As the Vietnamese economy faces both opportunities and challenges, listed companies continue to face pressure in realizing their 2025 business plans. Many large enterprises have proactively built scenarios to cope with US tariff risks and have not adjusted their operational goals downward. Additionally, stable macroeconomic policy management and gradual improvements in the domestic business environment are important supportive factors, providing a foundation for the recovery of business results.

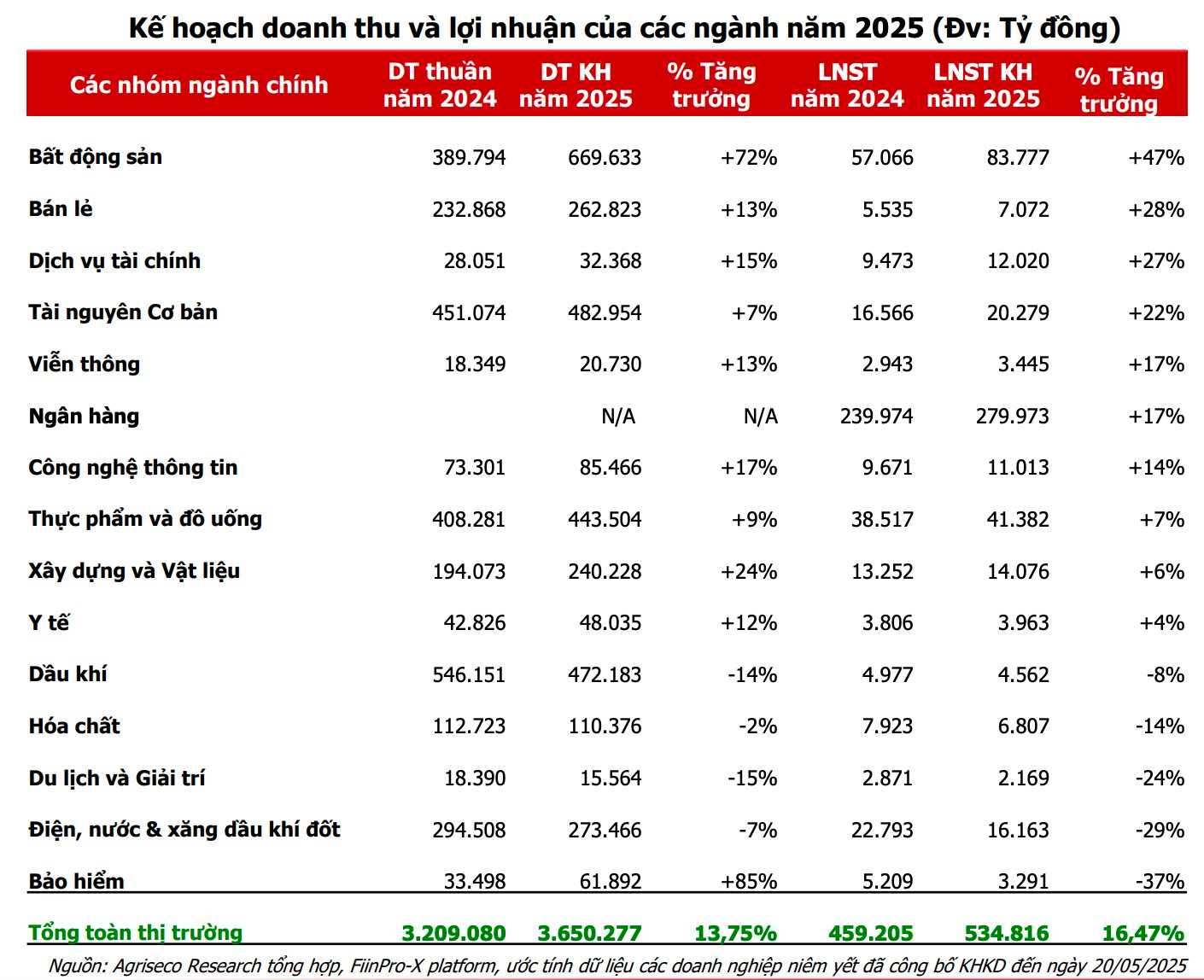

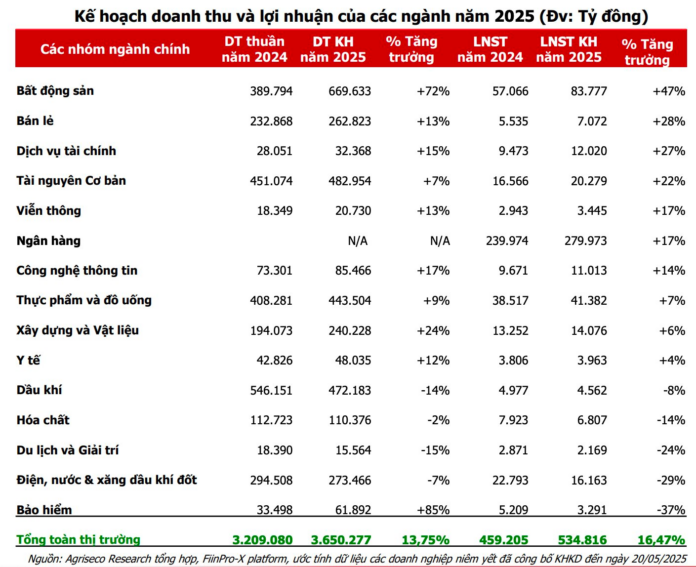

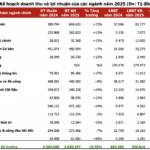

In its latest report, Agribank Securities (Agriseco Research) estimates that based on the 2025 business plans, the market’s net profit will grow by over 16%, and total revenue (excluding banks) will increase by nearly 14% compared to the previous year. Overall, the picture of the market’s 2025 profit plans is positive but clearly polarized between sectors.

