The notable weakness of the Vin group has caused the market to lose its leading growth momentum. The index hovered around the reference level throughout the session, eventually closing at 1,314 points, a negligible increase of 0.62 points from the previous day. While the breadth wasn’t overly negative, with 162 gainers and 150 losers, the decline was mainly driven by large-cap stocks. Banks and securities underwent corrections.

The stalwarts of the banking group turned red today, including TCB, CTG, BID, VCB, and VPB, while the rest of the group saw gains with STB, ACB, HDB, and EIB in the green. The securities group unanimously faced heavier selling pressure, resulting in most stocks closing in the red, with notable 1% declines in HCM, MBS, FTS, VDS, and VIX. The market continues to witness profound differentiation within the same industry groups.

This is particularly evident in the real estate sector, where the Vin family endeavored to prop up the market. VIC experienced several dips below the reference level but managed to close slightly higher by 0.53%; VHM gained 1.03%, and VRE rose by 1.18%. In contrast, most other real estate stocks underwent corrections.

In the materials sector, steel and mining stocks underwent a sell-off, while fertilizer, rubber, and plastics stocks made a strong breakthrough, including DCM, BMP, and NTP. Fertilizer and chemical stocks are expected to benefit from the cooling oil prices. The transportation group left a strong impression, with ACV surging by 3.33% and HAH climbing by 3.81%.

Overall, there are signs of capital rotation from large-cap stocks to small-cap stocks, which have been overlooked in the past 1-2 weeks, as large-caps have already witnessed significant gains. The market awaits official announcements regarding tariffs.

