Profit-taking money from stocks that have risen sharply seems to be looking for a “new circle” in other potential codes. The VNI is still mainly pulled up by VIC and VHM, while the majority of blue-chips are just fluctuating. Whether the index peaks or fails, the opportunity still lies in choosing the right stock or not.

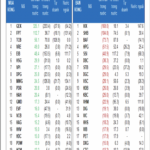

The breadth of the general market, as well as the VN30, midcap, and smallcap groups, all show a clear differentiation. Even in the rising price group, most only rose slightly. The VNI this session had only about 70 stocks that increased by more than 1%, with transactions concentrated in half (35 codes) of the most active group (liquidity above 10 billion), and this group even accounted for 48% of the market’s money flow.

Therefore, when talking about the opportunity to enjoy strong increases in prices, it is also only a minority, and the vast majority belong to the medium and small capitalization groups. VCG, GEX, CII, NVL, HVN, and HAH hit the ceiling with extremely high liquidity. The strength of the money flow is clearly demonstrated here, and the psychology is extremely strong. The rest are not bad either, trading in a few tens of billions each code, suitable for the taste of most retail investors. Those who trade a few billion to a few hundred million don’t count.

In general, today’s market is not strong, it’s just fluctuating, and even falling in price is a lot. Normal psychology is to look at the most positive developments to reinforce faith, for example, a portfolio of five codes, even if only one code increases, it still feels comfortable and prefers to observe that code more than the other four red codes. The market this session has room to support psychology with many well-traded codes. However, portfolio management is a whole, strong stocks are inherently good, what is needed is to create a script for different scenarios, especially for bad codes, not because of one strong code that ignores all the codes that are getting worse.

Currently, the trend of the index is the trend of a few pillar stocks, but the index is not the market, let alone the state of the portfolio. For example, the VN30 has peaked, but the stocks in the basket are very different. The same goes for the VNI; whether or not it peaks is less important than how the portfolio is doing. The phenomenon of money flow circling in search of opportunities does not represent the portfolio unless the right stock is chosen.

The good thing is that the movement of money flow in the market is very strong. Money withdrawn from this stock still flows into other stocks and maintains high liquidity. In the last few sessions, there have been a few stocks trading in the thousands of billions every day. However, even when filtering out these abnormal trading stocks to reduce noise (for example, the top 5 trading codes per day), the rest of the market still shows growth in liquidity. At a time when it is unclear whether the VNI will break through, the psychology still accepts high risks to seek opportunities, showing a significant excitement.