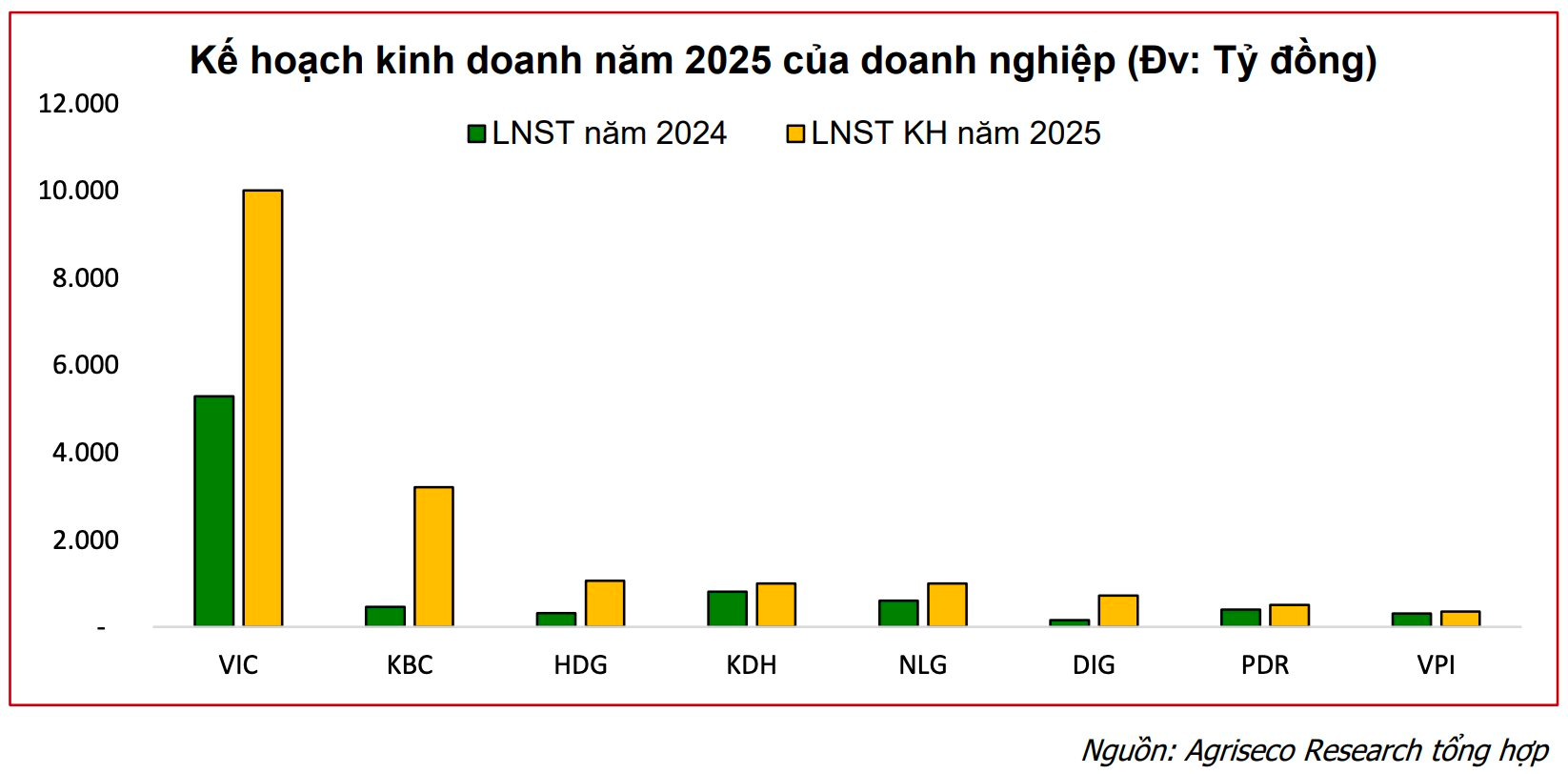

In the real estate sector, the 2025 business plan reflects growth due to many projects entering the handover and profit recognition phase. Real estate project sales are expected to increase significantly with the launch of new projects. For the industrial park group, while they set optimistic growth targets, mid-term risks remain if Vietnam is subjected to higher taxes by the US.

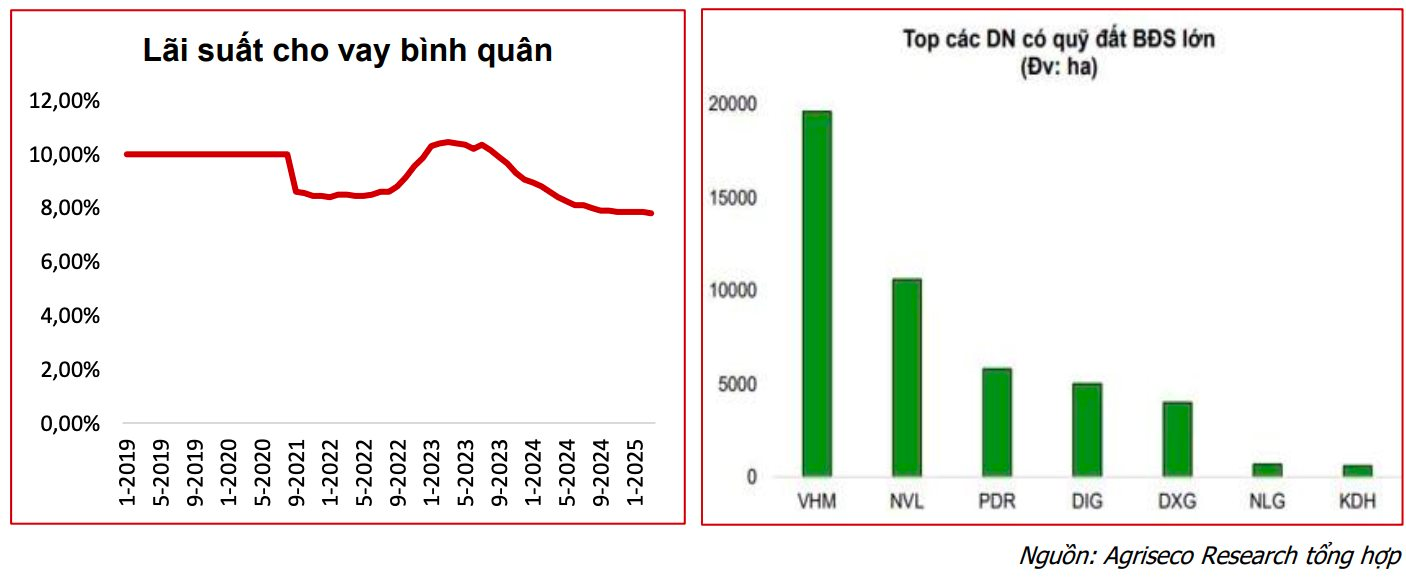

According to Agriseco, supportive factors for the industry include low-interest rates, which help real estate businesses reduce borrowing costs and improve profit margins in the coming periods. The government has also removed legal obstacles for many projects, and the real estate market is recovering in terms of liquidity, supply, and demand, focusing on the South. Agriseco assesses that leading real estate enterprises have a stable financial foundation, own large land funds, and continue to recognize revenue from projects under delivery. However, they still face loan and bond maturity pressures.

