading View)

Recently, SHB announced June 10, 2025, as the record date for shareholders to receive a 5% cash dividend for 2024, with the payment date set for June 20, 2025. According to the resolutions of the 2025 Annual General Meeting of Shareholders, SHB will pay a total dividend of 18% for 2024, including 5% in cash and 13% in shares.

In 2025, the bank aims to increase its charter capital to VND 45,942 billion. It targets a pre-tax profit of VND 14,500 billion, up 25% from the previous year. Total assets are planned to exceed VND 832,000 billion in 2025 and reach VND 1,000,000 billion in 2026, marking a significant step forward in its position in the domestic and regional financial markets.

Steadfastly Marching Forward in the New Era

At the 33rd Annual General Meeting of Shareholders, SHB shareholders expressed their delight with the impressive business results, confidence in the bank’s strategic goals, governance, and management’s ability to steer the bank’s long-term growth and the benefits it brings to shareholders.

As of the end of the first quarter of 2025, SHB’s total assets reached VND 790,742 billion, up 6% from the end of 2024. Credit balance stood at VND 575,777 billion, an increase of 7.8%. The bank focused its lending on key production and business sectors and industries with high growth potential, in line with the orientation of sustainable economic development, laying the foundation for stable and efficient long-term growth. Pre-tax profit for the first quarter of 2025 was nearly VND 4,400 billion, achieving 30% of the full-year plan.

Fitch Ratings, one of the top three credit rating agencies in the world, has assigned SHB a Long-Term Issuer Default Rating of “BB–” with a Stable Outlook and a Viability Rating of “b+”, placing it among the top-rated banks in the industry.

The Fitch rating continues to showcase SHB’s reputation in the international market and reflects its solid financial foundation and stable profitability.

SHB is implementing a comprehensive 2024-2028 transformation strategy based on four pillars: reforming mechanisms, policies, regulations, and processes; prioritizing people; customer and market centricity; and modernizing information technology and digital transformation. The bank remains committed to its six core cultural values: “Heart – Trust – Faith – Knowledge – Wisdom – Vision.”

In line with its transformation strategy, SHB is collaborating with SAP Fioneer and Amazon Web Services (AWS) to revolutionize its digital capabilities and adopt cutting-edge technologies, bringing the Bank of Future (BOF) model to life. This initiative will comprehensively enhance SHB’s competitive strengths and customer service capabilities, yielding significant results in 2025 and 2026, including advanced digital services, digitization of customer journeys, enhanced customer experiences, increased automation, data-driven growth, and a modernized core banking system.

With its determination to execute its transformation strategy and commitment to investing in technology and digitalization, SHB is expected to make a remarkable leap forward in the new era, elevating its position in the international and regional arenas. The bank will continue to be a trusted partner of prominent global organizations such as the World Bank, IFC, and ADB.

Accompanying the Country’s Socio-Economic Development

Throughout its 32-year history, SHB has aligned its growth with the country’s progress, becoming a symbol of relentless advancement and a constant presence at significant milestones in Vietnam’s development journey. The bank has always been ready to support crucial national initiatives: it underwent a merger as part of the restructuring of credit institutions, provided capital for key infrastructure projects, green energy, and clean agriculture, and deployed preferential credit packages to support individuals and businesses in line with the government and State Bank of Vietnam’s directives.

With the Resolution No. 68-NQ/TW of the Politburo on developing the private economy, which recognizes the private sector as the most critical driver of the economy, SHB continues to fulfill its role as the lifeblood of the economy, channeling capital to businesses and individuals and contributing to socio-economic development. The bank has launched multiple credit packages, including a VND 11,000 billion package with preferential rates for SMEs in production, business, and auto purchases, and a VND 16,000 billion package for homebuyers. Additionally, SHB proactively offers non-financial solutions, facilitates market connections for input and output within the business community, and provides financial consulting and training.

Moreover, SHB has consistently ranked in the Top 5 private banks and Top 15 private enterprises in terms of budget contributions.

SHB actively contributes to the country’s social welfare activities

SHB’s sustainable development goes hand in hand with its commitment to creating prosperous value for customers, shareholders, partners, and society. The bank takes the lead in social welfare activities and actively supports the development of cultural and sports endeavors in Vietnam, such as COVID-19 prevention, flood relief, and accompanying the Vietnamese football team to their victory in the 2024 ASEAN CUP. The bank has also participated in nationwide programs to eradicate temporary housing.

With its robust financial capabilities and relentless drive for breakthrough growth, SHB aspires to create sustainable and enduring value, contributing to the country’s socio-economic development and marching forward into the new era of prosperity and strength.

“OCB to Issue 197.2 Million Bonus Shares to Boost Chartered Capital”

OCB is set to issue a bonus share dividend, offering 197.2 million new shares to its shareholders. This move will increase the bank’s charter capital from VND 24,657.8 billion to VND 26,630.5 billion.

The Vanishing Liquidity: A Market Tug-of-War

The weakening of Vin stocks remains a key signal for investors to exercise caution. The blue-chip group’s attempts to push higher were met with strong resistance, resulting in a retreat that kept the VN-Index confined to a narrow range around the reference level throughout the session. A 40% plunge in HoSE’s liquidity to a 15-session low underscores the return of cautious sentiment.

Stock Market Blog: How Long Can We Hold On?

The recent volatility in the large-cap group has once again posed challenges for the VN Index, reminiscent of the struggles faced on May 16th. While the index is being pulled and pushed, the damage to individual stocks is evident. The window of opportunity for a counter-trend rally is narrowing, and accurate stock picking is becoming increasingly difficult.