Livzon Pharmaceutical Group Inc. has announced its acquisition of a Vietnamese company.

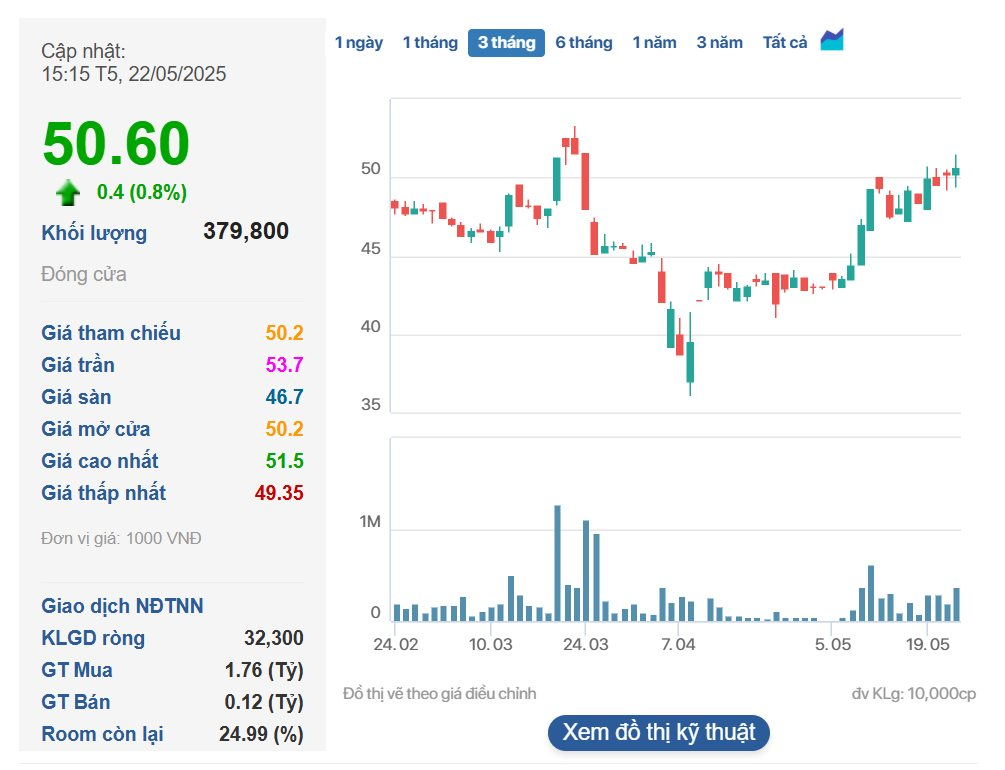

On May 22nd, Livzon Pharmaceutical Group Inc. (China) disclosed its acquisition of a Vietnamese company. According to the announcement, the indirect subsidiary of Livzon Pharmaceutical Group and the seller signed an agreement to purchase a total of 99,839,990 IMP shares, accounting for 64.81% of the issued shares of Imexpharm Pharmaceutical Joint Stock Company (IMP).