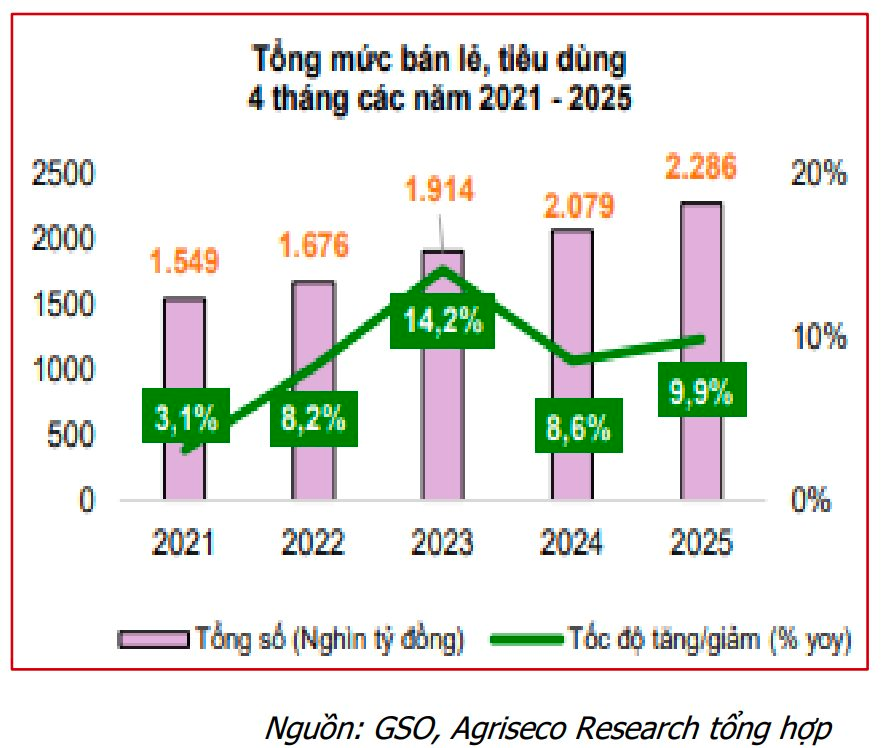

For retail businesses, the sector is expected to continue growing due to the recovery of domestic demand, supported by the VAT reduction to 8% until June 30, 2025, which may be extended into 2026. Moreover, the increase in the basic salary level can also boost consumption. Total retail sales of goods and services in the first four months of 2025 increased by 9.9% over the same period, higher than the previous year’s growth rate.

Pharmaceutical and healthcare products maintained stable growth as essential goods less affected by macroeconomic fluctuations and increased health awareness. In contrast, the ICT industry (technology equipment) may recover slowly due to supply chain disruptions. Leading retailers such as FRT, MWG, and DGW have set high profit targets for 2025 and are expected to achieve their plans thanks to their flexible, multi-channel retail models and effective expansion strategies.

In the banking sector, to achieve the State Bank of Vietnam’s credit growth target of 16% for 2025, Agriseco expects capital to be boosted in key sectors such as public investment, real estate, and industrial production. Meanwhile, personal consumer credit is forecast to recover significantly in the second half of the year.

Net interest margin (NIM) continues to improve due to low funding costs, helping the industry’s profit in 2025 maintain a stable growth rate of over 15% compared to 2024. Asset quality remains stable, with the bad debt ratio in 2025 expected to decrease compared to 2024 due to strategies focusing on bad debt handling and recovery, and the pressure of forming new bad debts has reduced at the end of the previous year.

The Securities industry is also expected to perform well due to the market upgrade story after the KRX system is operated. This could attract large foreign capital inflows, supporting liquidity and increasing brokerage, custody, and related financial services revenue. Additionally, low-interest rates continue to favor the shift of investment capital to stocks due to more attractive expected returns compared to traditional channels such as deposits or bonds. Furthermore, Agriseco points out that securities companies are entering a new cycle of increasing charter capital to enhance their financial capacity, expand margin lending limits, increase proprietary trading scale, and invest in technology infrastructure.