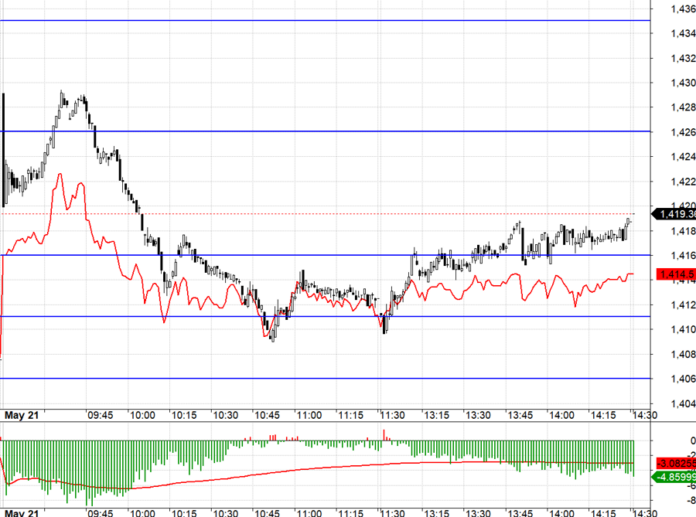

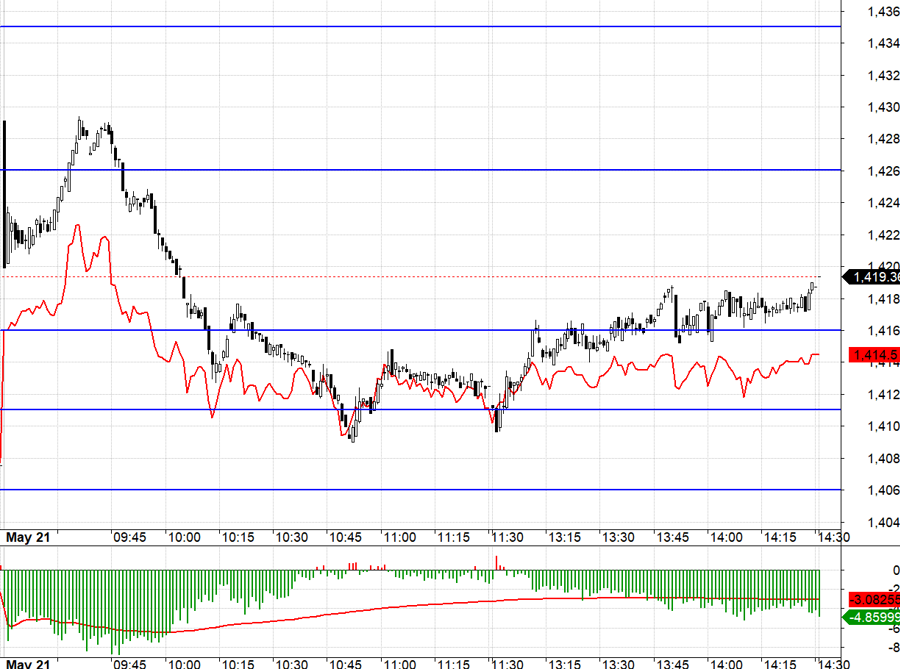

Today’s derivative market is also “wavering” following the VN30 index. The strength of VIC, VHM, and somewhere along with STB and MSN, is very good, but it does not create strong inertia. The best performance is right in the first few minutes of opening, and then the fluctuation is very narrow. When it was strongest, F1 again accepted an average discount of nearly 7 points, so it was difficult to Short. VN30 touched well and created two bottoms around 1411.xx, but then fluctuated too narrowly, and the basis limited profits.

Overall, the market still has strong money flow support and is stable. Whether the index rises or falls is not a big issue at the moment. What needs attention is the specific stock. The strategy is still to wait for the cover of the sold stocks, and if the rest continue to be strong, consider taking profits. Derivatives Long/Short flexibility.

VN30 closed at 1419.36. The nearest resistance tomorrow is 1426; 1435; 1442; 1450; 1455. Support 1416; 1411; 1405; 1396; 1388; 1384.

“Stock Blog” is personal and does not represent the opinion of VnEconomy. The views and evaluations are those of the individual investor, and VnEconomy respects the views and writing style of the author. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

The Sudden Spike: Stocks Take a Tumble

Liquidity across both exchanges soared 28.4% in the afternoon session, hitting a 19-session high. As the sea of red expanded, it confirmed that selling pressure had intensified. While the VN-Index managed to stay in the green, it had to concede closing at the day’s low.

The Vanishing Liquidity: A Market Tug-of-War

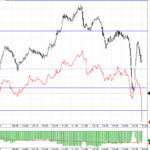

The weakening of Vin stocks remains a key signal for investors to exercise caution. The blue-chip group’s attempts to push higher were met with strong resistance, resulting in a retreat that kept the VN-Index confined to a narrow range around the reference level throughout the session. A 40% plunge in HoSE’s liquidity to a 15-session low underscores the return of cautious sentiment.

“MB Retains Crown as Vietnam’s “Best Forex Bank””

On May 22, 2025, in Jakarta, Military Commercial Joint Stock Bank (MB) was recognized by The Asian Banker magazine as the “Best FX Bank in Vietnam” at the Transaction Banking Awards 2025. This prestigious award ceremony, held in Jakarta, Indonesia, highlighted MB’s exceptional performance and leadership in the foreign exchange market within Vietnam.

Stock Market Blog: How Long Can We Hold On?

The recent volatility in the large-cap group has once again posed challenges for the VN Index, reminiscent of the struggles faced on May 16th. While the index is being pulled and pushed, the damage to individual stocks is evident. The window of opportunity for a counter-trend rally is narrowing, and accurate stock picking is becoming increasingly difficult.