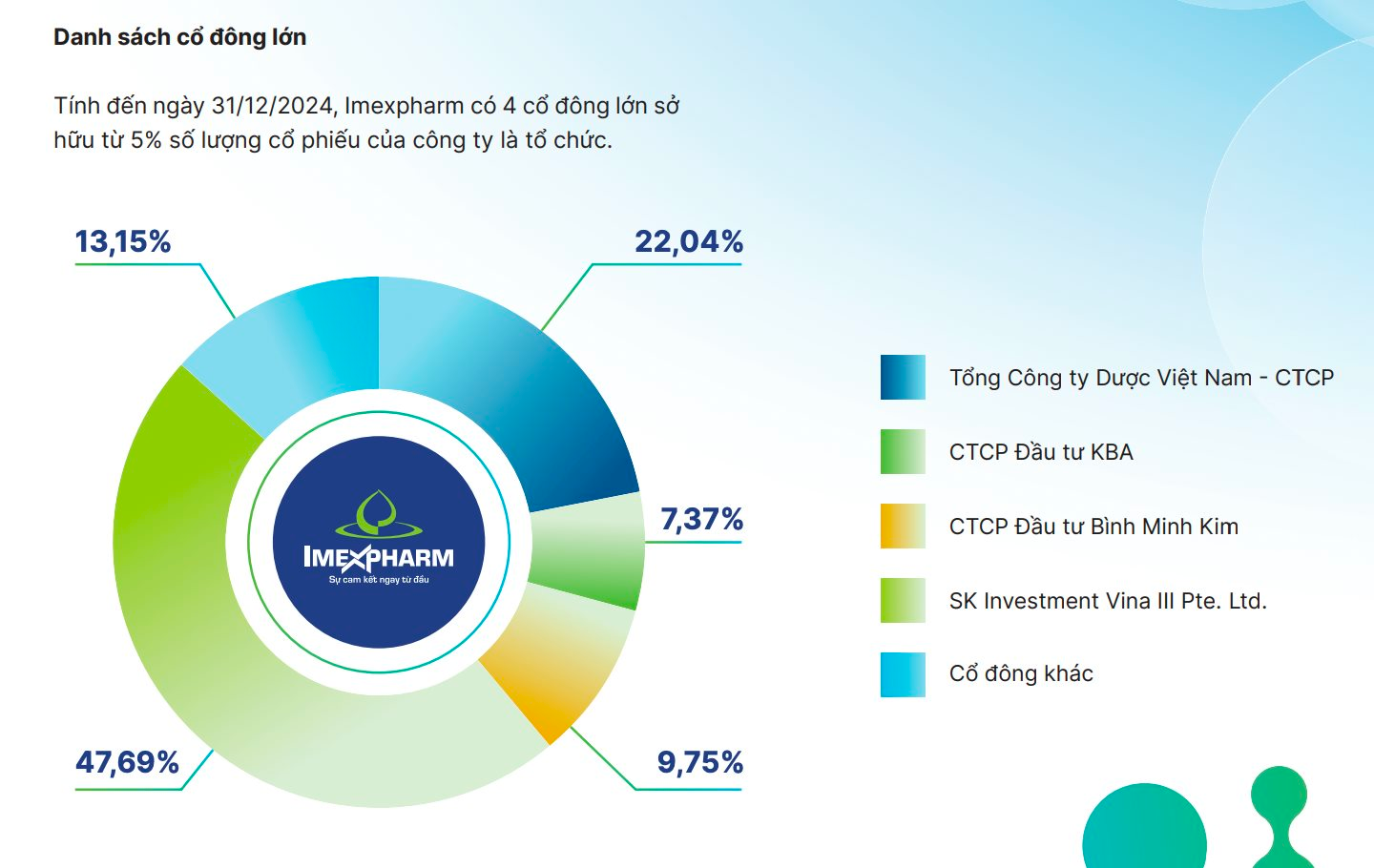

Specifically, the agreed transaction includes 73,457,880 IMP shares owned by SK Investment, 15,026,784 IMP shares owned by Binh Minh Kim Investment Joint Stock Company, and 11,355,326 IMP shares owned by KBA Investment Joint Stock Company.

The deal is valued at nearly VND 5,731 billion, corresponding to an average price of VND 57,400 per share. SK Investment will receive over VND 4,216 billion, Binh Minh Kim will receive nearly VND 863 billion, and KBA will receive nearly VND 652 billion.

This price is approximately 13% higher than the market value of these nearly 99.9 million IMP shares based on the closing price on May 22nd, which was VND 5,052 billion.

The acquisition is expected to enhance Livzon’s expansion into foreign markets and support its internationalization and sustainable development strategy in the pharmaceutical industry.

The completion of the acquisition will be carried out according to the procedures agreed upon by the parties and in compliance with applicable laws and regulations. If a public offering is triggered, the regulations of the Ho Chi Minh City Stock Exchange (HoSE) related to public offerings will be followed.

Following the completion of the acquisition, IMP will become an indirectly owned subsidiary of the Company, and its financial results will be consolidated into the Group’s financial statements.

The reason for the acquisition is stated as laying a solid foundation for the Group’s further expansion into foreign markets, supporting its internationalization strategy, and promoting sustainable development in the pharmaceutical industry.

From the perspective of the Directors (including independent non-executive Directors), the terms of the Agreement (including the consideration) are fair and reasonable. The acquisition is considered to be conducted on normal commercial terms and in the interests of the Company and its shareholders as a whole.

Previously, in December 2024, international media reported that SK Group was considering selling its 65% stake in Imexpharm Pharmaceutical Joint Stock Company (IMP). The South Korean conglomerate worked with a financial advisor on this transaction. They also reached out to pharmaceutical companies and private equity funds to gauge interest in the stake.

Addressing this issue at the 2025 Annual General Meeting of Shareholders, Mr. Sung Min Woo, Chairman of the Board of Directors of Imexpharm, shared that SK is currently restructuring its investment portfolio, including all of SK’s global assets. Therefore, he revealed that there might be a change in SK’s ownership ratio at Imexpharm in the future.

It is known that SK Group initially acquired nearly 25% of Imexpharm’s capital through its subsidiary, SK Investment Vina III, in 2020, with the investment value undisclosed. Subsequently, the fund continuously bought and increased its holding to 65% through SK Investment Vina III, Binh Minh Kim Investment Joint Stock Company, and KBA Investment Joint Stock Company.

SK Group has recently also divested part of its large investments in Masan Group and Vingroup.

Livzon Pharmaceutical Group Inc. was established in January 1985 with registered capital of 935 million RMB and is headquartered in Zhuhai, Guangdong Province, China.

Livzon operates in various fields, including research and development, manufacturing, and marketing of pharmaceutical products. The company’s product portfolio is diverse, encompassing chemical preparations, active pharmaceutical ingredients (APIs) and intermediates, biological products, traditional Chinese medicines, reagents, and diagnostic equipment.

With a workforce of over 8,000 employees, the company is listed on both the Shenzhen Stock Exchange and the Hong Kong Stock Exchange.

In 2024, Livzon recorded operating revenue of RMB 11,812 million (over VND 41,000 billion) and a net profit attributable to the company’s shareholders of RMB 2,061 million (over VND 7,000 billion).

The Stationery King Prepares to Conquer: The Story of an Office Supplies Empire’s Ambitions

On May 19, the Board of Directors of Thien Long Group (HOSE: TLG) announced a resolution for one of its subsidiaries to acquire shares from the parent company of Phuong Nam Bookstore Chain. This acquisition may be the deal that CEO Tran Phuong Nga previously alluded to without providing specific details, at the company’s annual meeting a month ago.

Harvesting Gold: A Look at the Success of Industry Giants

The pharmaceutical industry witnessed a mixed performance in Q1 2025. While several industry giants thrived through continuous product restructuring and robust business promotions, numerous others experienced significant downturns due to diverse challenges.

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.

“TIG to Divest from Five Subsidiaries, Delays Stock Dividend Payment”

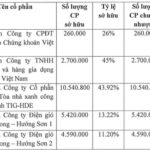

The Hanoi-based Thang Long Investment Group JSC (HNX: TIG) has recently unveiled three resolutions passed by its Board of Directors. These resolutions pertain to the company’s capital investments in its subsidiaries and associated companies, as well as a plan to issue bonus shares as dividends.