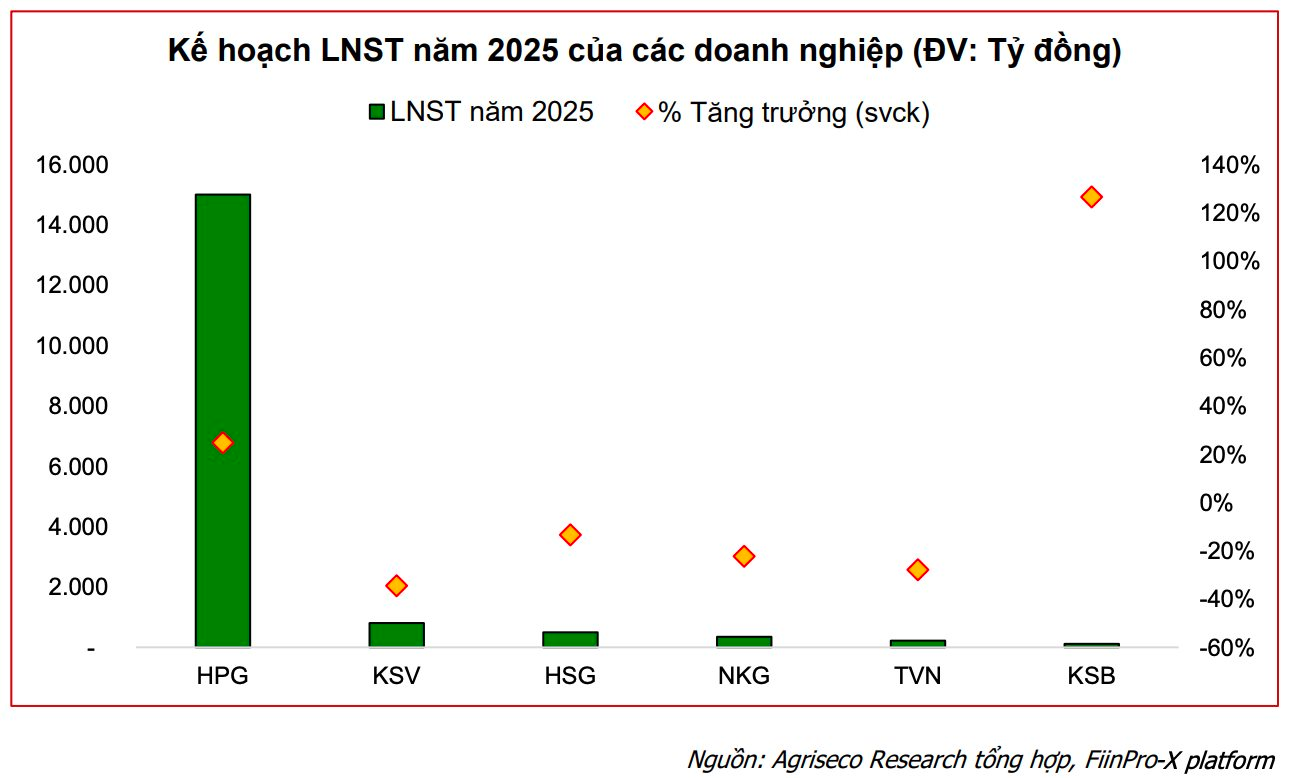

In the Basic Resources sector, steel giant HPG targets a significant profit increase, expecting higher demand from the domestic real estate market and infrastructure construction. In contrast, coating enterprises set more cautious plans due to export difficulties amid trade protectionism waves. Some mineral enterprises also plan cautiously, assessing that some mines have challenging extraction conditions, while others are temporarily halted or have not yet chosen suitable strategic partners and technologies.