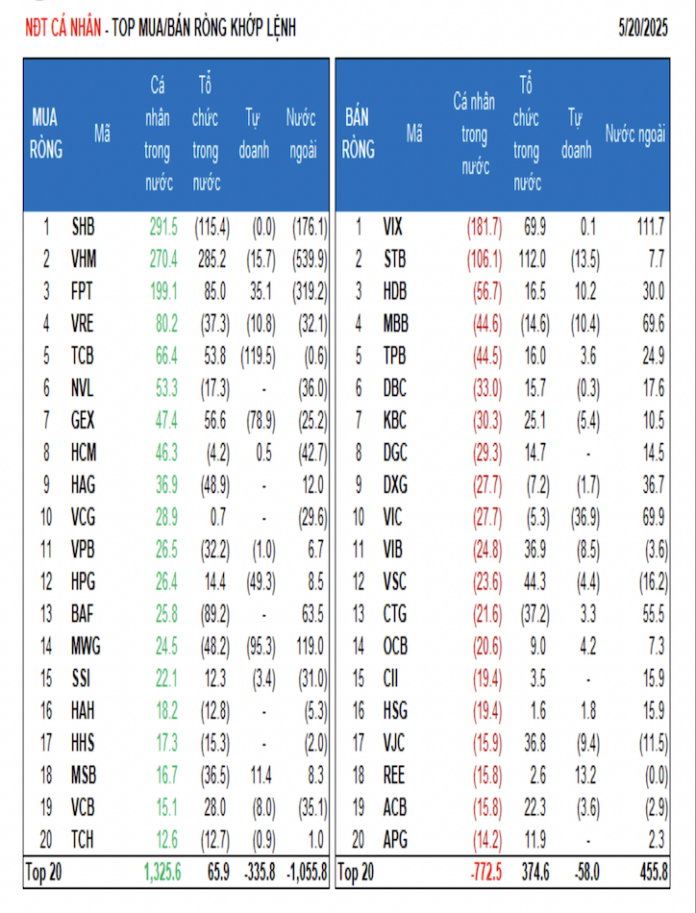

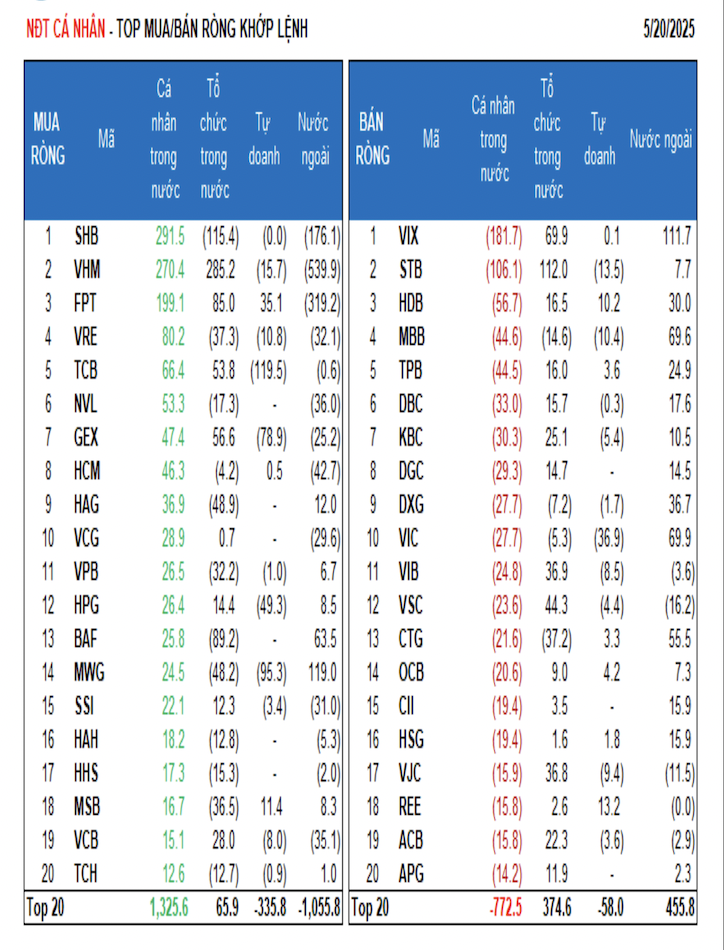

Today’s liquidity across the three exchanges decreased to VND18,200 billion, with foreign investors net selling VND197.1 billion. Specifically, in matched orders, they net sold VND142.0 billion. Their main net buying by matched orders focused on the real estate and banking sectors, including GEX, VHM, VIC, STB, TCH, MBB, HAG, GAS, and HHS. On the selling side, financial services were the main sector net sold by foreigners through matched orders, including stocks such as FPT, MSN, MWG, HCM, HPG, SSI, VRE, VIX, and DPM.

Individual investors net sold VND206.3 billion, of which VND300.9 billion was net sold by matched orders. In terms of matched orders, they net bought 10/18 sectors, mainly in the food and beverage industry. The top net bought stocks by individual investors included VIX, MWG, VRE, HCM, MSN, FPT, VCB, DPM, TPB, and HAH. On the net selling side by matched orders, 8/18 sectors were net sold, mainly in the banking and real estate industries. The top net sold stocks were SHB, STB, MBB, GEE, DGC, CTG, HPG, HDB, and TCB.

Proprietary trading net bought VND197.3 billion, of which VND210.2 billion was net bought by matched orders. In terms of matched orders, proprietary trading net bought 12/18 sectors, with the main sectors being financial services and information technology. The top net bought stocks by proprietary trading today included SSI, FPT, HPG, MSN, ACB, FUESSVFL, VIC, TCB, VHM, and DGC. The top net sold sector was industrial goods & services. The top net sold stocks included NVL, VPB, GEX, STB, HAH, VCB, PNJ, KBC, BID, and CTR.

Domestic institutional investors net bought VND143.6 billion, of which VND232.6 billion was net bought by matched orders. In terms of matched orders, domestic institutions net sold 6/18 sectors, with the largest value in the real estate sector. The top net sold stocks included VHM, GEX, VIC, VIX, HAG, HHS, TCH, TPB, VCB, and VRE. The largest net bought sector by value was banking. The top net bought stocks included SHB, FPT, HPG, MSN, DGC, MWG, GMD, GEE, HDB, and PDR.

Today’s matched order trading value reached VND1,982.8 billion, up 26.9% from the previous session and contributing 10.8% of the total trading value.

Notable transactions today included TCB, with over 12.3 million units worth VND376.1 billion traded between individual investors. Additionally, there was a matched order transaction between foreign institutions in VNM, with 3.7 million units (valued at VND204.5 billion) changing hands.

Domestic institutions continued to trade large-cap stocks (FPT, MWG), banks (EIB, HDB, MSB), and EVF.

The allocation of trading value increased in real estate, construction, chemicals, agricultural & aquatic products, food, retail, software, building materials & interior decoration, and petroleum distribution, while it decreased in banks, securities, steel, and electrical equipment.

In terms of matched orders, the allocation of trading value increased in the large-cap VN30 and small-cap VNSML groups, while it decreased in the mid-cap VNMID group.

Market Pulse May 24: Extended See-Saw Movement, Foreigners Resume Net Selling

The market closed with the VN-Index up 0.62 points (+0.05%), reaching 1,314.46; while the HNX-Index fell 0.47 points (-0.22%) to 216.32. The market breadth was relatively balanced, with 374 gainers and 371 losers. Similarly, the VN30 basket saw a tight contest between bulls and bears, resulting in 15 gainers, 12 losers, and 3 unchanged stocks.

“Capital Floods Blue-Chip Stocks as VN30-Index Soars to New Heights”

The HoSE matching liquidity slightly increased by 2.6% compared to the previous session, while the VN30 basket witnessed a more robust 10% surge. Trading of this blue-chip basket accounted for 62% of the entire exchange, with the VN30-Index climbing by 2.01% and setting a new peak since early May 2022.

Market Pulse, May 15: Real Estate Pressures Mount, But Banking Sectors Come to the Rescue

The VN-Index demonstrated its resilience in the face of morning pressures, with the critical 1,300 level providing excellent support as buying interest emerged. The index rebounded to close at 1,313.2 points, a gain of 3.47 points. The contrasting performances of the two large-cap sectors, banking, and real estate, were the highlight of the session.

Stock Market Insights: Capital Flows Gain Further Momentum

Today marked the debut of VPL on the HSX exchange, while VIC and VHM experienced brief moments of instability. Despite this, the supporting forces at these pillars remained relatively robust, and the decline was not significant. The closing session of VIC even witnessed a boost beyond the reference level. The stable index backdrop encouraged more active trading in mid-to-small-cap stocks.