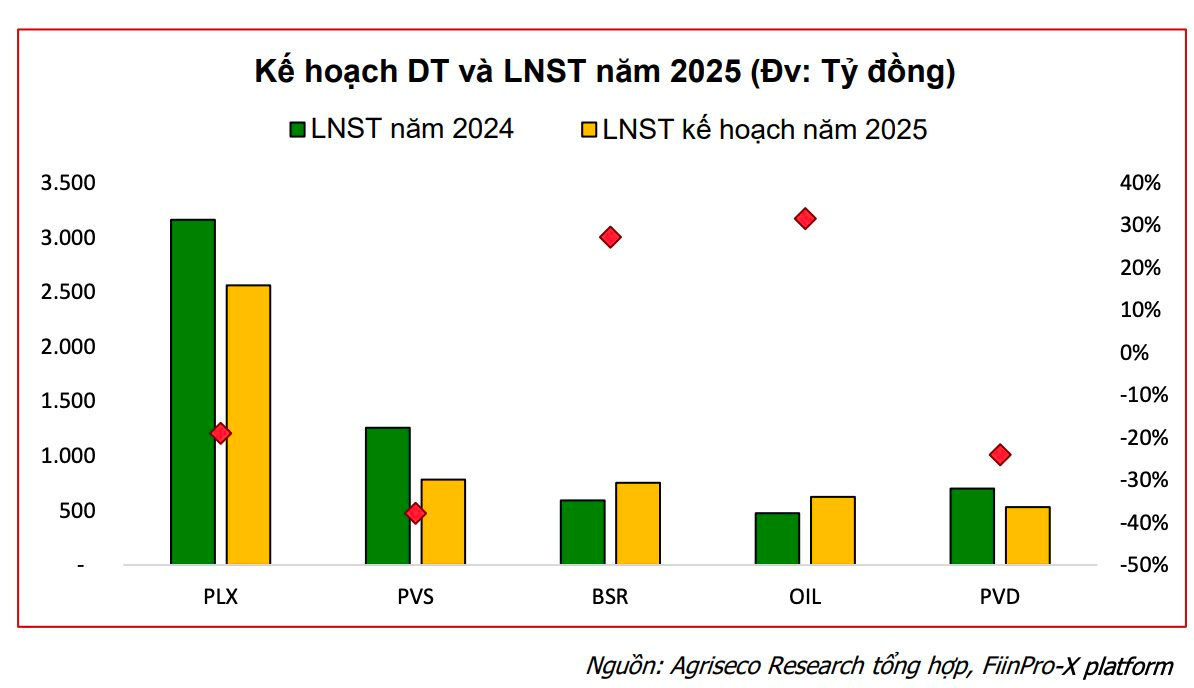

For the electricity, water, and oil and gas industries, electricity enterprises show a polarized profit plan picture. Oil and gas enterprises, with GAS contributing 88%, will also face challenges in 2025, including declining domestic gas supply and unexploited new gas fields. The forecasted decline in Brent oil prices will also impact their profit margins.

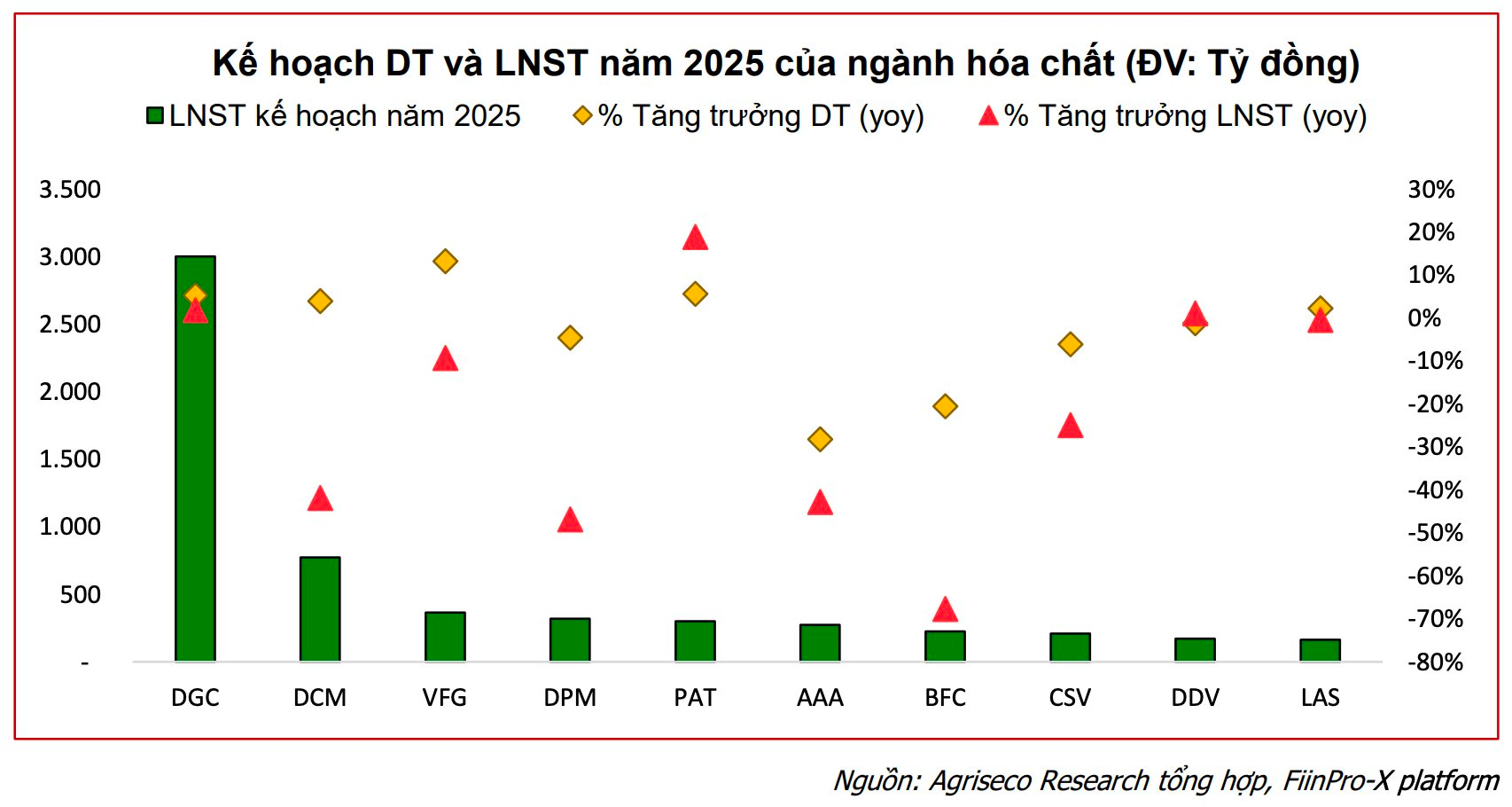

Meanwhile, the profit picture for 2025 of the chemical and fertilizer industry is relatively cautious, reflecting the specific nature of the enterprises’ operations and the sector’s not-so-positive prospects. However, from the second half of the year, fertilizer enterprises’ profits may be positively supported by the new VAT Law for Fertilizer, which takes effect from July 1, 2025, helping reduce costs through input tax credit.

More cautiously, most oil and gas enterprises set reduced business plans for 2025 amid forecasted oil price declines and continued unpredictable fluctuations in the context of global macroeconomic challenges and the risk of recession in major economies, leading to reduced oil consumption. Increased production by large organizations (OPEC+) and weak consumption in major markets may cause oversupply, reducing revenue from new exploration and oil and gas engineering contracts. The energy transition trend may also negatively affect enterprises engaged in the business and retail of gasoline.

Unlocking Property Ownership: Clearing the Path for Over 71,000 Homeowners in Ho Chi Minh City

After 6 months of operation, the Task Force has successfully addressed issues and facilitated the certification process for 97 out of 142 projects. This has resulted in the delivery of 71,418 residential units, including apartments, houses, land lots, officetels, and shops, as well as over 888 other real estate products, to the Ho Chi Minh City market.

“Proposed Property Tax on Stalled and Vacant Properties: A Study”

“Vice Prime Minister Tran Hong Ha has proposed a study on imposing taxes on idle land, as well as on real estate projects and housing developments that are delayed or stagnant. This proposal aims to address the issues of land speculation and stagnant development, encouraging more efficient use of land resources and promoting a vibrant and sustainable real estate market in Vietnam.”

What Business Sectors Have the Strongest Growth Plans for 2025?

As of May 20, 2025, listed companies’ earnings reports revealed a promising outlook for the market. According to Agriseco, net profits for the year 2025 exhibited a significant growth of 16.47% compared to 2024. Moreover, excluding the banking group, total revenue plans indicated a remarkable surge of 13.75% year-over-year. These figures showcase the market’s robust health and promising trajectory for the upcoming year.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)